FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

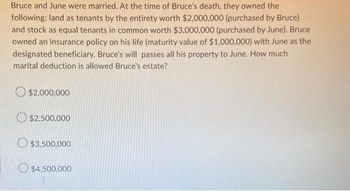

Transcribed Image Text:Bruce and June were married. At the time of Bruce's death, they owned the

following: land as tenants by the entirety worth $2,000,000 (purchased by Bruce)

and stock as equal tenants in common worth $3,000,000 (purchased by June). Bruce

owned an insurance policy on his life (maturity value of $1,000,000) with June as the

designated beneficiary. Bruce's will passes all his property to June. How much

marital deduction is allowed Bruce's estate?

$2,000,000

$2,500,000

$3,500,000

$4,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jason and Alicia Johnston purchased a home in Austin, Texas, for $655,000. They moved into the home on September 1, year 0. They lived in the home as their primary residence until July 1 of year 5, when they sold the home for $982,500. What amount of the $327,500 gain are they allowed to exclude? (Assume married filing jointly.) (Enter only numbers with no dollar signs or other punctuation.)arrow_forwardIn the current year K gifted shares of a public corporation to his spouse. The shares, that originally cost $15,000, had a value of $20,000 at the time of the gift. During the year, K's spouse received an eligible dividend of $600 from the public corporation. What amount, if any, is included in K's net income for tax purposes in the current year?arrow_forwardCarlos and Connie own a farm as tenancy by the entirety (TBE). The farm is currently valued at $2 million. All of the following statements are correct except A)if Connie dies, $1 million is included in her gross estate for estate tax purposes. B)if Carlos dies, Connie receives a stepped-up basis in 100% of the farm. C)if Carlos dies, Connie becomes full owner of the farm by right of survivorship. D)Carlos and Connie are spouses.arrow_forward

- Many years ago James and Sergio purchased property for $945,000. Although they are listed as equal co-owners, Sergio was able to provide only $420,000 of the purchase price. James treated the additional $52,500 of his contribution to the purchase price as a gift to Sergio. Required: If the property is worth $1,134,000 at Sergio's death, what amount would be included in Sergio's estate if the title to the property was tenants in common? What if the title was joint tenancy with right of survivorship? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Amount to be included in Sergio's estate if: Title to the property was tenants in common Title to the property were joint tenancy with right of survivorshiparrow_forwardWayne and Carol have been married for 60 years. At Carol's passing (and Wayne surviving) all of the assets, worth $40 Million, are either titled as Joint Tenancy with Rights of Survivorship or are held in Wayne's name only. There have been no taxable gifts made during lifetime. a. Would Carol's estate have any estate tax liability? b. Have Wayne and Carol failed to optimize Carol's exemption? c. What election could the executor of Carol's estate make to remediate the problem with how assets were held to potentially reduce the survivor's eventual estate tax?arrow_forwardCora, 79, has an estate that includes her personal residence valued at $120,000 and $18,000 in a bank account that is solely in her name. She would like to arrange her estate so that she maintains exclusive control of the assets during her lifetime, but at her death the assets will pass to her friend, Mabel, outside of probate. Based on Cora's goals and situation, which of the following are correct statements about will substitutes that she could use? She should put her bank account in tenancy in common with Mabel. She should title her personal residence in joint tenancy with her friend, Mabel. She should execute a will that names her friend, Mabel, as the legatee of the bank account and the devisee of the personal residence. She should place the bank funds in a payable on death (POD) account with Mabel as beneficiary. She should change the title on her personal residence to indicate a life estate reserved for her lifetime and a remainder to her friend, Mabel. A)IV and V…arrow_forward

- Mason buys real estate for $2,215,800 and lists ownership as follows:"Mason and Dana, joint tenants with the right of suvivorship." Mason dies first, when the real estate is valued at $2,880,540. How much is included in mason's gross estate in Mason and Dana are a.brother and sister and b. Spoucesarrow_forwardRay and Carin are partners in an accounting firm. The partners have entered into an arm's length agreement requiring Ray to purchase Carin's partnership interest from Carin's estate if she dies before Ray. The price is set at 120% of the book value of Carin's partnership interest at the time of her death. Ray purchased an insurance policy on Carin's life to fund this agreement. After Ray had paid $45,000 in premiums, Carin was killed in an automobile accident and Ray collected $800,000 of life insurance proceeds. Ray used the life insurance proceeds to purchase Carin's partnership interest. Question Content Area a. What amount should Ray include in his gross income from receiving the life insurance proceeds? Question Content Area b. The insurance company paid Ray $16,000 interest on the life insurance proceeds during the period Carin's estate was in administration. During this period, Ray had left the insurance proceeds with the insurance company. Is this…arrow_forwardCarl and Karina file a joint return. Karina earned a salary of $40,250 and received dividends of $3,180, taxable interest income of $2,090, and nontaxable interest of $1,045. Carl received $9,360 of social security benefits and a gift of $6,090 from his brother. What amount of social security benefits is taxable to Carl and Karina? Taxable social security benefits = $arrow_forward

- At the time of her death on September 4, Alicia held the following assets: Bonds of Emerald Tool Corporation Stock in Drab Corporation Insurance policy (face amount of $1,456,000) on the life of her brother, Mitch Traditional IRAs Cash surrender value. Fair Market Value The amount included in Alicia's gross estate for these items is $ $3,640,000 4,368,000 * 291,200 1,092,000 Alicia also held a lifetime income interest in a trust (fair market value of trust assets $5,500,000) created by her late spouse Bert. (The executor of Bert's estate had made a QTIP election.) In October, Alicia's estate received an interest payment of $15,000 ($7,500 accrued before September 4) paid by Emerald and a cash dividend of $10,550 from Drab. The Drab dividend was declared on August 19 and was payable to date of record shareholders on September 3. Although Mitch survives Alicia, she is the designated beneficiary of the insurance policy. The IRAs are distributed to Alicia's children.arrow_forwardThe Smiths give their daughter, Megan, a parcel of land with an adjusted basis to the Smiths of $22,000. It had a fair market value at the time of the gift of $20,000. No gift tax was due on the transfer. Megan sold the land a couple of years later for $21,000. How much gain or loss does Megan recognize?arrow_forwardBret died and was survived by his wife, Anne, and two adult children. Bret's will provided for the maximum estate tax applicable exclusion amount for the year of death to be placed into a family bypass trust, in which Anne and the children were named as income beneficiaries, with the children to receive equal shares of the trust assets upon Anne's death. The will provided that the remainder of Bret's estate was to be placed in a power of appointment trust. Bret did not make any lifetime taxable gifts. Assume that no federal estate tax deductions other than the marital deduction were taken. Which of the following are CORRECT statements about the federal estate tax implications of the estate planning techniques contained in Bret's will? Bret's taxable estate will be zero, but his tax base will be the maximum estate tax applicable exclusion amount. Anne's interest in the family bypass trust is considered to be a terminable interest; thus, assets placed in this trust will not be entitled…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education