Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Subject accounting

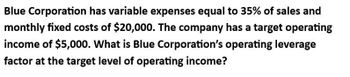

Transcribed Image Text:Blue Corporation has variable expenses equal to 35% of sales and

monthly fixed costs of $20,000. The company has a target operating

income of $5,000. What is Blue Corporation's operating leverage

factor at the target level of operating income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Singh Co. reports a contribution margin of $960,000 and fixed costs of $720,000. (1) Compute the company’s degree of operating leverage. (2) If sales increase by 15%, what amount of income will Singh Co. expect?arrow_forwardWhat is the degree of operating leverage for this accounting question?arrow_forwardWhat is the operating leverage for this general accounting question?arrow_forward

- A company requires $1305600 in sales to meet its operating income target. Its contribution margin is 30%, and fixed costs are $230400. What is the target operating income?arrow_forwardThe following annual information is for Bressler Corporation: Product X Revenue per unit: $10.00 Variable cost per unit: $5.00 Total fixed costs: $100,000 How many units the company has to sell to achieve an after tax income of $75,000 if the income tax rate is 25%?arrow_forwardDiamond, Inc.'s most recent contribution margin income statement shows the following: Sales @ $10 per unit Less: Variable expenses Contribution margin Less: Fixed expenses Operating income (loss) $160,000 (120,000) $ 40,000 (50,000) $ (10,000) If Diamond, Inc's advertising costs increased by $5,000, by how much would sales have to increase for the company to achieve an operating income of $4,000? a. $56,000 b. $42,000 c. $76,000 Od. $18,000arrow_forward

- Diamond, Inc.'s most recent contribution margin income statement shows the following: Sales @ $10 per unit Less: Variable expenses Contribution margin Less: Fixed expenses Operating income (loss) $160,000 (120,000) $ 40,000 (50,000) $ (10,000) If Diamond, Inc's advertising costs increased by $5,000, by how much would sales have to increase for the company to achieve an operating income of $4,000? a. $56,000 Ob. $42,000 c. $76,000 Od. $18,000arrow_forwardWhat is the operating profit ? General accounting questionarrow_forwardwhat is its operating leverage? accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning