Question

Solve the below problem as soon as possible.

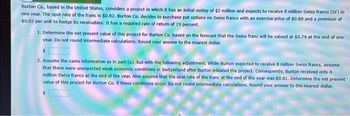

Transcribed Image Text:Burton Co., based in the United States, considers a project in which it has an initial outlay of $2 million and expects to receive 8 million Swiss francs (SF) in

one year. The spot rate of the franc is $0.82. Burton Co. decides to purchase put options on Swiss francs with an exercise price of $0.80 and a premium of

$0.02 per unit to hedge its receivables. It has a required rate of return of 19 percent.

1. Determine the net present value of this project for Burton Co. based on the forecast that the Swiss franc will be valued at $0.74 at the end of one

year. Do not round intermediate calculations. Round your answer to the nearest dollar.

$

2. Assume the same information as in part (a), but with the following adjustment. While Burton expected to receive 8 million Swiss francs, assume

that there were unexpected weak economic conditions in Switzerland after Burton initiated the project. Consequently, Burton received only 4

million Swiss francs at the end of the year. Also assume that the spot rate of the franc at the end of the year was $0.81. Determine the net present

value of this project for Burton Co. if these conditions occur. Do not round intermediate calculations. Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- The platters, a rock-and-roll group that had many hits in the late 1950s, has undergone many personnel changes since that era. However, a group performing under that name is still touring the country giving concerts. The group would like to stop in Detroit, Michigan, on its current tour. An “oldies” radio station, WDMI, is in charge of making the arrangements. The station has listed activities that must be completed prior to the concert in the table. Times are in weeks. Use PERT/CPM to find the critical path.arrow_forwardIn addition to the written materials discussed in the previous question, what else should the supervisor do to orient new letter carriers? Carol Burgess is a letter carrier and a part-time trainer of letter carriers for the U.S. Postal Service in a major city on the west coast. She trains all new letter carriers in her service area, which encompasses the northern half of her state. Over the past five years she has trained 318 new letter carriers. Typically, the training is offered prior to the new letter carrier’s entry onto the job, although sometimes it occurs shortly thereafter. The training program typically encompasses both the orientation of new employees to the U.S. Postal Service and the development of specific skills needed by the new letter carrier. The latter involves practice in casing mail (i.e., sorting) to appropriate locations of a case in preparation for delivery, reading maps, determining appropriate sequencing of delivery, and customer relations. The total training…arrow_forwardMo. The I Love Operations Management (ILOM) Conference, a major international conference, is staffed by student volunteers. One of the tasks of the student volunteers is to register conference attendees. The registration process involves confirming that fees have been paid, retrieving a conference package specific to that person (filed under their last name), and passing on relevant information about the conference. In 2023, conference registration will be handled by a group of 10 student volunteers who work in five pairs to register the attendees (i.e., each pair will together register one attendee at a time). Attendees line up in a common line to be served by the next available pair of volunteers. Attendees arrive at an average rate of 139 per hour (assume Poisson arrival distribution) and the service time is, on average, two minutes (following a negative exponential distribution). What is the average time needed to register (includes waiting and registering), in minutes (round…arrow_forward

- Asap pleasearrow_forwardWilliam, a project manager, has a workload of 25,000 hours that needs to be completed in 30 weeks. He has a team of 20 people who work five 8-hour days per week. He notices that in the 30-week period, there are three holidays and 6 members have each requested 8 days off. Given this information, William is _____ short of completing his workload. Question options: 23,136 hours 1,864 hours 480 hours 1,480 hours 384 hoursarrow_forwardplease answer in details within 30 minutes.arrow_forward

- The following memo is from an exasperated manager to her staff. Obviously, this manager does not have the time to clean up her writing or another set of eyes to review her written material before mailing it. From: Albertina Sindaha, Operations Manager To: All Emplovees Subject: Cleanup! Message You were all supposed to clean up your work areas last Friday. but that didn't happen. A few people cleaned their desks, but no one pitched in to clean the common areas. So we're going to try again. As you know, we don't have a big enough custodial budget anymore. Everyone must clean up himself. This Friday I want to see action in the copy machine area, things like emptying waste baskets, and you should organize paper and toner supplies. The lunch room is a disaster area. You must do something about the counters, the refrigerator, the sinks, and the coffee machine. And any food left in the refrigerator on Friday afternoon should be thrown out because it stinks by Monday. Finally, the office…arrow_forwardplease solve for question Carrow_forwardproject operation management please answerarrow_forward

- The cost accounting team needs to determine the value of a moving ticket.arrow_forwardName the five steps of the theory of constraints and explain the purpose of each. Which is the mostimportant step and why?arrow_forwardGiven the following information, assign tasks to work stations using the most followers rule. Assume the cycle time is 60 seconds and the minimum number of workstations is 3. Submit for each workstation (1,2,3,4 etc.), the tasks assigned in order of assignment, the idle time for each work station and the total idle time. (It will help for you to make the diagram but you are not required to submit the diagram) Task A D w Immediate Predecessor D CE Task Time (seconds) 35 50 20 10 25 40arrow_forward

arrow_back_ios

arrow_forward_ios