FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

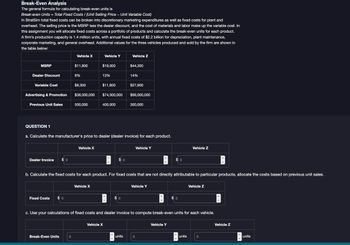

Transcribed Image Text:Break-Even Analysis

The general formula for calculating break-even units is

Break-even Units = Total Fixed Costs / (Unit Selling Price - Unit Variable Cost)

In StratSim total fixed costs can be broken into discretionary marketing expenditures as well as fixed costs for plant and

overhead. The selling price is the MSRP less the dealer discount, and the cost of materials and labor make up the variable cost. In

this assignment you will allocate fixed costs across a portfolio of products and calculate the break-even units for each product.

A firm's production capacity is 1.4 million units, with annual fixed costs of $2.2 billion for depreciation, plant maintenance,

corporate marketing, and general overhead. Additional values for the three vehicles produced and sold by the firm are shown in

the table below:

Vehicle X

Vehicle Y

Vehicle Z

MSRP

$11,800

$19,000

$44,300

Dealer Discount

8%

13%

14%

Variable Cost

Advertising & Promotion

$8,300

$11,600

$27,900

$38,000,000 $74,000,000

$99,000,000

Previous Unit Sales

500,000

400,000

300,000

QUESTION 1

a. Calculate the manufacturer's price to dealer (dealer invoice) for each product.

Dealer Invoice

$ 0

Vehicle X

Vehicle Y

$ 0

Vehicle Z

b. Calculate the fixed costs for each product. For fixed costs that are not directly attributable to particular products, allocate the costs based on previous unit sales.

Fixed Costs

$ 0

Vehicle X

$ 0

Vehicle Y

Vehicle Z

c. Use your calculations of fixed costs and dealer invoice to compute break-even units for each vehicle.

Break-Even Units

0

Vehicle X

units

0

Vehicle Y

units

0

Vehicle Z

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The cost-volume-profit analysis for a breakeven chart does not assume Group of answer choices Some costs vary inversely with volume. Production will equal sales. Costs are linear and continuous over the relevant range. Price will remain fixed.arrow_forwardContribution margin dividedt by Income is the: Multiple Choice Contribution margin ratio. Margin of safety. Degree of operating leverage. Sales mix. Break-even point in units.arrow_forwardOperating Leverage=Quantity×(Price per unit-Variable cost per unit)Quantity×(Price per unit-Variable cost per unit)-Fixed operating cost is the correct function?arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Felix & Company reports the following information. Period Units Produced 0 560 960 123456789 10 1,360 1,760 2,160 2,560 2,960 3,360 3,760 Total Costs $ 4,660 3,960 4,360 4,960 4,060 4,260 8,760 16,160 4,960 11,992 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 2,440 units are produced.arrow_forwardIf a company chooses a price to charge for its product by adding up all the expenses necessary to make the product and then adding in a profit, this is known as: a) Target Costing Ob) Skimming Pricing Oc) Cost-Based Pricing Od) Odd-Even Pricing Oe) Penetration Pricingarrow_forwardOn the CVP graph, the next unit sold will increase sales by an amount equal to the Select one: O a. Contribution margin ratio O b Selling price per unit minus the variable.costs per unit Oc Variable costs per unit Od. Difference between contribution margin and fixed costs O e. Selling price per unitarrow_forward

- 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $48,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage?arrow_forwardThe contribution margin ratio is calculated as: O a. The selling price per unit ratio /variable cost per unit ratio O b. Selling price per unit the variable cost per unit O c. None of the given answers O d. The selling price per unit/variable cost per unit e. (total sales/total sales) – variable cost ratioarrow_forwardPlease explain this statement thoroughly. "To estimate what the profit will be at various levels of activity, multiply the number of units to be sold above or below the break-even point by the unit contribution margin."arrow_forward

- Explain how the unit contribution margin can be used todetermine the unit sales required to break even.arrow_forwardnts Break-Even Analysis The general formula for calculating break-even units is Break-even Units = Total Fixed Costs / (Unit Selling Price - Unit Variable Cost) In StratSim total fixed costs can be broken into discretionary marketing expenditures as well as fixed costs for plant and overhead. The selling price is the MSRP less the dealer discount, and the cost of materials and labor make up the variable cost. In this assignment you will allocate fixed costs across a portfolio of products and calculate the break-even units for each product. A firm's production capacity is 1.4 million units, with annual fixed costs of $2.2 billion for depreciation, plant maintenance, corporate marketing, and general overhead. Additional values for the three vehicles produced and sold by the firm are shown in the table below: Vehicle X Vehicle Y Vehicle Z MSRP $11,800 $19,000 $44,300 Dealer Discount 8% 13% 14% Variable Cost $8,300 $11,600 $27,900 Advertising & Promotion $38,000,000 $74,000,000 $99,000,000…arrow_forwardIf an organization wants to make a profit, it must generate more sales revenue than the total costs it incurs. This relation can be expressed using which of the following profit equations? O a. Operating income = [(Sales price per unit - Variable cost per unit) x #units sold] - Fixed cost O b. Operating income = [Sales price per unit - Fixed cost per unit) x # units produced] -Variable cost Oc Operating income Sales revenue - Total variable costs - Discretionary costs O d. Operating income - Sales revenue - Committed costs - Fixed costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education