FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

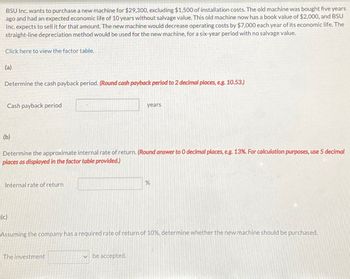

Transcribed Image Text:BSU Inc. wants to purchase a new machine for $29,300, excluding $1,500 of installation costs. The old machine was bought five years

ago and had an expected economic life of 10 years without salvage value. This old machine now has a book value of $2,000, and BSU

Inc. expects to sell it for that amount. The new machine would decrease operating costs by $7,000 each year of its economic life. The

straight-line depreciation method would be used for the new machine, for a six-year period with no salvage value.

Click here to view the factor table.

(a)

Determine the cash payback period. (Round cash payback period to 2 decimal places, e.g. 10.53.)

Cash payback period

(b)

Determine the approximate internal rate of return. (Round answer to O decimal places, e.g. 13%. For calculation purposes, use 5 decimal

places as displayed in the factor table provided.)

Internal rate of return

(c)

years

The investment

Assuming the company has a required rate of return of 10%, determine whether the new machine should be purchased.

be accepted.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $102,990, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $30,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 14%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $26,475 per year. Under these conditions, what is the internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 1.…arrow_forwardRandi Corporation is considering the replacement of some machinery that has zero book value and a current market value of $2,800. One possible alternative is to invest in new machinery that costs $30,000. The new equipment has a four-year service life and an estimated salvage value of $3,500, will produce annual cash operating savings of $9,400, and will require a $2,200 overhaul in year 3. The company uses straight-line depreciation. Required: Prepare a net-present-value analysis of Randi's replacement decision, assuming an 8% hurdle rate and no income taxes. Should the machinery be acquired? Note: Round calculations to the nearest dollar.arrow_forwardYou are given financial statements and a Dupont analysis for Tesco and Ahold. What do you conclude about the two companies’ performances based on these numbers?arrow_forward

- Teitelbaum Corp. plans to buy equipment costing $880,000. In connection with this transaction, old equipment having a book value of $140,000 will be sold for $210,000. Annual cash flow returns from this new investment are estimated at $370,000 before taxes. Depreciation on the new equipment will be $88,000 each year for the next 10 years. No salvage value is expected on this new equipment. No further depreciation can be taken on the old equipment that will be sold. The income tax rate is 30 percent. Determine the NPV of the new investment using a discount rate of 20%: $ ______________arrow_forwardThe Cornchopper Company is considering the purchase of a new harvester. • The new harvester is not expected to affect revenue, but operating expenses will be reduced by $13,600 per year for 10 years. • The old harvester is now 5 years old, with 10 years of its scheduled life remaining. It was originally purchased for $74,000 and has been depreciated by the straight- line method. • The old harvester can be sold for $21,600 today. • The new harvester will be depreciated by the straight-line method over its 10-year life. • The corporate tax rate is 21 percent. . The firm's required rate of return is 15 percent. • The initial investment, the proceeds from selling the old harvester, and any resulting tax effects occur immediately. • All other cash flows occur at year-end. . The market value of each harvester at the end of its economic life is zero.arrow_forwardCrane Sporting Goods is planning to buy a new equipment to replace the existing old equipment. The new equipment will not affect the firm's unlevered net income or net working capital. The old equipment was purchased 3 years ago at a price of $1.2 million and follows a five-year straight-line depreciation method. The old equipment has a market value of $0.5 million now and $0 in the future. The new equipment will cost $1.4 million and follows a five-year straight-line depreciation method. By the end of year five, the CFO expects to sell the new equipment for a price of $0.6 million. What is the NPV of the equipment replacement plan for the next five years at a discount rate of 12%? The marginal tax rate for the firm is 25%. A. -0.046 million B. -0.054 million C. 0.035 million D. 0.045 millionarrow_forward

- CTI Corporation purchased a special-purpose turnkey stamping machine four years ago for $18,000. It was estimated at that time that this machine would have a life of 10 years and a salvage value of $4,000 with a removal cost of $1,500. These estimates are still good. This machine has annual operating costs of $3,000. A new machine, which is more efficient, will reduce the annual operating costs to $1,500 but will require an investment of $22,000, plus $2,000 for installation. The life of the new machine is estimated to be 12 years with a salvage value of $4,000 and a removal cost of $2,000. An offer of $7,000 has been made for the old machine, and the purchaser is willing to pay for its removal. Find the economic advantage of replacement or of continuing with the present machine. State any assumptions that you make. (Assume i = 12%.)arrow_forwardThere is old machinery with a value of $95,565, with an expected life of 20 years. There is a sale of old equipment with a book value of $30,000 and a market value of $66,000.It is intended to replace that machine with a new one worth $145,000 with a useful life of 10 years. It will ultimately be sold at market value for $90,000, to generate salvage value.Old operating costs are $95,565 and new costs are $56,984. There is an initial working capital of $35,000, with movements of 15% of the initial working capital untilyear 6. From year 7 and 8 they are 20% of the initial working capital and in the ninth year 14% of the initial working capital.The WACC required for this project is 17% with a tax rate of 38.5%. The following table shows the depreciation of the new equipment.Depreciation1 20%2 15%3 15%4 10%5 10%6 10%7 7%8 5%9 5%10 3%Calculate your PV, NPV, IRR, TIRM, PAYBACK, IR and ROIPlease if you can send me the excel to: 0229275@up.edu.mxor tell me the steps to follow and if you can…arrow_forward7) costs for the current machine. The current machine is based on older technology and has negligible market value. The purchase price of the new equipment is $500,000 and it is expected to last for 10 years. Its terminal salvage value is $50,000. Operating and maintenance (O&M) costs are estimated to be $20,000 for the first year. Thereafter, these O&M costs are expected to increase by $2,000 each year over the previous year's costs. MARR is 10% per year compounded annually. a) b) purchase this new equipment? Explain. EmKay, Inc. has decided to purchase new equipment because of the increasing maintenance Compute the present worth for this new equipment purchase. If the annual O&M costs for the current machine are $75,000, would you support the decision toarrow_forward

- Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $102,990, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $30,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 14%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $26,475 per year. Under these conditions, what is the internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 1.…arrow_forwardMaxwell Manufacturing is contemplating the purchase of a new machine to replace a machine that has been in use for seven years. The old machine has a net book value (NBV) of $51,000 and still has five years of useful life remaining. The old machine has a current market value of $5,100, but is expected to have no market value after five years. The variable operating costs and depreciation expenses (straight-line basis) are $120,000 per year. The new machine will cost $86,000, has an estimated useful life of five years with zero disposal value after five years, and an annual operating expense of $101,000 (including straight-line depreciation). Considering the five years in total and ignoring the time value of money and income taxes, what is the difference in total relevant costs for the two decision alternatives (keep vs. replace)?arrow_forwardA conveyor system was purchased three years ago for $60,000 with an expected useful life of 10 years and no expected salvage value. Due to a change in product configuration, the conveyor system must be upgraded at a cost of $20,000. Maintenance on this system is approximately $4000 per year and the current system has a market value of $2000. Alternatively, the current system can be replaced with new equipment costing $65,000, with operating costs of $1,000 per year and an expected salvage of $10,000 after 7 years. Determine whether the company should keep or replace the defender now at an MARR of 15% per year. The current system is the Defender and the new system is the Challenger. What is the annual worth of the challenger?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education