FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do not use chatgpt.

Answer in step by step with explanation.

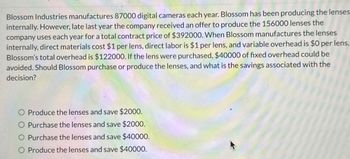

Transcribed Image Text:Blossom Industries manufactures 87000 digital cameras each year. Blossom has been producing the lenses

internally. However, late last year the company received an offer to produce the 156000 lenses the

company uses each year for a total contract price of $392000. When Blossom manufactures the lenses

internally, direct materials cost $1 per lens, direct labor is $1 per lens, and variable overhead is $0 per lens.

Blossom's total overhead is $122000. If the lens were purchased, $40000 of fixed overhead could be

avoided. Should Blossom purchase or produce the lenses, and what is the savings associated with the

decision?

Produce the lenses and save $2000.

O Purchase the lenses and save $2000.

O Purchase the lenses and save $40000.

O Produce the lenses and save $40000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- i cant find the answer on the sitearrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardCan you solve it in an Excel spreadsheet? because something is wrong with the asnwer. tyhank you,arrow_forward

- Ma1 . Who benefits most from Peace of Mind®? Complex return filers. EITC filers. Clients with refunds. All clients.arrow_forwardHow does the payback method reduce the information search?arrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forward

- A system contains many processes. Three common processes that are “grouped” together are transaction corrections, adjustments, and cancellations. These three elements work to properly serve customers. Imagine a system that allows you to register for a class online. The online system must give you a way to correct any errors you made, such as registering for the wrong class. This would be a transaction correction. The system should also allow you to make adjustments, such as adding or dropping classes. Finally, the system should allow you to make cancellations, such as cancelling the registration process entirely. Notice that all three of these processes, correction, adjustment, and cancellation, work together to provide you with one service, which is registering for classes. What type of requirements are transaction corrections, adjustments, and cancellations? Select one. Question 4 options: A Functional Requirements B Nonfunctional Requirementsarrow_forwardDefine Tagging in XBRLarrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

- Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardWhich of the following QBO features can be used to save a transaction that will be re-used in the future? Multiple Choice Saved transactions (+) New icon Recurring transactions None of the choices is correct.arrow_forwardPlease help me,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education