Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:D

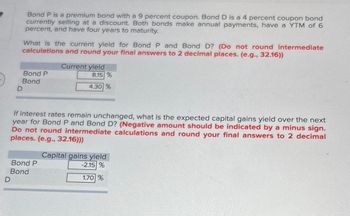

Bond P is a premium bond with a 9 percent coupon. Bond D is a 4 percent coupon bond

currently selling at a discount. Both bonds make annual payments, have a YTM of 6

percent, and have four years to maturity.

What is the current yield for Bond P and Bond D? (Do not round intermediate

calculations and round your final answers to 2 decimal places. (e.g., 32.16))

Bond P

Bond

Current yield

8.15%

4.30 %

If interest rates remain unchanged, what is the expected capital gains yield over the next

year for Bond P and Bond D? (Negative amount should be indicated by a minus sign.

Do not round intermediate calculations and round your final answers to 2 decimal

places. (e.g., 32.16)))

Bond P

Bond

D

Capital gains yield

-2.15 %

1.70 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vijayarrow_forwardes Find the duration of a 6.6% coupon bond making semiannually coupon payments if it has three years until maturity and has a yield to maturity of 6.6%. What is the duration if the yield to maturity is 9.0%? Note: The face value of the bond is $1,000. Do not round intermediate calculations. Round your answers to 2 decimal places. 6.6% YTM 9% YTM Duration years yearsarrow_forwardConsider a bond that is currently priced at $1100. If the face value of the bond is $1000, coupon payments are made semiannually, the bond matures in 5 years, and the YTM is 3%, what is the coupon rate? Group of answer choices 5.17% 2.58% 3.00% $25.84arrow_forward

- An investor wants to find the duration of a(n) 15-year, 6% semiannual pay, noncallable bond that's currently priced in the market at $587.05, to yield 12%. Using a 150 basis point change in yield, find the effective duration of this bond (Hint: use Equation 11.11). Question content area bottom Part 1 The new price of the bond if the market interest rate decreases by 150 basis points (or 1.5%) is $enter your response here. (Round to the nearest cent.)arrow_forwardThe following table summarizes current prices of various zero-coupon bonds (expressed as a percentage of face value): Bond A B C D Maturity (years) 1 2 3 4 Price (per $100 face value) 96.62 82.56 82.69 83.26 E.G for bond A it will mature in 1 year and has a current bond price of $96.62. For bond B, it will mature in 2 years and had a current bond price of $82.56 Assume the YTM for each bond doesn't change over time. After two years, what is the price for bond D? 1. bond A 2. bond B 3. bond C 4. Bond Darrow_forwardWhat are the Modified Duration and Macaulay Duration of the following bond? Coupon Rate = 8% (Semi-annually paid) YTM = 9% Maturity = 2 Years Par Value = 1,000 (Hint: this question is similar to Example 1 and Example 2 on slides) ModD = 1.886 and MacD = 1.805 ModD = 1.784 and MacD = 1.954 ModD = 1.954 and MacD = 1.784 ModD = 1.805 and MacD = 1.886arrow_forward

- A Treasury bond with the longest maturity (30 years) has an ask price quoted at 101.9375. The coupon rate is 4.10 percent, paid semiannually. What is the yield to maturity of this bond? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturity %arrow_forwardFind the duration of a bond with a settlement date of May 27, 2023, and maturity date November 15, 2034. The coupon rate of the bond is 8.5%, and the bond pays coupons semiannually. The bond is selling at a bond-equivalent yield to maturity of 10.0%. Use Spreadsheet 16.2. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Macaulay duration Modified durationarrow_forwardSuppose 1-year Treasury bonds yield 4.40% while 2-year T-bonds yield 5.70%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero, what is the yield on a 1-year T-bond expected to be one year from now? Do not round your intermediate calculations. Round your final answer to 2 decimal places. a. 7.02% b. 5.66% c. 5.05% Od. 4.92% e. 7.32%arrow_forward

- Question Given the following information about a bond, calculate the modified duration of the bond. i) The term-to-maturity is two years. ii) Coupons are payable annually at 5%. iii) The bond is trading at par. Possible Answers A B D 1.859 с 1.928 E 1.881 1.952 Cannot be determined since the yield rate i is not provided.arrow_forwardBond J has a coupon rate of 7 percent and Bond K has a coupon rate of 13 percent. Both bonds have 16 years to maturity, make semiannual payments, and have a YTM of 10 percent. a. If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.) b. What if rates suddenly fall by 2 percent instead? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardA 30-year maturity bond with face value of $1,000 makes semiannual coupon payments and has a coupon rate of 8.00%. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places. a. What is the yield to maturity if the bond is selling for $930? Yield to maturity b. What is the yield to maturity if the bond is selling for $1,000? Yield to maturity % Yield to maturity 8.000 % c. What is the yield to maturity if the bond is selling for $1,135? %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education