FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

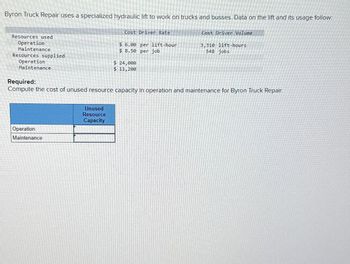

Transcribed Image Text:Byron Truck Repair uses a specialized hydraulic lift to work on trucks and busses. Data on the lift and its usage follow

Cost Driver Rate

Cost Driver Volume

Resources used

Operation

Maintenance

$ 6.00 per lift-hour

$8.50 per job

3,310 lift-hours

548 jobs

Resources supplied

Operation

$ 24,000

$ 11,200

Maintenance

Required:

Compute the cost of unused resource capacity in operation and maintenance for Byron Truck Repair.

Operation

Maintenance

Unused

Resource

Capacity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. The following actual activity usage produced 10,000 Pup tents and 5,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. Activity Usage Activity Cost Driver Pup tents Pop-up tents Direct labor hours(DLH) 30,500 12,500 Machine hours (MH) 3,600 6,400 Purchase orders(PO) 200 300arrow_forwardLarned Recreational builds two models of dune buggies: Sport and Custom. Both models require the same assembly and finishing process and are assembled in the same factory. They differ in the quality and detail of the materials. The following data reflect expected operations for the upcoming year. Sport Custom Total Number of units 3,200 1,800 5,000 Direct materials cost per unit $ 400 $ 1,100 Conversion costs: Direct labor $ 1,832,000 Overhead 2,608,000 Total $ 4,440,000 Required: Larned Recreation uses operations costing and assigns conversion costs based on the number of units assembled. Compute the cost per unit of the Sport and Custom models for the upcoming year. The financial team at Larned suggests that a two-stage system be used to compute the product cost of the two models. Their recommendation is to assign direct labor cost based on the number of units and overhead cost based on direct materials cost. Compute the cost per unit of…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Gable co uses 3 activity pools: Activity Pools total cost of pools cost driver estimated cost driver Machining 208,960 number of machine hours 65,300 designing costs 53,125 number of design hours 6,250 setup costs 68,400 number of batches 480 Gable co manufactures 3 products, manufactured are ,A,B,C: Product A Product B Product C Number of Machine hours 23,000 33,000 9,300 Number of design hours 2,500 1,450 2,300 Number of batches 40…arrow_forwardPlease do not give solution in image format thankuarrow_forwardABC Company has an ABC system with three pools: Total cost in cost pool Activity Machine setups Customer service Maintenance $18,500 $5,000 Cost Driver $29,000 #setups O $9,000 #orders not enough information machine- hours $13,000 $6,000 $10,000 Compute total capacity costs allocated to product X. Activity volume (#cost driver units) Product X Product Y Total 45 15 25 20 5 25 65 20 50arrow_forward

- A-5arrow_forwardPlease do not give solution in image format thankuarrow_forwardHayward Industries manufactures dining chairs and tables. The following information is available: Machine setups Inspections Dining Chairs Tables Total Overhead Cost 200 600 $48,000 250 470 $72,000 2,600 2,400 Labor hours Hayward is considering switching from Traditional Costing based on labor hours to activity-based costing. Assign total overhead costs to Tables using Activity Based Costing. $120,000 $62,400 $83,000 $37,000 $57,600arrow_forward

- Subject: acountingarrow_forwardPlease do not give solution in image format thankuarrow_forwardLampierre makes brass and gold frames. The company computed this information to decide whether to switch from the traditional allocation method to ABC: Brass Gold Units Planed 750 150 Material Moves 400 100 Machine Setups 500 750 Direct Labor Hours 600 1,100 The estimated overhead for the material cost pool is estimated as $13,000, and the estimate for the machine setup pool is $40,000. A. Calculate the allocation rate per unit of brass and per unit of gold using the traditional method? Round intermediate calculations and final answers t two decimal places. Brass 24.94 228.63 B. Calculate the allocation rate per unit of brass and per unit of gold using the activity-based costing method? Round intermediate calculations and final answers to two decimal places. Gold Brass Allocation Rate per Unit Gold Allocation Rate per Unit SA 35.2 177.33arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education