Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

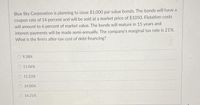

Transcribed Image Text:Blue Sky Corporation is planning to issue $1,000 par value bonds. The bonds will have a

coupon rate of 14 percent and will be sold at a market price of $1050. Flotation costs

will amount to 6 percent of market value. The bonds will mature in 15 years and

interest payments will be made semi-annually. The company's marginal tax rate is 21%.

What is the firm's after-tax cost of debt financing?

9.38%

11.06%

11.23%

14.00%

14.21%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- I draw 5 cards from a deck (replacing each cardimmediately after it is drawn). I receive $4 for each heartthat is drawn. Find the mean and variance of my total payoff.arrow_forwardYou are a corn producer. Today, May 1, you have planted corn and you expect a crop of over 1,500,000 bushels. You would like to sell the crop soon after the October harvest. You are fairly certain that prices are heading down, so you want to lock in a price for December delivery. The performance bond deposit of $1,000.00 per contract and possible performance bond calls will not cause you a cash-flow problem. You decide to sell three hundred December corn futures contracts (5,000 bushels each, or 1,500,000 bushels). The December futures price today is $5.6125 and the local forward cash for December is $5.2125. Brokerage fees for each contract is $25.00 round-turn. In December, futures prices have fallen to $5.6000 and cash prices to $5.2000. Date Cash Market Futures Market Basis May December Results In May do you take a long or short position in the futures market? In December, what do you do in the futures market?…arrow_forwardWhat is the main reason lenders pay borrowers' property taxes through a pre-paid escrow account? It prevents a tax lien from being applied to the home. The tax lien would be senior to the mortgage lien. It prevents the borrower from refinancing with another lender because they would lose all of their escrow funds. It allows the lender to earn interest on the pre- paid tax money as itsits in the account. It allows the lender to take advantage of corporate tax deductions.arrow_forward

- Kayla took out an amortized loan of $240,000 with a 5% interest rate. Her monthly payment is $1,288.37. How much will she pay in interest on her first monthly payment? $900 $1.200 $1,150 $1.000arrow_forwardThe interest rate for the first five years of a $34,000 mortgage loan was 3.95% compounded semiannually. The monthly payments computed for a 10-year amortization were rounded to the next higher $10. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the principal balance at the end of the first term. Principal balance $ b. Upon renewal at 6.45% compounded semiannually, monthly payments were calculated for a five-year amortization and again rounded up to the next $10. What will be the amount of the last payment? Final payment $arrow_forwardBill Matthews is investing $13,200 in the Washington Mutual fund. The fund charges a 5.75 percent commission when shares are purchased. Calculate the amount of commission Bill must pay.arrow_forward

- Financial ratio analysis is conducted by three main groups of analysts: credit analysts, stock analysts, and managers. What is the primary emphasis of each group, and how would that emphasis affect the ratios on which they focus? Why would the inventory turnover ratio be more important for someone analyzing a grocery store chain than an insurance company? Over the past year, M.D. Ryngaert & Co. had an increase in its current ratio and a decline in its total asset’s turnover ratio. However, the company’s sales, cash, and equivalents, DSO, and fixed assets turnover ratio remained constant. What balance sheet accounts must have changed to produce the indicated changes? Profit margins and turnover ratios vary from one industry to another. What differences would you expect to find between the turnover ratios, profit margins, and DuPont equations for a grocery store and a steel company? How does inflation distort ratio analysis comparisons for one company over time (trend analysis) and…arrow_forwardClass book: Fundamentals of Corporate Finance by Brealey, Myers, and Marcus Cost of Capital. Why do financial managers refer to the opportunity cost of capital? How would you find the opportunity cost of capital for a safe investment?arrow_forwardSandra’s Special Memories is a company that creates family and group photographic portraits. She has over 50 stores in Major Malls and busy downtown areas across Canada. She is just contemplating an online business. The major investment required will be for designing the Website, security for payment processing and confidentiality, and of course whatever technology is required to be successful. What potential advantages or disadvantages will be difficult to quantify from a capital investment standpointarrow_forward

- Explain in detail that increase in the capital stock would cause the real rental price of capital to (Hint: Use Cobb-Douglas production function)arrow_forward27.Options buyers who are delta-hedging (riskless hedge) would do which of the following in the underlying (asset) market. A. buy when the underlying market is falling and sell when it is rising. B. sell when the underlying market is falling and buy when it is rising. C. buy whether the underlying market is falling or rising. D. sell whether the underlying market is falling or rising.arrow_forwardAssume that one year ago, you bought 240 shares of a mutual fund for $24 per share and that you received an income dividend of $0.31 cents per share and a capital gain distribution of $1.04 per share during the past 12 months. Also assume the market value of the fund is now $26.50 a share. Calculate the total return for this investment if you were to sell it now.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.