FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

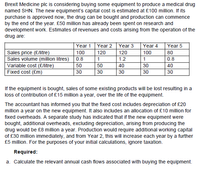

Transcribed Image Text:Brexit Medicine plc is considering buying some equipment to produce a medical drug

named SHN. The new equipment's capital cost is estimated at £100 million. If its

purchase is approved now, the drug can be bought and production can commence

by the end of the year. £50 million has already been spent on research and

development work. Estimates of revenues and costs arising from the operation of the

drug are:

Year 1

Year 2

Year 3

Year 4

Year 5

Sales price (£/litre)

Sales volume (million litres)

Variable cost (£/litre)

Fixed cost (£m)

100

120

120

100

80

0.8

1

1.2

1

0.8

50

50

40

30

40

30

30

30

30

30

If the equipment is bought, sales of some existing products will be lost resulting in a

loss of contribution of £15 million a year, over the life of the equipment.

The accountant has informed you that the fixed cost includes depreciation of £20

million a year on the new equipment. It also includes an allocation of £10 million for

fixed overheads. A separate study has indicated that if the new equipment were

bought, additional overheads, excluding depreciation, arising from producing the

drug would be £8 million a year. Production would require additional working capital

of £30 million immediately, and from Year 2, this will increase each year by a further

£5 million. For the purposes of your initial calculations, ignore taxation.

Required:

a. Calculate the relevant annual cash flows associated with buying the equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A firm is considering an investment in a new machine with a price of $15.9 million to replace its existing machine. The current machine has a book value of $5.7 million and a market value of $4.4 million. The new machine is expected to have a 4-year life, and the old machine has four years left in which it can be used. If the firm replaces the old machine with the new machine, it expects to save $6.45 million in operating costs each year over the next four years. Both machines will have no salvage value in four years. If the firm purchases the new machine, it will also need an investment of $280,000 in net working capital. The required return on the investment is 11 percent and the tax rate is 23 percent. The company uses straight-line depreciation. a)- What is the NPV of the decision to purchase the new machine? b) What is the IRR of the decision to purchase the new machine? c) WHat is the NPV of the decison to keep using the old machine? d) What is the IRR of the decison to keep…arrow_forward7arrow_forwardNPV. Grady Precision Measurement Tools has forecasted the following sales and costs for a new GPS system: annual sales of 45,000 units at $16 a unit, production costs at 37% of sales price, annual fixed costs for production at $200,000. The company tax rate is 38%. What is the annual operating cash flow of the new GPS system? Should Grady Precision Measurement Tools add the GPS system to its set of products? The initial investment is $1,320,000 for manufacturing equipment, which will be depreciated over six years (straight line) and will be sold at the end of five years for $380,000. The cost of capital is 12%. What is the annual operating cash flow of the new GPS system? $ (Round to the nearest dollar.)arrow_forward

- The financial manager of Tepung Berhad, Encik Danial, is considering a project which requiresan investment of RM53,000 in a machine. This machine in which will improve the performanceand production quantities of the company’s range of biscuits. At the end of the five-year period,this machine will be scrapped.Encik Danial expects that this project will lead to increased sales for the next five years as follows:Year Sales (‘000 units)1 8002 9003 1,0004 1,1005 1,200The selling price per unit is RM20. Labor and utilities costs are estimated to be RM8 and RM4 perunit respectively. The project requires an increase in net working capital of RM10,000 in the initialyear and will be fully recovered at the end of the project. The company’s required return oninvestment of 15%.Encik Danial thinks that the unit sales, selling price, labor, and utilities cost projections areaccurate to within 15%.Note: The calculation on depreciation, fixed cost and the effect on tax is ignored for this question.…arrow_forwardWebmasters.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year’s projected sales; for example, NWC0 10% Sales1. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company’s non-variable costs would be $1 million in Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated…arrow_forward4arrow_forward

- Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $27.00 million. The plant and equipment will be depreciated over 10 years to a book value of $2.00 million, and sold for that amount in year 10. Net working capital will increase by $1.43 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.30 million per year and cost $2.46 million per year over the 10-year life of the project. Marketing estimates 13.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 33.00%. The WACC is 12.00%. Find the IRR (internal rate of return).arrow_forward18arrow_forwardHT Bowling, Inc is considering the purchase of VOIP phone system. It will require an initial investment of $29,500 and $9,000 per year in annual operating costs over the equipment's estimated useful life of 4 years. The company will use a discount rate of 11%. What is the equivalent annual cost? $3,460 O $12,623 O $26,810 O $18,509arrow_forward

- A manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardLeeds Limited is looking to expand its operations and increase its market share in the cell phone industry. To achieve this, they are looking to increase its current productive capacity of 100 000 cell phones a year by at least 6% for each of the next 5 years. It is considering two cell phone making machines and is unsure which to purchase: Cell Phone Machine ABC:Cell Phone Machine ABC can be imported at a landed purchase cost of R160 000 and a further R20 000 transport and installation costs will have to be incurred to get it ready for production. This machine is expected to last 5 years after which it will be sold at its scrap value of R20 000. Net cash flow from the sale of the additional production is expected to be R58 000, R63 000, R68 000, R72 000 and R51 000 respectively over the 5-year lifespan of the machine. This machine will enable Leeds Limited to achieve a 4% increase in productive capacity.Cell Phone Machine XYZ:Cell Phone Machine XYZ can be purchased locally for R190…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education