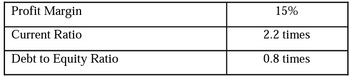

The below information relates to Drake Ltd which manufactures and sells commercial kitchen equipment. The company is constantly profitable. Drake Ltd’s financial statement ratios are as follows:

For each of the following transactions or events, indicate the directional effect (increase, decrease, no change) on the Profit Margin,

a. Drake Ltd borrowed an additional $200,000 as short-term, 6-month loan from the bank.

b. Sold obsolete inventory purchased for $75,000 for $50,000 cash

c. Paid $100,000 dividends to shareholders (previously declared)

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- at the bottom. Had there been a loss for the In reviewing the income statement of a profitable company, one can see that it begins with at the top and ends with year, the final result would have been a What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? (Select all the answers that apply.) A. The balance sheet balances the firm's assets against its financing, which can be either debt or equity. B. The total value of all of the firm's assets should equal the sum of its short- and long-term debt plus stockholder's equity. C. In order for the balance sheet to balance, stockholder's equity must exclude preferred stock, common stock at par value, paid in capital in excess of par on common stock and retained earnings from previous profitable years in which some of the earnings were held back and not paid out as dividends. D. When the balance sheet does not balance, the difference must be reported as an "off-balance sheet" account for…arrow_forward1.) Solve the Income Statement of AAA Company using Horizontal Analysis. 2.) As a Financial Analyst how would you interpret the data?arrow_forwardPlease explain why solvency ratios, such as, debt, debt/equity, and time interest earned ratios are important to businesses. Please explain what information is provided by each ratio.arrow_forward

- Indicate if the following transaction from Torte Baking Company increases or decreases assets, liabilities, equity, revenue, expense, and net income. The pattern of the + and - must adhere to the balance sheet equation. Show the impact of revenue and expense on both net income and equity. If there is a + and - within one category (e.g., assets for transaction 2), then list the accounts that go up and down. Transaction (26) Recognize tax expense that will be paid later. Assets ["", "", ""] Liabilities ["", "", ""] Equity ["", "", ""] Revenue ["", "", ""] Expense ["", "", ""] Net Income ["", "", ""]arrow_forwarddetermine the following ratios for both companies, then based on the information analvze and compare the two companies' solvency and profitability. Ratios: Return on total assets Return on stockholders' equity Times interest earned Ratio of total liabilities to stockholders' equity.arrow_forward5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Petroxy Oil Co. and make comments on its second-year performance as compared with its first-year performance. The following shows Petroxy Oil Co.'s income statement for the last two years. The company had assets of $9,400 million in the first year and $15,037 million in the second year. Common equity was equal to $5,000 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Petroxy Oil Co. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 5,080 4,000 1,855 1,723 254 160 Net Sales Operating costs except depreciation and amortization Depreciation…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education