Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

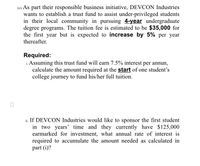

Transcribed Image Text:(e) As part their responsible business initiative, DEVCON Industries

wants to establish a trust fund to assist under-privileged students

in their local community in pursuing 4-year undergraduate

degree programs. The tuition fee is estimated to be $35,000 for

the first year but is expected to increase by 5% per year

thereafter.

Required:

i. Assuming this trust fund will earn 7.5% interest per annun,

calculate the amount required at the start of one student's

college journey to fund his/her full tuition.

ii. If DEVCON Industries would like to sponsor the first student

in two years' time and they currently have $125,000

earmarked for investment, what annual rate of interest is

required to accumulate the amount needed as calculated in

part (i)?

Transcribed Image Text:DEVCON INDUSTRIES LIMITED

Income Statement

For the years ended Dec. 31, 2018 and

2019

2018

2019

so00's

s000's

Sales

900000

1125000

Cost of Goods Sold

300000

306600

Gross Profit

600000

818400

Selling and Administrative Expenses

150000

156000

Depreciation Expense

54000

57000

Advertising Expenses

18000

21000

Earnings Before Interest and Taxes

378000

584400

Interest Expense

3000

3000

Taxable Income

375000

581400

Taxation (35%)

131250

203490

Net Income

243750

377910

Dividends (40%)

97500

151164

Addition to Retained Earnings

146250

226746

Additional Information

Share Price

21

27.3

Ordinary Shares Outstanding

120000000

144000000

DEVCON INDUSTRIES

LIMITED

Statement of Financial

Position

As at Dec. 31, 2018 and 2019

ASSETS

2018

2019

LIABILITIES & EQUITY

2018

2019

Current Assets

s00's

s000's

Current Liabilities

so00's

So00's

Inventories

264000

276000

Accounts Payables

Notes Payables

138000

114000

Accounts Receivables

294000

330000

150900

132654

Cash and Equivalents

210900

270000

288900

246654

768900

876000

Non-current Liabilities

120000

90000

Total Liabilities

408900

336654

Net Fixed Assets

630600

690000

Equity

Common Stock

264000

276000

Retained Earnings

726600

953346

Total Equity

990600

1229346

Total Assets

1399500

1566000

Total Liabilities & Equity

1399500

1566000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Give typing answer with explanation and conclusion A University is offering a charitable gift program. A former student who is now 50 years old is consider the following offer: The student can invest $7,500.00 today and then will be paid a 8.00% APR return starting on his 65th birthday (i.e For a $10,000 investment, a 9% rate would mean $900 per year). The program will pay the cash flow for this investment while you are still alive. You anticipate living 20.00 more years after your 65th birthday. The former student wants a return of 5.00% on his investments, but would like to consider this opportunity. Using the student's desired return, what is the value of this deferred annuity today on his 50th birthday?arrow_forwardPresent value. Prestigious University is offering a new admission and tuition payment plan for all alumni. On the birth of a child, parents can guarantee admission to Prestigious if they pay the first year's tuition. The university will pay an annual rate of return of 6.5% on the deposited tuition, and a full refund will be available if the child chooses another university. The tuition is expected to be $12,000 a year at Prestigious 18 years from now. What would parents pay today if they just gave birth to a new baby and the child will attend college in 18 years? How much is the required payment to secure admission for their child if the interest rate falls to 2.5%? What would parents pay today if they just gave birth to a new baby and the child will attend college in 18 years? (Round to the nearest cent.)arrow_forwardA generous alum would like to establish an endowment that would sponsor a student organization's conferences in perpetuity. A one-time cost of $500,000 must be paid today to purchase supplies for the conference. The conference is held once every four years and costs $90,000 . The first conference will take place at the end of year 4 . The alum's gift is invested in an account that earns 4% annually. How much would the alum need to place in the endowment to be able to sponsor the student organization's conferences? [Enter your answer with no dollar sign or comma.]arrow_forward

- As a future graduate of the University of Minnesota, someday you would like to endow a scholarship (meaning give the university money in your name) to pay for tuition expenses for future UMN students. Assume you just graduated (congratulations!). You plan to work for fifteen years after graduation before endowing this scholarship (at the end of the fifteenth year AFTER graduation). Annual tuition at UMN is $10,000 today, and is expected to grow at the long-term average rate of inflation of 3% per year forever. Savings are expected to earn a return of 7% per year forever. a) The first tuition payment is due one year after the scholarship is endowed. How much will the tuition be when your scholarship makes the first payment? b) You would like the scholarship to pay all tuition for one student per year for the twenty years following the creation of the endowment, how much money do you need to endow the scholarship? c)If you would like the scholarship to pay for tuition for one student…arrow_forwardSt. Thomas University (STU) plans to build an addition to the Gus Machado School of Business 4 years from today. It will need to have $8 million in an account at that time. It would like to make 4 equal annual deposits, starting 1 year from today, into an account earning 4% per year to meet this need. What is the amount of each deposit STU must make to meet this need?arrow_forwardMark is trying to decide if he should attend college or not. Part of his decision will be based on the return on investment of college. He estimates costs to attend Texas Tech for 4 years including room and board are $20,000 per year. He also assumes tuition costs will rise by 3.5% per year. How much is a 4-year degree going to cost Mark? $92,183.27 $84,298.86 $7,231,158.87 $1,314,002.83arrow_forward

- On September 1, 2014, a university received a grant of $100,000 from Tajinder. The money is invested at 8% compounded quarterly. The grant is to be used to pay out semi-annual scholarships for 20 years. What is the size of each scholarship if the first one is awarded on September 1, 2016? Need well explained answer, please do not use excel.arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $32,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 10 percent, how much must the donor contribute today to fully fund the scholarship? Note: Negative value should be indicated by a parenthesis. > Answer is complete but not entirely correct. $(240,421) X Contributionarrow_forward

- A wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forwardThe Jeffersons have asked you what would be needed to fund the children’s future college costs. Assume each child will begin college at age 18 and graduate in four years. Assume current costs are $24,000 per year and are expected to increase by 5% per year and investments earn 7%. A. Assuming no existing assets are dedicated to college, what is the annual savings amount required to fund the children’s education? The Jeffersons’ goal is to have an amount at the beginning of the freshman year for each child that is sufficient to fund a serial payment covering the $24,000 of current costs of college adjusted for inflation for each of the four years of college. Please include your calculator keystroke inputs [PV, I/YR, N, FV, and PMT (if needed)] for each step of this calculation. Also include whether any PMTs are in the end mode or the begin mode. B. What would you say to the Jeffersons about their education funding situation? Write a script of a single paragraph as if you…arrow_forwardGradFi is a startup that aims to use the power of social communities to transform the student loan market. It connects participants through a dedicated lending pool, enabling current students to borrow from a school's alumni community. GradFi's revenue model is to take an upfront fee of 60 basis points (0.60%) each from the alumni investor and the student borrower for every loan originated on its platform. GradFi hopes to go public in the near future and is keen to ensure that its financial results are in line with that ambition. GradFi's budgeted and actual results for the third quarter of 2017 are presented below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education