Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What will be the expected net income and return on assets for the year of this financial accounting question?

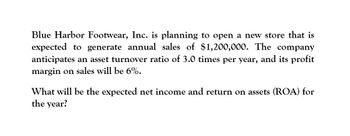

Transcribed Image Text:Blue Harbor Footwear, Inc. is planning to open a new store that is

expected to generate annual sales of $1,200,000. The company

anticipates an asset turnover ratio of 3.0 times per year, and its profit

margin on sales will be 6%.

What will be the expected net income and return on assets (ROA) for

the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hernandez Corporation expects to have the following data during the coming year. What is Hernandez's expected ROE? (Show your work) Assets = $200,000 D/A = 65% EBIT = $25,000 Interest rate = 8% Tax rate = 40%arrow_forwardA math tee shirt business is expected to generate $19,000 in revenue per year for the next 20 years. If the income is reinvested in the business at a rate of 3% per year compounded continuously, determine the present value of this income stream. Present value (exact value) = Present value (rounded to the nearest cent) X dollars dollarsarrow_forwardWhat is the payback period of this financial accounting question?arrow_forward

- A business worth $180,000 is expected to grow at 12% per year compounded annually for the next 4 years. (a) Find the expected future value. (b) If funds from the sale of the business today would be placed in an account yielding 8% compounded semiannually, what would be the minimum acceptable price for the business at this time?arrow_forwardBest Properties is considering an investment that will pay $1,000.00 at the end of each year for the next 15 years. It expects to earn an annual return of 16% on its investment. How much should the company pay today for its investment? Type your numeric answer and submitarrow_forwardWhat would be the net income and return on assets for the year on this accounting question?arrow_forward

- Database Systems is considering expansion into a new product line. Assets to support expansion will cost $890,000. It is estimated that Database can generate $1,860,000 in annual sales, with an 13 percent profit margin. What would net income and return on assets (investment) be for the year? (Input your return on assets answer as a percent rounded to 2 decimal places.) Net Income Return on assets 96arrow_forwardA company is considering investment in new equipment... Please answer the financial accounting questionarrow_forwardCelebNav, Inc. had sales last year of $750,000 and the analysts are predicting a good year for the start up, with sales growing 21 percent a year for the next 3 years. After that, the sales should grow 12 percent per year for another two years, at which time the owners are planning on selling the company. What are the projected sales for the last year before the sale? (Round intermediate calculations to 6 decimal places, in all cases round your final answer to the nearest penny.) Projected sales in year 5 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT