FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

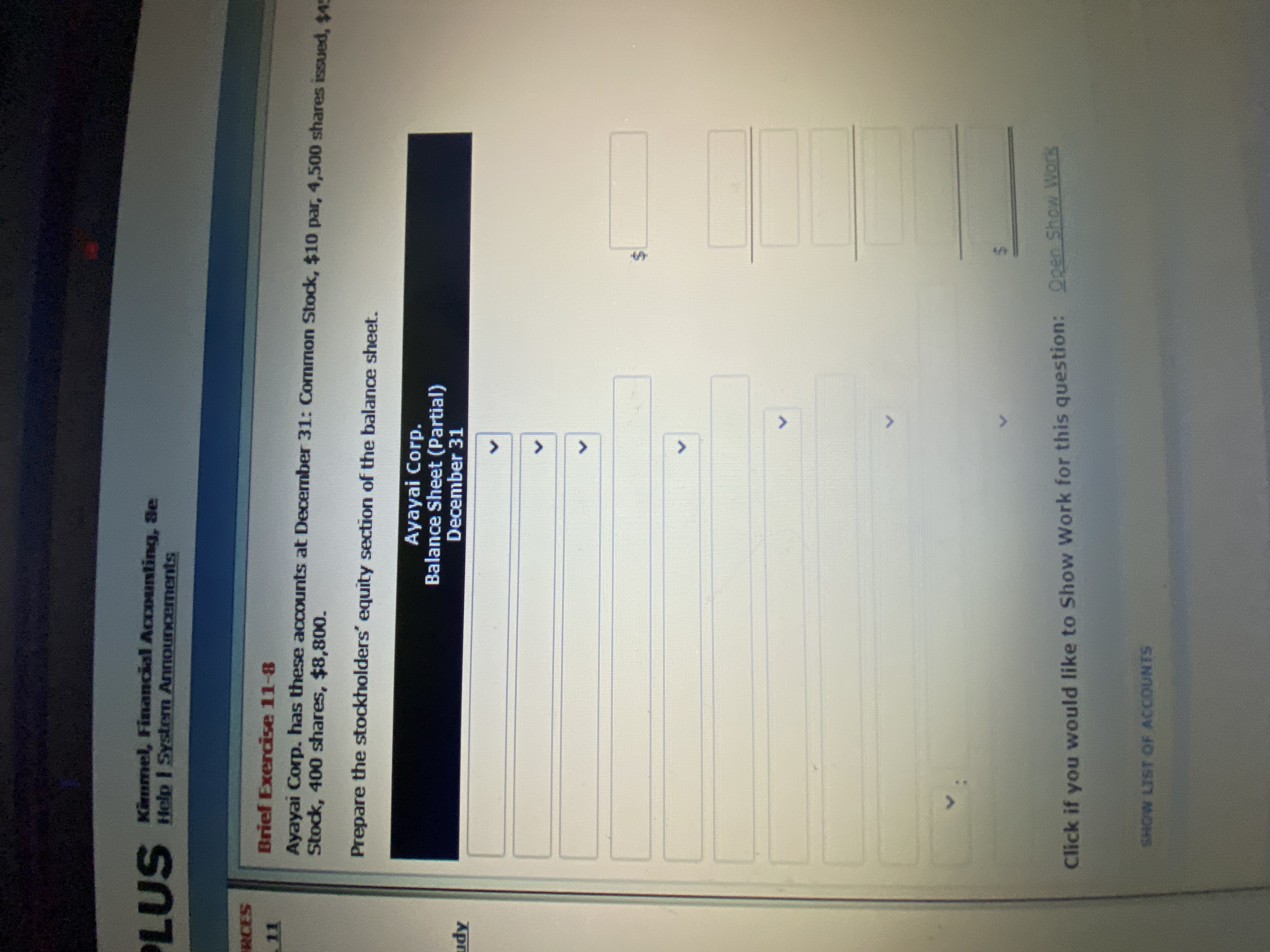

Transcribed Image Text:Brief Exercise 11-8

Ayayai Corp. has these accounts at December 31: Common Stock, $10 par, 4,500 shares issued, $45

Stock, 400 shares, $8,800.

Prepare the stockholders' equity section of the balance sheet.

Ayayai Corp.

Balance Sheet (Partial)

December 31

%24

Transcribed Image Text:Kimmel, Financial Accounting, 8e

US elo I Systen Announcements

CALCULATOR

NOISWIA MLNmM

SIR

Brief Exercise 11-8

TR

Ayayai Corp. has these accounts at December 31: Cornmon Stock, $10 par, 4,500 shares issued, $45,000; Paid-in Capital in Excess of Par Value $18,000; Retained Earnings $43,000; and Treamum

Stock, 400 shares, $8,800.

Prepare the stockholders' equity section of the balance sheet.

Ayayai Corp.

