FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

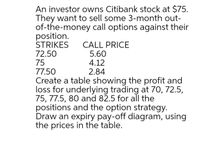

Transcribed Image Text:An investor owns Citibank stock at $75.

They want to sell some 3-month out-

of-the-money call options against their

position.

STRIKES

72.50

75

77.50

CALL PRICE

5.60

4.12

2.84

Create a table showing the profit and

loss for underlying trading at 70, 72.5,

75, 77.5, 80 and 82.5 for all the

positions and the option strategy.

Draw an expiry pay-off diagram, using

the prices in the table.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You work on a proprietary trading desk of a large investment bank, and you have been asked for a quote on the sale of a call option with a strike price of $53 and one year of expiration. The call option would be written on a stock that does not pay a dividend. From your analysis, you expect that the stock will either increase to $73 or decrease to $38 over the next year. The current price of the underlying stock is $53, and the risk-free interest rate is 5% per annum. What is this fair market value for the call option under these conditions? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardSuppose that all investors have the disposition effect. A new stock has just been issued at a price of $70, so all investors in this stock purchased the stock today. A year from now the stock will be taken over, for a price of $84 or $56 depending on the news that comes out over the year. The stock will pay no dividends. Investors will sell the stock whenever the price goes up by more than 10%.A- Suppose good news comes out in 6 months (implying the takeover offer will be $84). B-What equilibrium price will the stock trade for after the news comes out, that is, the price thatequates supply and demand?arrow_forwardYou have $50,000 to invest. You want to either invest it all in one stock, or in options. The stock of the company you are considering- Khai Co.- is currently selling for $20 per share. There is also a call option available for Khai's stock with a $20 strike price and six months to maturity. The premium is $5. Khai pays no dividends. What is your annualized return from these two investments if, in six months, Khai is selling for $26 per share? What about $16 per share?arrow_forward

- You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $240 at year-end. XYZ currently sells for $240. Over the next year, the stock price will either increase by 7% or decrease by 7%. The T-bill rate is 3%. Unfortunately, no put options are traded on XYZ Company. Required: a. How much would it cost to purchase if the desired put option were traded? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would be the cost of the protective put portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardSuppose that XTel currently is selling at $50 per share. You buy 800 shares using $30,000 of your own money, borrowing the remainder of the purchase price from your broker. The rate on the margin loan is 7%. Required:a. What is the percentage increase in the net worth of your brokerage account if the price of XTel immediately changes to (i) $56; (ii) $50; (ii) $44? (Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Round your answers to 2 decimal places.) b. If the maintenance margin is 25%, how low can XTel’s price fall before you get a margin call? (Round your answer to 2 decimal places.) c. How would your answer to requirement b would change if you had financed the initial purchase with only $20,000 of your own money? (Round your answer to 2 decimal places.) d. What is the rate of return on your margined position (assuming again that you invest $30,000 of your own money) if XTel is selling after one…arrow_forwardsolve a,b,c and d please. round to nearest dollararrow_forward

- You decided to invest $10,000 of your savings in a stock whose current price is $25 per share. To utilize the benefit of margin investing, you borrowed an additional $10,000 from your broker and invested $20,000 in the stock, If the maintenance margin is 30 pereent, at what price will you receive your first margin call?arrow_forwardsolve a,b,c and d please. Round to the nearest dollararrow_forwardYou would like to be holding a protective put position on the stock of XYZ Co. to lock in a guaranteed minimum value of $109 at year- end. XYZ currently sells for $109. Over the next year the stock price will increase by 12% or decrease by 12%. The T-bill rate is 6%. Unfortunately, no put options are traded on XYZ Co. a. Suppose the desired put option were traded. How much would it cost to purchase? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Cost to purchase b. What would have been the cost of the protective put portfolio? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Cost of the protective put portfolio c. What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X = 109? Show that the payoff to this portfolio and the cost of establishing the portfolio match those of the desired protective put. (Do not round…arrow_forward

- f2. Subject :- Financearrow_forwardYou own a call option on Intuit stock with a strike price of $34. When you purchased the option, it cost $6. The option will expire in exactly three months' time. a. If the shares are trading at $43 in three months, what will be the payoff of the call? What will be the profit of the call? b. If the shares are trading at $31 in three months, what will be the payoff of the call? What will be the profit of the call? c. Draw a payoff diagram showing the value of the call at expiration as a function of the share price at expiration. d. Redo (c), but instead of showing payoffs, show profits. a. The payoff of the call is $ (Round to the nearest dollar.) and the profit of the call is $arrow_forwardPlease show me how to calculate earnings from the stock options with the scenario below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education