Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

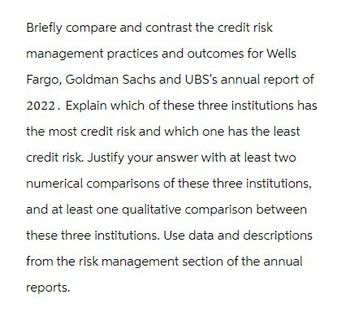

Transcribed Image Text:Briefly compare and contrast the credit risk

management practices and outcomes for Wells

Fargo, Goldman Sachs and UBS's annual report of

2022. Explain which of these three institutions has

the most credit risk and which one has the least

credit risk. Justify your answer with at least two

numerical comparisons of these three institutions,

and at least one qualitative comparison between

these three institutions. Use data and descriptions

from the risk management section of the annual

reports.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Identify trends, examine financial market principles and standards, make judgments, and prepare recommendations or solutions. Be sure to explore issues of diversity and ethics as related to money markets. also Assess why money markets are of interest to an accountant and why organizations should also share this same concern.arrow_forwardI need help answering A, B, and C, questions please in the pic.arrow_forwardAll of the following are purposes of internal risk rating systems except: Group of answer choices D. Pricing and trading of loans. B. Setting of limits and acceptance or rejection of new transactions. C. Inadequacy of loan reserves. A. Monitoring of credit quality.arrow_forward

- Identify at least two different ratios from the standpoint of an investor or creditor in determining the financial health of an organization. Describe how the measure is calculated and the reason for selecting the two ratios that you chose.arrow_forwardsarrow_forwardConsider the following questions on credit risk a) Describe the Basel II framework and its drawbacks b) Sean who is a credit risk analyst has come up with the following counts of good andbadcredit score models.arrow_forward

- Question No: 04 This is a subjective question, hence you have to write your answer in the Text-Field given below. "In case of financial institutions along with financial performance financial stability is also very crucial." Discus with suitable illustrations the ratios calculated in order to measure financial stability of a bank.arrow_forwardIf you were the banker, what information would you want from a company to evaluate their riskiness and their ability to repay a loan? What specific information would you need to begin a cash receipts forecast? Identify three items that would be helpful.arrow_forwardCritically evaluate the role of credit rating agencies.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education