FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

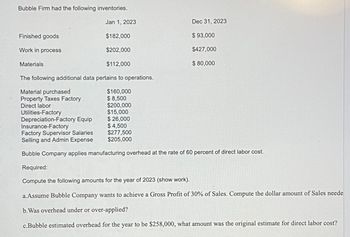

Transcribed Image Text:Bubble Firm had the following inventories.

Jan 1, 2023

$182,000

$202,000

$112,000

The following additional data pertains to operations.

$160,000

$8,500

Finished goods

Work in process

Materials

Material purchased

Property Taxes Factory

Direct labor

Utilities-Factory

Depreciation-Factory Equip

Insurance-Factory

$200,000

$15,000

$ 26,000

$ 4,500

$277,500

$205,000

Dec 31, 2023

$ 93,000

$427,000

$ 80,000

Factory Supervisor Salaries

Selling and Admin Expense

Bubble Company applies manufacturing overhead at the rate of 60 percent of direct labor cost.

Required:

Compute the following amounts for the year of 2023 (show work).

a.Assume Bubble Company wants to achieve a Gross Profit of 30% of Sales. Compute the dollar amount of Sales neede

b. Was overhead under or over-applied?

c.Bubble estimated overhead for the year to be $258,000, what amount was the original estimate for direct labor cost?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

show

and show a journal entry (from part b) assuming the amount is large enough to intentionally impact decision of users.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

show

and show a journal entry (from part b) assuming the amount is large enough to intentionally impact decision of users.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer letter k to o.arrow_forwardSun Inc. has provided the following information: $ 60,000 55,000 Beginning Work-in-Process Inventory Beginning Raw Materials Inventory Purchases and Freight In of Raw Materials Ending Raw Materials Inventory 315,000 80,000 Direct Labor 70,000 Depreciation-Plant and Equipment Plant Utilities, Insurance, and Property Taxes 25,000 15,500 Ending Work-in-Process Inventory Selling and distribution overhead 23,000 40,000 Calculate the cost of goods manufactured. a) $412,500 b) $437,500 c) $477,500 d) $422,000arrow_forwardSolve all questionsarrow_forward

- The following data from the just completed year are taken from the accounting records of Mason Company: $ 653,000 $ 88,000 $ 130,000 $ 100,000 $ 40,000 $ 225,000 $ 202,000 Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning $ 8,900 $ 5,500 $ 73,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Complete this question by entering your answers in the tabs below. Ending $ 10,600 $ 20,100 $ 25,800 Required 1 Required 2 Required 3 Direct materials: Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct…arrow_forwardprovide correct answer apsp pleasearrow_forward.arrow_forward

- accountsarrow_forwardSelected data from Design Corporation for 206 is as follows: Inventories Beginning $34,000 135,000 110,000 Ending $40,000 150,000 102,000 Raw Materials Work in process Finished goods Other information: Plant janitorial services Administrative expenses Raw materials purchased Depreciation – Plant Building & Equipment Insurance on plant Depreciation expense on delivery truck Direct manufacturing wages Sales revenue Plant Utilities Sales commissions $8,000 $121,230 $41,000 $32,500 $11,500 $18,250 $144,000 $575,000 $28,000 $23,700 Conversion Cost is: a. $179,000 O b. $354,000 O c. $224,000 O d. $259,000arrow_forwardThe following data from the just completed year are taken from the accounting records of Mason Company: $ 654,000 $ 89,000 $ 135,000 $ 107,000 $ 46,000 $ 226,000 $ 210,000 Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning Ending $8,800 $ 10,100 $5,000 $ 20,800 $77,000 $ 25,400 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. Direct…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education