Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Help me tutor

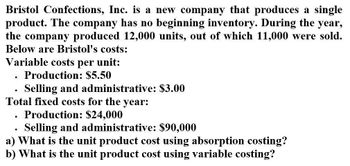

Transcribed Image Text:Bristol Confections, Inc. is a new company that produces a single

product. The company has no beginning inventory. During the year,

the company produced 12,000 units, out of which 11,000 were sold.

Below are Bristol's costs:

Variable costs per unit:

•

•

Production: $5.50

Selling and administrative: $3.00

Total fixed costs for the year:

•

•

Production: $24,000

Selling and administrative: $90,000

a) What is the unit product cost using absorption costing?

b) What is the unit product cost using variable costing?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was Refer to the information in 2.24. The gross margin percentage for last year was a. 12.57% b. 55.67% c. 28.95% d. 38.33%arrow_forwardStarling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200arrow_forwardOttis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forward

- Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardKildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for 52 each. The actual unit cost is as follows: The selling expenses consisted of a commission of 1.30 per unit sold and advertising copayments totaling 95,000. Administrative expenses, all fixed, equaled 183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 132,600 for 3,400 easels. Required: 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 2. Prepare a cost of goods sold statement. 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.arrow_forwardBethany Company has just completed the first month of producing a new product but has not yet shipped any of this product. The product incurred variable manufacturing costs of 5,000,000, fixed manufacturing costs of 2,000,000, variable marketing costs of 1,000,000, and fixed marketing costs of 3,000,000. Under the variable costing concept, the inventory value of the new product would be: a. 5,000,000. b. 6,000,000. c. 8,000,000. d. 11,000,000.arrow_forward

- Bodega Chocolate, Inc. is a new company that produces a single product. The company has no beginning inventory. During the year, the company produced 10,000 units out of which 9,000 were sold. Below are Bodega's costs: Variable costs per unit: Production $4.00 Selling and administrative $2.50 Total fixed costs for the year: Production $20,700.00 Selling and administrative $85,000 a) What is the unit product using absorption costing? b) What is the unit product cost using variable costing?arrow_forwardSierra Company incurs the following costs to produce and sell its only product. Variable costs per unit: Direct materials $ 9 Direct labor $ 8 Variable manufacturing overhead $ 3 Variable selling and administrative expenses $ 4 Fixed costs per year: Fixed manufacturing overhead $ 60,000 Fixed selling and administrative expenses $ 305,000 During this year, 30,000 units were produced and 25,250 units were sold. The Finished Goods inventory account at the end of this year shows a balance of $95,000 for the 4,750 unsold units. Required: 1-a. Calculate this year's ending balance in Finished Goods inventory two ways—using variable costing and using absorption costing. 1-b. Does it appear that the company is using variable costing or absorption costing to assign costs to the 4,750 units in its Finished Goods inventory? 2. Assume that the company wishes to prepare this year's financial statements for its stockholders. a. Is Finished Goods inventory…arrow_forwardThe following information for the past year for the Magic Corporation has been provided: Fixed costs: Manufacturing Marketing $150,000 24,000 Administrative 18,000 Variable costs: Manufacturing Marketing Administrative $118,000 24,000 36,000 During the year, the company produced and sold 70,000 units of product at a selling price of $19.34 per unit. There was no beginning inventory of product at the beginning of the year. What is the contribution margin per unit for the company? (Round any intermediary calculations and your final answer to the nearest cent.) O A. $16.8 O B. $2.54 O C. $5.29 O D. $16.6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning