Microeconomics: Principles & Policy

14th Edition

ISBN: 9781337794992

Author: William J. Baumol, Alan S. Blinder, John L. Solow

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answering all questions compulsory...

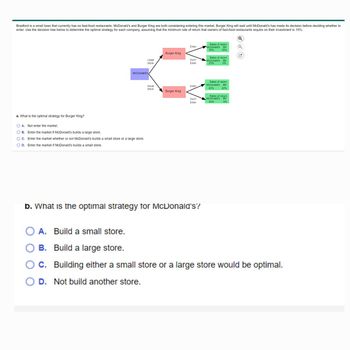

Transcribed Image Text:Bradford is a small town that currently has no fast-food restaurants. McDonald's and Burger King are both considering entering this market. Burger King will wait until McDonald's has made its decision before deciding whether to

enter. Use the decision tree below to determine the optimal strategy for each company, assuming that the minimum rate of return that owners of fast-food restaurants require on their investment is 15%.

McDonald's

a. What is the optimal strategy for Burger King?

○ A. Not enter the market.

B. Enter the market if McDonald's builds a large store.

C. Enter the market whether or not McDonald's builds a small store or a large store.

D. Enter the market if McDonald's builds a small store.

Q

Enter

Rates of return

McDonald's BK

16%

16%

Burger King

LVY

Large

Store

Don't

Enter

Rates of return

McDonald's

25%

BK

0%

Small

Store

Rates of return

McDonald's BK

Enter

20%

20%

Burger King

Rates of return

Don't

McDonald's

BK

Enter

30%

0%

b. What is the optimal strategy for McDonald's?

○ A. Build a small store.

B. Build a large store.

C. Building either a small store or a large store would be optimal.

○ D. Not build another store.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Lyft launched its IPO on April 1st 2019 with a share price of $72. Before the IPO, Lyft’s board of directors was likely trying to decide how to compensate CEO Logan Green to provide an incentive for him to increase the firm’s performance and share price after it went public. Let’s say the board was considering two possibilities such that they were deciding between providing one million dollars worth of shares of the firm stock at $72 per share or one million dollars worth of call options with a strike price of $72 and a maturity and vesting date one year after the IPO. To keep things simple, let’s say CEO Logan Green can choose between providing two levels of effort: regular effort or high effort. He has been exerting regular effort all along. He could switch to high effort which would be much more costly for him as he would have to work even longer hours, but the extra effort would likely result in better performance for the firm. The goal of the board’s incentive compensation is to…arrow_forwardQuestion An incumbent firm Pilly has a product that works well but has the possibility of causing side-effects to users. Both Pilly and an upstart firm Smirck are having the opportunity to develop a new product without the side effects. The following table shows the expected net return (after considering R&D costs, probability of success in product development, and future profits) for each firm under different scenarios. Smirck Invest Smirck Not Invest Pilly: $2.4 m Smirck: -$0.1 m. Pilly Invest Pilly: $4.9 m Smirck: $0 Pilly Not Invest Pilly: $3 m Smirck: $0.4 m Pilly: $5 m Smirck: $0 Assume that the two firms simultaneously choose whether to invest or not. What is the Nash Equilibrium of this game (that is, the action choices of the two firms in the Nash Equilibrium)? Would your answer be different if Pilly is the first mover and commits to its choice before Smirck makes its response (that is, a sequential-move game)? Equilibrium in the simultaneous-move game (No need for…arrow_forwardGo to investor.siriusxm.com and check whether Sirius XM’s recent financial reports indicate that its business model is working. Are its subscription fees increasing or declining? Are its revenue stream advertising and equipment sales growing or declining? Does its cost structure allow for acceptable profit marginsarrow_forward

- Olympus has integrated many components into its SLR camera. Recently, Olympus has introduced a smartphone app, Olympus Image Share (OI.Share) to pair with its camera. It says: "Paired with a compatible Olympus camera, the Olympus Image Share (OI.Share) smartphone app makes photography more enjoyable than ever. With this app, you can release the shutter remotely, then easily import photos from the camera to your smartphone and share your most inspiring moments with friends and family". a. How might this news be an example of non-price competition for an oligopolistic firm? Discuss.arrow_forwardDuddy Kravitz owns the Saint Viateur Bagel store. His world famous bagels are hand rolled, boiled in honey-water and baked in a wood-burning oven. The store sells 5,000 bagels per day and is open 365 days of the year. The bagels are so popular that, on weekends, the customer line-up runs half-way down the block. Uncle Benjy thinks that the wood-fired oven should be replaced by a modern gas oven, which would reduce costs by $0.02 per bagel. A new oven would cost $105,000. Duddy is considering Uncle Benjy's idea, but he only plans to be in business for another two years. The bagels are sold for $0.75 each. The cost of producing each bagel with the wood-burning oven is $0.50 which includes labour and raw materials. The current oven was purchased five years ago for $20,000. It could be sold today for $5,000 and will be worth $3,000 in two years. A new oven costs $105,000 today and could be sold for $55,000 in two years. Duddy's cost of capital is 9%. Assume that investment cash flows occur…arrow_forwardA university spent $1.3 million to install solar panels atop a parking garage. These panels will have a capacity of 900 kilowatts (kW) and have a expectancy of 20 years. Suppose that the discount rate is 10%, that electricity can be purchased at $0.30 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 565.55 622.11 226.22 848.33 If the solar panels can operate only for 509 hours a year at maximum, the project Continue to assume that the solar panels can operate only for 509 hours a year at maximum. break even. In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at leastarrow_forward

- Assume Allergan, Inc. is facing a capacity constraint in manufacturing Botox®. Analytically, this implies its marginal cost curve is extremely steep. As Botox® is oftentimes used for cosmetic reasons, it is reasonable to assume consumers have quite elastic demand curves. Hypothetically, assume a forthcoming study will highlight the safety of Botox® for cosmetic procedures. Given this potential study, where should Allergan, Inc. focus its strategic resources? a. Operations, specifically finding ways to lower costs in an effort to justify a price increase. b. Staffing, specifically preparing to significantly increase its staff to prepare for a large increase in the number of units of Botox® sold. c. Marketing/Pricing, specifically preparing to significantly raise the price for Botox®.arrow_forwardWhat is the Porter's Five Forces of Alibaba Group: The Rise of a Platform Giant?arrow_forwardSingComp-AI (“SCAI”) is a Singapore-based startup which develops compliance technology driven by artificial intelligence (“AI”) for financial institutions in Singapore. Compliance technology helps financial institutions in their adherence to applicable laws and regulations, as well as identifying and managing compliance-related risks. In the first year of its operations, SCAI assembled a competent team of professionals to help build its AI infrastructure and to support its growth. Marisa, an AI professional, was hired to head the product development team, and she is widely recognized as one of the key contributors to SCAI’s early success. In SCAI’s second year of operations, Marisa tendered her resignation. It was revealed that Marisa will be joining a rival company called “Eye-Tech” (“ET”), which upset the management of SCAI greatly. ET operates in the same business niche as SCAI, and is also looking to develop similar AI-driven compliance technology for financial institutions. Given…arrow_forward

- pls answer and provide solutionarrow_forwardWhat is the Related Diversification of Alibaba Group: The Rise of a Platform Giant?arrow_forwardThe objective of a publicly traded company is to make profit for its owners i.e. shareholders. However, there are millions of AIDS victims in this world. Most of these victims are from destitute countries, like African nations. It would be irrational for us to think that these people could afford this medicine at an existing market price. The world organizations, such as WHO (world health organization), provide with assistance by subsidizing AIDS related medicine. However, this is not enough as many people are dying every day. Many argue that this medicine should be free as it is the only way a victim's life could be prolonged or saved. GlaxcoSmithKline already allows license for generic drug production to countries, like South Africa. Should our government be involved in controlling the price of this drug? Or, should thegovernment force Glaxco to share the key knowledge of this product with its competitors (price becomes competitive)? Explain why or why not?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning