Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:### Investment Analysis of a Nylon-Knitting Machine

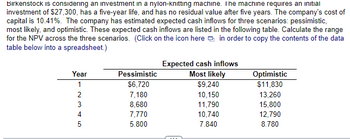

Birkenstock is evaluating an investment opportunity involving a nylon-knitting machine. The specifics of this investment include:

- **Initial Investment**: $27,300

- **Lifespan**: 5 years

- **Residual Value**: $0 after 5 years

- **Cost of Capital**: 10.41%

The company forecasts expected cash inflows under three scenarios: pessimistic, most likely, and optimistic. These projections are detailed in the table below:

#### Expected Cash Inflows

| Year | Pessimistic | Most Likely | Optimistic |

|------|-------------|-------------|------------|

| 1 | $6,720 | $9,240 | $11,830 |

| 2 | $7,180 | $10,150 | $13,260 |

| 3 | $8,680 | $11,790 | $15,800 |

| 4 | $7,770 | $10,740 | $12,790 |

| 5 | $5,800 | $7,840 | $8,780 |

### Instructions

Calculate the range for the Net Present Value (NPV) across all three scenarios. This information can be copied into a spreadsheet for further analysis.

(Note: For interactive use, there's a feature to directly copy the table data into a spreadsheet by clicking on a designated icon.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The management of SoComfy Hotel wishes to capitalize on an investment project that will cost the management to pay $85,000 as an initial cost. This project will take three years to finish with the net cash flows stream of $18,000 for the first year, $21,000 for the second year, and $22,500 for the third year. Should the management accept the project by analyzing the net present value (NPV) of the cash flow stream if they have 12.00% minimum required rate of return on the project?arrow_forwardA company must make a choice between two investment alternatives. Alternative 1 will return the company $33,000 at the end of two years and $70,000 at the end of seven years. Alternative 2 will return the company $8,000 at the end of each of the next seven years. The company normally expects to earn a rate of return of 10% on funds invested. Compute the present value of each alternative and determine the preferred alternative according to the discounted cash flow criterion. The present value of Alternative 1 is S (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The present value of Alternative 2 is S (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The preferred alternative is Alternative 1. Alternative 2.arrow_forwardGrady-White Boats, Inc. is considering a project that will require additional inventory of $1,131,000. In addition, pursuing this project will also increase accounts payable by $400,000 as suppliers are willing to finance part of these purchases. Accounts receivable are currently $800,000 and are expected to increase by 10% if this project is accepted. The firm's cash requirements are not anticipated to change. What is the incremental change to net working capital as a result of accepting this project? O A. $1,531,000 O B. $1,451,000 C. $811,000 D. $651,000 O E. $1,611,000arrow_forward

- A Company is considering an investment proposal, involving an initial cash outlay of TZS 450,000. The proposal has an expected life of 7 years and zero salvage value. At a required rate of return of 12 percent, the proposal has a profitability index of 1.182. Required: Calculate annual cash inflows.arrow_forwardSnyder Company is considering purchasing equipment. The equipment will produce the following cash inflows: Year 1, $25,000; Year 2, $30,000; and Year 3, $40,000. Snyder requires a minimum rate of return of 11%.What is the maximum price Snyder should pay for this equipment? Please show how to do it using financial calculator. THnaks.arrow_forwardte.8arrow_forward

- Blur Corp. is looking at investing in a production facility that will require an initial investment of $500,000. The facility will have a three-year useful life, and it will not have any salvage value at the end of the project’s life. If demand is strong, the facility will be able to generate annual cash flows of $250,000, but if demand turns out to be weak, the facility will generate annual cash flows of only $120,000. Blur Corp. thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 13%, what will be the expected net present value (NPV) of this project? -$66,346 -$63,187 -$34,753 -$44,231 Blur Corp. could spend $510,000 to build the facility. Spending the additional $10,000 on the facility will allow the company to switch the products they produce in the facility after the first year of operations if demand turns out to be weak in year 1. If the…arrow_forwardWavy Inc is examining a project that requires an initial investment of -10 million today. This will be followed by several years of positive incremental after-tax cash flows. However, during the last year of the project's life Wavy expects that the incremental cash flow will again be negative. By which method should Wavy determine whether or not to invest? A) Both NPV or IRR are fine, as they must arrive at same investment decision B) IRR, because there will be no NPV solution in this case C) Neither NPV or IRR are useful in this situation D) NPV, since this project will have two IRRsarrow_forwardGeneral Forge and Foundry Co. is considering a three-year project that will require an initial investment of $40,000. If market demand is strong, General Forge and Foundry Co. thinks that the project will generate cash flows of $29,500 per year. However, if market demand is weak, the company believes that the project will generate cash flows of only $1,750 per year. The company thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 10%, what will be the expected net present value (NPV) of this project? -$914 -$972 -$1,143 -$1,257arrow_forward

- I think the payback periods are correct, I just need the different cash flows of each year + the final question at the bottom. Thank you.arrow_forwardBirkenstock is considering an investment in a nylon-knitting machine. The machine requires an initial investment of $27,600, has a five-year life, and has no residual value after five years. The company's cost of capital is 10.99%. The company has estimated expected cash inflows for three scenarios: pessimistic, most likely, and optimistic. These expected cash inflows are listed in the following table. Calculate the range for the NPV across the three scenarios. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year Pessimistic 1 $6,720 2 7,310 8,730 4 7,850 5 5,840 $9,320 13,270 ITTI Expected cash inflows Most likely Optimistic $11,750 10,320 11,680 10,720 15,830 12,780 7,730 8,820 For the pessimistic scenario, the NPV is $ (Round to the nearest cent.)arrow_forwardOakland Chips, which has a 10 percent required return (K), is considering a new extractor. Because of anticipated start-up delays, cash flow will be $1.000 at the end of each year for years 4 through 20. What is the present value of those future cash flows? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education