Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Three years after the intercompany equipment sale

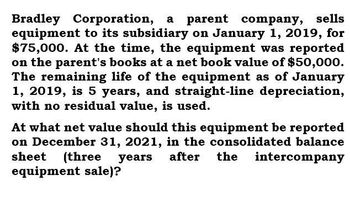

Transcribed Image Text:Bradley Corporation, a parent company, sells

equipment to its subsidiary on January 1, 2019, for

$75,000. At the time, the equipment was reported

on the parent's books at a net book value of $50,000.

The remaining life of the equipment as of January

1, 2019, is 5 years, and straight-line depreciation,

with no residual value, is used.

At what net value should this equipment be reported

on December 31, 2021, in the consolidated balance

sheet (three years after the intercompany

equipment sale)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?arrow_forwardBliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.arrow_forwardOn May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.arrow_forward

- Petes Petroleum, Inc., an SEC registrant with a calendar year-end, is in the business of constructing and operating offs] lore oil platforms. Petes Petroleum is required legally to dismantle and remove the platforms at the end of their useful lives, which is estimated to be 10 years. On January 1, 2019, Pete constructed and began operating an offshore oil platform off the coast of Brazil. The total capitalized cost to construct the platform was 3,700,000. In addition, while the future cost of dismantling the oil platform is difficult to estimate, Pete believes there is a 40% chance that the future cost will be 1,425,000, a 40% chance it will be 1,650,000, and a 20% chance that it will cost 2,125,000. The appropriate discount rate is 12%, and Pete uses the straight-line method of depreciation. Required: 1. Prepare the journal entries that Pete should record in 2019 related to the oil platform. 2. Prepare an amortization schedule for the asset retirement obligation. 3. Next Level Prepare a table showing the effect of accounting for the asset retirement obligation on assets, liabilities, shareholders equity, and net income relative to accounting for the associated costs at the end of the assets service life when the expenditure is made.arrow_forwardKam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.arrow_forwardAt what net value should this equipment be recorded?arrow_forward

- On April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre Corporation, for $40,000. At the time of the transfer, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life. Barre reported net income of $250,000, $270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000, $105,000 and $120,000 for 2020, 2021, and 2022, respectively. Assume that Republic uses the cost method to account for its investment in Barre. Compute the [ADJ] consolidating entry necessary for 2021. Select one: a. $155,750 b. $205,000 c. $320,750 d. $165,000 e. $245,750 x Your answer is incorrect. The correct answer is: $155,750arrow_forwardOn April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre Corporation, for $40,000. At the time of the transfer, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life.Barre reported net income of $250,000, $270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000, $105,000 and $120,000 for 2020, 2021, and 2022, respectively. Assume that Republic uses the equity method to account for its investment in Barre. What is the balance in the pre-consolidation Income (loss) from Subsidiary account for 2021?arrow_forwardOn January 1, 2019, Ferrothorn Co. sold equipment, to its subsidiary, Klang Corp., for P115,000. The equipment had cost P125,000 and the balance in accumulated depreciation was P45,000. The equipment had an estimated remaining useful life of eight years and P0 salvage value. Both companies use straight-line depreciation. On their separate 2019 income statements, Ferrothorn and Klang reported depreciation expense of P84,000 and P60,000 respectively. The amount of depreciation expense on the consolidated income statement for 2019 would have been:arrow_forward

- On July 15, 2021, Cottonwood Industries sold a patent and equipment to Roquemore Corporation for $750,000 and $325,000, respectively. On the date of the sale, the book value of the patent was $120,000, and the book value of the equipment was $400,000 (cost of $550,000 less accumulated depreciation of $150,000). Prepare separate journal entries to record (1) the sale of the patent and (2) the sale of the equipment.arrow_forwardOn July 15, 2021, Cottonwood Industries sold a patent and equipment to Roquemore Corporation for $930,000 and $415,000, respectively. On the date of the sale, the book value of the patent was $ $210,000, and the book value of the equipment was $508,000 (cost of $748,000 less accumulated depreciation of $240,000) Prepare the journal entries to record the sales of the patent and equipment.arrow_forwardOn July 15, 2021, Cottonwood Industries sold a patent and equipment to Roque more Corporation for $910,000 and $405,000, respectively. On the date of the sale, the book value of the patent was $ $200,000, and the book value of the equipment was $496,000 (cost of $726,000 less accumulated depreciation of $230,000) Prepare the journal entries to record the sales of the patent and equipment < 1 2 Record the sale of the equipment for $405,000. On the date of the sale, the book value of the equipment was $496,000 (cost of $726,000 less accumulated depreciation of $230,000). Note: Enter debits before credits. Event 2 General Journal Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning