FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

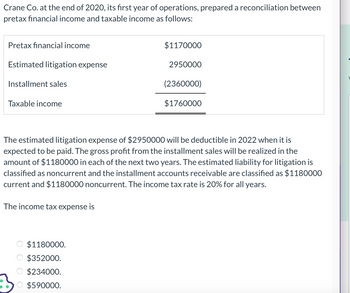

Transcribed Image Text:Crane Co. at the end of 2020, its first year of operations, prepared a reconciliation between

pretax financial income and taxable income as follows:

Pretax financial income

Estimated litigation expense

Installment sales

Taxable income

$1170000

$1180000.

$352000.

$234000.

$590000.

2950000

(2360000)

$1760000

The estimated litigation expense of $2950000 will be deductible in 2022 when it is

expected to be paid. The gross profit from the installment sales will be realized in the

amount of $1180000 in each of the next two years. The estimated liability for litigation is

classified as noncurrent and the installment accounts receivable are classified as $1180000

current and $1180000 noncurrent. The income tax rate is 20% for all years.

The income tax expense is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject :- Account At the end of 2024, its first year of operations, Blossom Company prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $2,890,000 Estimated litigation expense 3890000 Extra depreciation for taxes (5892000) Taxable income $888,000 The estimated litigation expense of $3890000 will be deductible in 2025 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1964000 in each of the next 3 years. The income tax rate is 20% for all years. The deferred tax asset at the end of 2024 to be recognized isarrow_forwardNadal Inc. has two temporary differences at the end of 2019. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Nadal's accounting department has developed a schedule of future taxable and deductible amounts related to these temporary differences as follows. 00202000 00202100 00202200 00202300 Taxable amounts $40,000) $50,000) $60,000) $80,000) Deductible amounts 0000000) 0(15,000) 0(19,000) 0000000) $40,000) $35,000) $41,000) $80,000) As of the beginning of 2019, the enacted tax rate is 34% for 2019 and 2020, and 20% for 2021–2024. At the beginning of 2019, the company had no deferred income taxes on its balance sheet. Taxable income for 2019 is $500,000. Taxable income is expected in all future years. Instructions a. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019. b. Indicate how deferred income…arrow_forwardLax Company at the end of 2019, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income P900,000; Estimated litigation expense P1,200,000; Extra depreciation for taxes (P1,800,000); Taxable income P400,000. The estimated litigation expense of P1,200,000 will be deductible in 2020 when it is expected to be paid. Use of the depreciable asset will result in taxable amounts of P600,000 in each of the next three years. The income tax rate is 30% for all years. Income tax payable is? a.P0 b.P120,000 c.P180,000 d.P270,000arrow_forward

- Trey, Inc. reports a taxable loss of 5210.000 for 2022. Its taxable income for the last two years was as föllows: 2020 2021 $60,000 80,000 Trey expects tavable income in future years and has a tax rate of 30% for all periods affected. The amount that Trey, Inc. reports as a net loss for Inardal reporting purposes in 2022 is: Seet one 74 ST00000 loss 0 S108000 loss OL 147000 loss 04 ST0000 loss O210000 lossarrow_forwardPharoah Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $1320000 Estimated litigation expense 3200000 Installment sales (2560000) Taxable income $1960000 The estimated litigation expense of $3200000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $1280000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1280000 current and $1280000 noncurrent. The income tax rate is 20% for all years.The deferred tax asset to be recognized is $128000 current. $640000 noncurrent. $0. $128000 noncurrent.arrow_forwardPlease help.Thank youarrow_forward

- 12) Ehrlich Corporation prepared the following reconciliation for its first year of operations: Pretax financial income for 2021 $2,550,000 Excess depreciation expense (450,000) Taxable income $2,100,000 The temporary difference will reverse evenly over the next two years at an enacted tax rate of 30%. The enacted tax rate for 2021 is 20%. Prepare the journal entry for the income taxes for 2021arrow_forwardLax Company at the end of 2019, its first year of operations, prepared areconciliation between pretax financial income and taxable income asfollows: Pretax financial income P900,000; Estimated litigation expenseP1,200,000; Extra depreciation for taxes (P1,800,000); Taxable incomeP400,000. The estimated litigation expense of P1,200,000 will bedeductible in 2020 when it is expected to be paid. Use of the depreciableasset will result in taxable amounts of P600,000 in each of the next threeyears. The income tax rate is 30% for all years. Income tax payable is A. P0B. P120,000C. P180,000D. P270,000arrow_forwardTroy Ltd., at the end of 2023, its first year of operations, prepared a reconciliation between pre- tax accounting income and taxable income as follows: Pre-tax accounting income $300,000 Excess CCA claimed for tax purposes ... (600, 000) Estimated expenses deductible when paid $200,000 Use of the depreciable assets will result in taxable 500,000 Taxable income ... amounts of $200,000 in each of the next three years. The estimated expenses of $500,000 will be deductible in 2026 when settlement is expected to be made. The enacted tax rate is 25% and is to increase to 30%, starting in 2024. Instructions a) Prepare a schedule of the deferred taxable and deductible amounts. b) Prepare the required adjusting entries to record income taxes for 2023arrow_forward

- At the end of 2022, its first year of operations, Zekany's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income Permanent difference Temporary difference-depreciation Taxable income $270,000 (15,400) 254,600 (19,200) Multiple Choice $235,400 Zekany's tax rate is 25%. No estimated taxes have been paid. What should Zekany report as income tax payable for 2022?arrow_forwardDuring 2021, a construction company that began operations in 2019 changed from the completed-contract method to the percentage-of-completion method for accounting purposes but not for tax purposes. Gross profit figures under both methods for the past three years appear below: Completed-Contract Percentage-of-Completion 2019 $ 385000 $ 790000 2020 525000 850000 2021 600000 950000 $1510000 $2590000 Assuming an income tax rate of 30% for all years and that comparative statements are not issued, the effect of this accounting change on prior periods should be reported by a increase of $511000 on the 2021 income statement. $755000 on the 2021 retained earnings statement. $511000 on the 2021 retained earnings statement. $755000 on the 2021 income statement.arrow_forwardOwearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education