Balance Sheet (Partial)

December 31

Apm

Click if you would like to Show Work for this question: Q2an Show Ws

SANDORON BO ASES MOHS

parse E o sitaagy wogsan

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- aaarrow_forwardExercise 11-13A (Algo) Recording and reporting treasury stock transactions LO 11-5 The following information pertains to JAE Corporation at January 1, Year 1: Common stock, $11 par, 14,000 shares authorized, 2,800 shares issued and outstanding Paid-in capital in excess of par, common stock Retained earnings $30,800 12,100 51,200 4 JAE Corporation completed the following transactions during Year 1: 1. Issued 1,150 shares of $11 par common stock for $30 per share. 2. Repurchased 160 shares of its own common stock for $27 per share. 3. Resold 50 shares of treasury stock for $28 per share. Required: a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below.…arrow_forwardI need help with thisarrow_forward

- Exercise 14-03 a-b (Video) On January 1, 2020, Oriole Corporation had $1,160,000 of common stock outstanding that was issued at par. It also had retained earnings of $747,500. The company issued 37,500 shares of common stock at par on July 1 and earned net income Journalize the declaration of a 15% stock dividend on December 10, 2020, for the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is re Entry" for the account titles and enter 0 for the amounts.) b. No. Account Titles and Explanation a. Par value is $10, and market price is $18. Par value is $5, and market price is $22. b. Debit LINK TO TEXT Credit Click if you would like to Show Work for this question: Open Show Work VIDEO: SIMILAR EXERCISEarrow_forwardQuestion Content Area Alma Corp. issues 870 shares of $6 par common stock at $19 per share. When the transaction is journalized, credits are made to a. Common Stock, $16,530. b. Common Stock, $5,220 and Paid-In Capital in Excess of Par—Common Stock, $11,310. c. Common Stock, $11,310 and Paid-In Capital in Excess of Stated Value, $5,220. d. Common Stock, $5,220 and Retained Earnings, $11,310.arrow_forwardAarrow_forward

- ces Exercise 11-6A (Static) Accounting for cumulative preferred dividends LO 11-3 When Crossett Corporation was organized in January Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earnings history is as follows: Year 1, net loss of $35,000; Year 2, net income of $125,000; Year 3, net income of $215,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $25,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. Required A Required B Assume that the Board of directors declares a $25,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are…arrow_forwardACCT2110 Financial Accounting Chapter 11 Stockholders' Equity Homework Problem 1. The stockholders' equity section of MaiStyle Corporation's balance sheet at December 31 is presented here. MAISTYLE CORPORATION Balance Sheet (partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 10,000 shares authorized, 6,000 shares issued and outstanding $900,000 Common stock, no par; 750,000 shares authorized, 600,000 shares issued 1,800,000 Total paid-in capital 2,700,000 Retained earnings 1,158,000 Total paid-in capital and retained earnings 3,858,000 Less: Treasury stock (8,000 common shares) (32,000) Total stockholders' equity $3,826,000 Instructions From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? (b) Assuming there is a stated value, what is the stated value of the common stock? (c) What is the par value of the preferred stock? (d) If the annual dividend on preferred stock is $36,000,…arrow_forwardPROBLEM 12-3B The following selected accounts appear in the ledger of Kingfisher Environmental Corporation on March 1, 2006, the beginning of the current fiscal year: Selected stock transactions Objectives 4, 5, 7 Preferred 2% Stock, $75 par (10,000 shares authorized, 8,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $10 par (50,000 shares authorized, 35,000 shares issued) Paid-In Capital in Excess of Par-Common Stock . Retained Earnings $ 600,000 ..... 100,000 RAS.S. 350,000 85,000 1,050,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 7,500 shares of common stock at $24, receiving cash. b. Sold 800 shares of preferred 2% stock at $81. c. Purchased 3,000 shares of treasury common for $66,000. d. Sold 1,800 shares of treasury common for $50,400. e. Sold 750 shares of treasury common for $14,250. f. Declared cash dividends of $1.50 per share on preferred…arrow_forward

- Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (LO10-2, 10-3, 10-4, 10-5) Skip to question [The following information applies to the questions displayed below.] Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 350 shares of preferred stock and 4,500 shares of common stock have been issued. The following transactions affect stockholders’ equity during 2021: March 1 Issue 1,600 shares of common stock for $47 per share. May 15 Purchase 450 shares of treasury stock for $40 per share. July 10 Resell 250 shares of treasury stock purchased on May 15 for $45 per share. October 15 Issue 250 shares of preferred stock for $50 per share. December 1 Declare a cash dividend on both common and preferred stock of $1.00 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury…arrow_forwardCurrent Attempt in Progress On January 1, Bramble Corporation had 72000 shares of $10 par value common stock outstanding On March 17, the company declared a 15% stock dividend to stockholders of record on March 20. Market value of the stock was $12 on March 17. The stock was distributed on March 30. The entry to record the transaction of March 30 would include a O credit to Cash for $108000. O debit to Stock Dividends for $21600. O credit to Paid-in Capital in Excess of Par for $21600. O debit to Common Stock Dividends Distributable for $108000arrow_forward9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education