FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

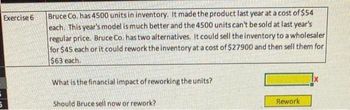

Transcribed Image Text:Exercise 6

Bruce Co. has 4500 units in inventory. It made the product last year at a cost of $54

each. This year's model is much better and the 4500 units can't be sold at last year's

regular price. Bruce Co. has two alternatives. It could sell the inventory to a wholesaler

for $45 each or it could rework the inventory at a cost of $27900 and then sell them for

$63 each.

What is the financial impact of reworking the units?

Should Bruce sell now or rework?

Rework

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the impact on profit for the year if Nardin Outfitters accepts the special order? (Enter your answers in thousands rounded to 1 decimal place. (i.e., 5, 400, 400 should be entered as 5, 400.4). Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) Nardin Outfitters has a capacity to produce 18, 500 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $ 1,550 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 570 Fixed manufacturing costs 155 Variable selling and administrative costs 145 Fixed selling and administrative costs 115 Total costs $ 985 The company has received a special order for 1,800 tents at a price of $730 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $58 per tent. The special…arrow_forwardTotally Tanked, Inc. sells tank tops. The firm is considering making some changes in order to achieve its goal of increasing its profit.If it makes no changes, the company anticipates the following for the coming year. Maria, one of the company’s managers suggests the following: “I think if we cut our price to $17 a tank top, we will increase our sales to 3,700,000 tank tops. I think that will help us achieve our goal” Question: Mr. Big, the CEO, upon hearing Maria’s plan says “This is great! We should go forward with your plan since we will increase sales by 700,000 tank tops.” How would you answer Mr. Big? # of tank tops to be sold 3,000,000 Selling price per tank top $20 Variable expense per tank top $8 Fixed expenses for the year $20,000,000arrow_forward29) Foamsoft sells customized boat shoes. Currently, it sells 16,850 pairs of shoes annually at an average price of $75 a pair. It is considering adding a lower-priced line of shoes which sell for $59 a pair. Foamsoft estimates it can sell 4,500 pairs of the lower-priced shoes but will sell 1,100 fewer pairs of the higher-priced shoes by doing so. What is the estimated value of the erosion cost that should be charged to the lower-priced shoe project?arrow_forward

- Alley Company is a speaker maker. Each speaker is priced at $400. The corporation spends $300 on the speaker. The corporation believes that in order to succeed in the economy, it needs reduce its sale price to $360. The marketing department believes that by lowering the purchase price by 20%, profits will rise by 20%. Currently, the firm offers 450,000 speakers a year. What should the target expense be, rounded to the nearest cent, if the target profit margin is 28% of revenue in order to maintain the competitive price of $360? Please Helparrow_forwardMcGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $815 per set and have a variable cost of $365 per set. The company has spent $150,000 for a marketing study that determined the company will sell 55,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,000 sets of its high-priced clubs. The high-priced clubs sell at $1,345 and have variable costs of $730. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for $445 and have variable costs of $210 per set. The fixed costs each year will be $9.45 million. The company has also spent $1 million on research and development for the new clubs. The plant and equipment required will cost $39.2 million and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1.85 million that will be returned at the end of the project. The tax rate is 25 percent, and the…arrow_forwardPlease help mearrow_forward

- 2. Company XYZ sells CDs. The price of its new CD is $15. Fixed costs are $1,500,000 per year. Variable costs are $9. The company expects to sell 300,000 units this year. a. How many DVDS will the company need to sell to break even? b. If the forecasts are correct, how much will company XYZ make or lose this year (before taxes)?arrow_forwardAlberto Technologies, manufacture and sells an electronic control device for $297. It has costs of $231 to manufacture it. A competitor is bringing a new electronic control device to market that will sell for $253. Marketing manager at Alberto believes it must lower the price to $253 to compete in the market for electronic control device. Marketing manager believes that the new price will cause sales to increase by 12%, even with a new competitor in the market. Alberto's sales are currently 6,000 units per year. What is the target cost per unit if the target operating income is 25% of salesarrow_forwardA company is trying to decide whether to buy a new delivery truck to replace their old one. The old truck originally cost $32,000. The new truck will cost $45,000. If they buy the new truck, they will sell the old truck to a used truck dealer for $4,000. Based on the information given, what is the immediate total incremental cost or benefit of buying the new truck? (Indicate a net benefit as a positive number and a net cost as a negative number.)arrow_forward

- The Tolar Corporation has 400 obsolete desk calculators that are carried in inventory at a total cost of $576,000. If these calculators are upgraded at a total cost of $100,000, they can be sold for a total of $160,000. As an alternative, the calculators can be sold in their present condition for $40,000. What is the financial advantage (disadvantage) to the company from upgrading the calculators? Multiple Choice $20,000 $(560,000) $120,000 $(60,000arrow_forwardMcGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $815 per set and have a variable cost of $365 per set. The company has spent $150,000 for a marketing study that determined the company will sell 55,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,000 sets of its high-priced clubs. The high-priced clubs sell at $1,345 and have variable costs of $730. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for $445 and have variable costs of $210 per set. The fixed costs each year will be $9.45 million. The company has also spent $1 million on research and development for the new clubs. The plant and equipment required will cost $39.2 million and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1.85 million that will be returned at the end of the project. The tax rate is 25 percent, and the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education