FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

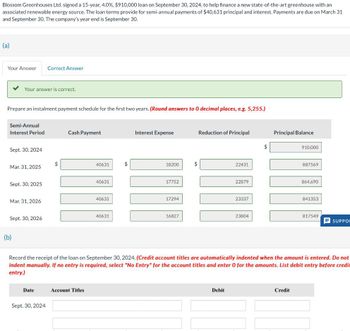

Transcribed Image Text:Blossom Greenhouses Ltd. signed a 15-year, 4.0%, $910,000 loan on September 30, 2024, to help finance a new state-of-the-art greenhouse with an

associated renewable energy source. The loan terms provide for semi-annual payments of $40,631 principal and interest. Payments are due on March 31

and September 30. The company's year end is September 30.

(a)

Your Answer

Correct Answer

Your answer is correct.

Prepare an instalment payment schedule for the first two years. (Round answers to 0 decimal places, e.g. 5,255.)

Semi-Annual

Interest Period

Cash Payment

Interest Expense

Reduction of Principal

Principal Balance

910,000

Sept. 30, 2024

40631

18200

22431

887569

Mar. 31, 2025

Sept. 30, 2025

40631

17752

22879

864,690

40631

17294

23337

841353

Mar. 31, 2026

Sept. 30, 2026

40631

16827

23804

817549

SUPPO

(b)

Record the receipt of the loan on September 30, 2024. (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit

entry.)

Date

Account Titles

Sept. 30, 2024

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.) On January 1, 2024, Monster Corporation borrowed $19 million from a local bank to construct a new highway over the next four years. The loan will be paid back in four equal installments of $5,609,334 on December 31 of each year. The payments include interest at a rate of 7%. 2. Prepare an amortization schedule over the four-year life of the installment note. (Round your final answers to the nearest dollar amount. Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000.).) Date 12/31/2024 12/31/2025 12/31/2026 12/31/2026 Cash Paid Interest Expense Decrease in Carrying Value Carrying Valuearrow_forwardVishnuarrow_forward0 Required information [The following information applies to the questions displayed below.] On January 1, 2024, Evanston Corporation borrowed $10 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $3,880,335 on December 31 of each year. The payments include interest at a rate of 8%. 3. Use amounts from the amortization schedule to record each installment payment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000.).) View transaction list Journal entry worksheet 1 2 3 Record the payment of first annual installment on the note payable. Note: Enter debits before credits. Date December 31, 2024 General Journal Debit Credit Record entry Clear entry View general journalarrow_forward

- ! Required information [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $580,000, paying $110.000 down and borrowing the remaining $470,000, signing a 9%, 15-year mortgage. Installment payments of $4,767.05 are due at the end of each month, with the first payment due on January 31, 2021. Required: 1. Record the purchase of the building on January 1, 2021. (f no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No Date General Journal Debit Credit 1 January 01, 2021 Interest Expense 3,525 x Notes Payable 1,242 X Cash 4,767 Xarrow_forwardPlease correct answerarrow_forwardun.9arrow_forward

- anent Attempt togress Sheridan Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $6,000,000 on January 1, 2025. Sheridan expected to complete the building by December 31, 2025. Sheridan has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2024 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2026 Long-term loan-11% interest, payable on January 1 of each year; principal payable on January 1, 2029 (a) Avoidable interest Assume that Sheridan completed the office and warehouse building on December 31, 2025, as planned, at a total cost of $6,240,000, and the weighted-average amount of accumulated expenditures was $4,320,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final…arrow_forwardChuck’s Publishing, Inc. borrows $30,000 from Citicorp to finance the purchase of a new office cooling system. The loan has an interest rate of 12% and Chuck’s will be required to make annual payments for the next 3 years. Fill in the following loan amortization schedule for this transaction.arrow_forwardi need the answer quicklyarrow_forward

- Required information [The following information applies to the questions displayed below.] On January 1, 2024, Bloomfield Enterprises purchases a building for $327,000, paying $57,000 down and borrowing the remaining $270,000, signing a 7%, 10-year mortgage. Installment payments of $3,134.93 are due at the end of each month, with the first payment due on January 31, 2024. 3-a. Record the first monthly mortgage payment on January 31, 2024. 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? Answer is not complete. Complete this question by entering your answers in the tabs below. Req 3a Req 3b Record the first monthly mortgage payment on January 31, 2024. (If no entry is required for select "No Journal Entry Required" in the first account field. Do not round intermediate calcul to 2 decimal places.) No Date General Journal 1 January 31, 2024 Interest Expense Notes Payable Cash Debit 1,559.93( 1,575.00arrow_forwardAt the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forwardshj.8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education