EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Financial accounting question

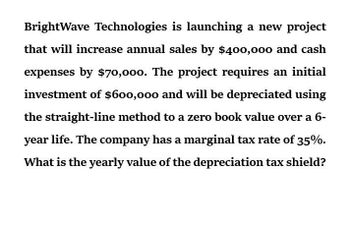

Transcribed Image Text:BrightWave Technologies is launching a new project

that will increase annual sales by $400,000 and cash

expenses by $70,000. The project requires an initial

investment of $600,000 and will be depreciated using

the straight-line method to a zero book value over a 6-

year life. The company has a marginal tax rate of 35%.

What is the yearly value of the depreciation tax shield?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardApex Digital Innovations is planning a project that will increase sales by $350,000 and cash expenses by $95,000. The project will cost $720,000 and will be depreciated using the straight- line method to a zero book value over the 8-year life of the project. The company's marginal tax rate is 30%. What is the yearly value of the depreciation tax shield?arrow_forwardAccounting question? ?arrow_forward

- I need help with this problem and accounting questionarrow_forwardBuilders Supply, Inc.is considering adding a new product line that is expected to increase annual sales by $367,000 and expenses by $256,000. The project will require $165,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 8-year life of the project. The company has a marginal tax rate of 34 percent. What is the depreciation tax shield?arrow_forwardPlease need help with this accounting questionarrow_forward

- Sunrise Furniture Inc. wants to upgrade the existing production process. The cost-cutting project can potentially reduce expenses by $665,000 per year. The project will require an initial investment in fixed assets of $1,268,000 that will be depreciated using the straight-line method to a zero book value over the 5-year life of the project. The company has a marginal tax rate of 23 percent. What is the depreciation tax shield at the end of year 2? A. $58,328 B. $411,400 C. $94,622 D. $253,600arrow_forwardPlanet Enterprises is purchasing a $9.6 million machine. It will cost $48,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.1 million per year along with incremental costs of $1.1 million per year. Planet's marginal tax rate is 30% . You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated? The free cash flow for year 0 will be ? The free cash flow for years 1-5 will be ?arrow_forwardDaily Enterprises is purchasing a $9.6 million machine. It will cost $45,000 to transport and install the machine. The machine has a depreciable life of 5 years and will have no salvage value. The machine will generate incremental revenues of $4.2 million per year along with incremental costs of $1.2 million per year. If Daily's marginal tax rate is 28%, what are the incremental earnings (net income) associated with the new machine?arrow_forward

- Daily Enterprises is purchasing a $10.4 million machine. It will cost $46,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.4 million per year along with incremental costs of $1.5 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $10,446,000. (Round to the nearest dollar.) The free cash flow for years 1-5 will be $ (Round to the nearest dollar.)arrow_forwardDaily Enterprises is purchasing a $10.4 million machine. It will cost $46,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.4 million per year along with incremental costs of $1.5 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $ (Round to the nearest dollar.)arrow_forwardDaily Enterprises is purchasing a $10.3 million machine. It will cost $46,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.2 million per year along with incremental costs of $1.1 million per year. Daily’s marginal tax rate is 35%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? A. The free cash flow for year 0 will be? (Round to nearest dollar.) B. The free cash flow for years 1-5 will be? (Round to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning