FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

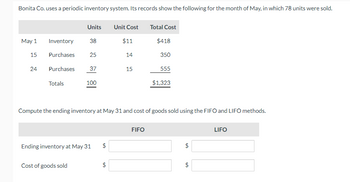

Transcribed Image Text:Bonita Co. uses a periodic inventory system. Its records show the following for the month of May, in which 78 units were sold.

May 1

15

24

Inventory

Purchases

Purchases

Totals

Units

38

Cost of goods sold

25

37

100

Ending inventory at May 31

$

Unit Cost

$

$11

14

15

Total Cost

Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods.

FIFO

$418

350

555

$1,323

$

$

LIFO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can do the FIFO AND THE LIFO and also the weighted average for January 1 January 10 January 20 January 25 January 30 thank youarrow_forwardWarnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 March 25 March 29 ) Periodic FIFO Beginning inventory Purchases. March 5 March 18 March 25 Activities Beginning inventory Purchase Sales Total Purchase Purchase Sales Totals b) Periodic LIFO For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. # of units oblem 6-2AA (Algo) Part 3 Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. ote: Round your "average cost per unit" to 2 decimal places. Cost of Goods Available for Sale Cost of Goods Available for Sale $ 5,750 115 $ Cost per unit 680 415 $ 55.00 150 $ 60.00 Units Acquired at Cost 115 units $50 per unit @$55 per unit 415 units 50.00 # of units 150 units…arrow_forwardA company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 330 units. Ending inventory at January 31 totals 140 units. Units Unit Cost Beginning inventory on January 1 300 $ 2.80 Purchase on January 9 70 3.00 Purchase on January 25 100 3.14 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method.arrow_forward

- WHAT IS THE DOLLAR AMOUNT ( FIFO & LIFO) FOR THE " ENDING INVENTORY AT MAY 31" AND " COST OF GOODS SOLD " ?arrow_forwardAztec Corporation uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the month of September: Cost Retail Beginning inventory $ 29,000 $ 46,000 Net purchases 14,500 ? question mark Net markups 10,700 Net markdowns 2,700 Net sales ? question mark The company used the average cost flow method and estimated inventory at the end of September to be $24,998.00. If the company had used the LIFO cost flow method, the cost-to- retail percentage would have been 50%. Required: Compute net purchases at retail and net sales for the month of September using the information provided.arrow_forwardThe accounting records of Sheridan Company show the following data. Beginning inventory 2,710 units at $5 Purchases 7,470 units at $7 Sales 9,376 units at $10 Calculate average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Average unit cost ______ Determine cost of goods sold during the period under a periodic inventory system using the FIFO method, the LIFO method, and the average-cost method. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO Average-cost Cost of goods sold: FIFO, LIFO, Average costarrow_forward

- Tamarisk Company uses a periodic inventory system. For April, when the company sold 550 units, the following information is available. April 1 inventory April 15 purchase April 23 purchase Units Unit Cost $26 Ending inventory 230 360 410 1,000 31 Cost of goods sold $ 34 Total Cost $5,980 11.160 Compute the April 30 inventory and the April cost of goods sold using the LIFO method. 13,940 $31.080arrow_forwardHaynes Company uses the perpetual inventory system. The following information is available for the month of March. March 1 Beginning Inventory 10 units at $2 for $20, March 4 Sold 8 units, March 22 Purchased 50 units at $4 for $200, March 26 Sold 48 units. If Haynes Company uses the LIFO inventory costing method, what is the Cost of Goods Sold for March? A. $212 B. $208 C. $204 D. $560arrow_forward4. AL ZAIN Itd uses a periodic inventory system. Its records show the following for the month of May, in which 46 units were sold Date Particulars Units Unit CostTotal Cost May 1 Inventory 35 17 Purchases 35 20 Purchases 10 Total 9. 315 245 12 120 80 680 Instructions: Compute the ending inventory at May31st and the cost of goods sold using the FIFO, LIFO and the average-cost methodarrow_forward

- 10. Zaynab Company uses a periodic inventory system. Its records show the following for the month of May, in which 60 units were sold. Units Unit Cost Total Cost ........ May 1Inventory 30 15 Purchase OMR 9 OMR 270 22 11 242 24 Purchase 38 12 456 Totals 90 OMR968 Instructions: Compute the ending inventory at May 31 and cost of goods sold using the FIFO, LIFO and Average-cost methods.arrow_forwardGhugharrow_forwardBridgeport Inc. uses a perpetual inventory system. Its records show the following for the month of May. Date May May May May 1 Inventory Purchase 15 18 Unit Explanation Units Cost 24 Sale Purchase Total -29 26 (42 ) 40 53 $10 11 12 Total Cost $290 286 480 $1,056arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education