Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

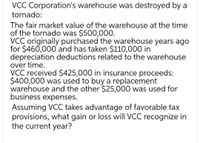

Transcribed Image Text:VCC Corporation's warehouse was destroyed by a

tornado:

The fair market value of the warehouse at the time

of the tornado was $500,000.

VCC originally purchased the warehouse years ago

for $460,000 and has taken $110,000 in

depreciation deductions related to the warehouse

over time.

VCC received $425,000 in insurance proceeds:

$400,000 was used to buy a replacement

warehouse and the other $25,000 was used for

business expenses.

Assuming VCC takes advantage of favorable tax

provisions, what gain or loss will VCC recognize in

the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Tree Lovers Inc. purchased 100 acres of woodland in which the company intends to harvest the complete forest, leaving the land barren and worthless. Tree Lovers paid $3,000,000 for the land. Tree Lovers will sell the lumber as it is harvested and expects to deplete it over five years (23 acres in year one, 30 acres in year two, 24 acres in year three, 10 acres in year four, and 13 acres in year five). Calculate the depletion expense for the next five years. Year 1 $ Year 2 Year 3 $ Year 4 Year 5 Prepare the journal entry for year one. If an amount box does not require an entry, leave it blank. %24 %24 %24 %24 %24arrow_forwardSalem Amusement Park paid $400,000 for a concession stand. Salem started out depreciating the building using the straight-line method over 20 years with a residual value of zero. After using the concession stand for four years, Salem determines that the building will remain useful for only four more years. Record Salem's depreciation on the concession stand for year five using the straight-line method. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Journal Entry Accounts Debit Creditarrow_forwardLou Lou and Company purchased a piece of machinery 2 years ago for $50,000 and has depreciation to date of $15,000. The fair market value of the asset is $30,000, but the company believes it can achieve $34,000 in net future cash flows from the asset. Costs to dispose of the asset is $200. Assuming the asset is held for use, determine if the asset is impaired. If so, what is the amount of the write-off? The asset is impaired and Lou Lou should record a $1,000 loss on impairment. The asset is impaired and Lou Lou should record a $5,200 loss on impairment. The asset is NOT impaired. The asset is impaired and Lou Lou should record a $5,000 loss on impairment.arrow_forward

- New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $283,600. The ovens originally cost $378,000, had an estimated service life of 10 years, had an estimated residual value of $23,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. 3. What is the gain or loss on the sale of the ovens at the end of the third year? Gain/Loss On salearrow_forwardSmith Company is an IFRS reporter. After 3 full years of use, the Smith Company revalues equipment with a carrying value of $970,000 to its fair value of $1,190,000 using the accumulated depreciation elimination method. The original cost of the equipment is $1,390,000 and the equipment has a useful life of 10 years with no scrap value. Smith depreciates under the straight-line method. What is the new carrying value of the asset? Group of answer choices $970,000 $1,390,000 $1,110,000 $1,190,000arrow_forwardBlossom Inc. recently replaced a piece of automatic equipment at a net price of $3,500, f.o.b. factory. The replacement was necessary because one of Blossom’s employees had accidentally backed his truck into Blossom’s original equipment and made it inoperable. Because of the accident, the equipment had no resale value to anyone and had to be scrapped. Blossom’s insurance policy provided for a replacement of its equipment and paid the price of the new equipment directly to the new equipment manufacturer, minus the deductible amount paid to the manufacturer by Blossom. The $3,500 that Blossom paid was the amount of the deductible that it has to pay on any single claim on its insurance policy. The new equipment represents the same value in use to Blossom. The used equipment had originally cost $64,000. It had a book value of $45,000 at the time of the accident and a second-hand market value of $50,000 before the accident, based on recent transactions involving similar equipment. Freight…arrow_forward

- Sage Ltd. owned several manufacturing facilities. On September 15 of the current year, Sage decided to sell one of its manufacturing buildings. The building had cost $6,325,000 when originally purchased 5 years ago, and had been depreciated using the straight-line method with no residual value. Sage estimated that the building had a 25-year life when purchased. Prepare the journal entry to record the sale of the building on Sage's books, assuming 5 years of depreciation has already been recorded in the accounts to the date of disposal. The building was sold for $5,250,000 cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Sept. 15 List of Accounts…arrow_forwardOn June 1, 2015, Skylark Enterprises (not a corporation) acquired a retailstore building for $500,000 (with $100,000 being allocated to the land). Thestore building was 39-year real property, and the straight-line cost recovery methodwas used. The property was sold on June 21, 2019, for $385,000.a. Compute the cost recovery and adjusted basis for the building using Exhibit 8.8from Chapter 8.b. What are the amount and nature of Skylark’s gain or loss from disposition ofthe property? What amount, if any, of the gain is unrecaptured § 1250 gain?arrow_forwardPlease explain Pizza corporation factory was destroyed by a hurricane. The fair market value of the factory at the time of the hurricane was $500,000 and its adjusted basis was $750,000. Pizza received insurance proceeds of $620,000, which it used to immediately buy a new factory. What gain or loss will pizza recognize related to the factory in the current year? $120,000 gain $250,000 loss No gain or loss $130,000 lossarrow_forward

- Several years ago, a company acquired an asset at a cost of $400,000. Last year, the company recognized an impairment loss of $25,000 and properly reduced the asset's book value from $250,000 to $225,000. Using the asset's new base of $225,000, the company calculates depreciation for the current year to be $10,000, bringing the book value down to $215,000. However, the company has also determined that the asset's fair value has recovered and is now estimated to be $260,000. How should the company measure the asset on its current balance sheet? O The company should reverse the prior impairment and measure the asset at its fair value prior to the initial impairment of $250,000. O The company should not reverse the impairment and should depreciate the asset by $10,000 to a new book value of $215,000. The company should not reverse the impairment and should not depreciate the asset further, leaving the book value at $225,000. O The company should reverse the prior impairment and measure…arrow_forwardJoe's Restaurant Inc. purchased an oven for $10,000 and takes $9,000 of depreciation on that oven over three years. Under IRC §1011 the basis of the oven is $1,000. A sells the oven for $20,000 thereby realizing a gain of $19,000. How much of the gain is recaptured as ordinary income, and how much is treated as §1231 gain . a. 9,000 recaptured as ordinary income 10,000 treated as §1231 gain b. 10,000 recaptured as ordinary income 9,000 treated as §1231 gain c. 19,000 recaptured as ordinary income none treated as §1231 gain d. none recaptured as ordinary income 19,000 treated as §1231 gainarrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $72.500. and it has claimed $24,800 of depreciation expense against the building. Required: a. Assuming that Houswirth receives $59,700 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $59,700 compute Houswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Houswirth receives $26.500 in cash in year 0 and a $57,000 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1. Complete this question by entering your answers in the tabs below. Required a Required b Required c Assuming that Hauswirth receives $59,700 in cash for the warehouse, compute the amount…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education