FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

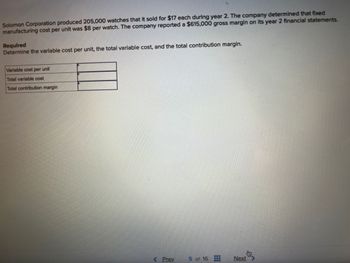

Transcribed Image Text:Solomon Corporation produced 205,000 watches that it sold for $17 each during year 2. The company determined that fixed

manufacturing cost per unit was $8 per watch. The company reported a $615,000 gross margin on its year 2 financial statements.

Required

Determine the variable cost per unit, the total variable cost, and the total contribution margin.

Variable cost per unit

Total variable cost

Total contribution margin

< Prev

5 of 16

Next

Expert Solution

arrow_forward

Step 1: Introductio

Costs that vary depending on the degree of manufacturing activity are known as variable costs. In contrast, fixed costs are expenses that remain constant regardless of how much manufacturing activity is taking place.

While fixed cost per unit fluctuates in response to variations in manufacturing activity, variable cost per unit stays constant.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Drake Company produces a single product. Last year's income statement is as follows: Sales (21,000 units) $1,278,900 Less: Variable costs 879,900 Contribution margin $399,000 Less: Fixed costs 259,800 Operating income $139,200 Required: Question Content Area 1. Compute the break-even point in units and sales revenue. In your computations, round the contribution margin per unit to the nearest cent and round the contribution margin ratio to four decimal places. Round your final answers to the nearest whole unit or dollar. Break-even units units Break-even dollars 2. What was the margin of safety in dollars for Drake Company last year? Round your final answer to the nearest whole dollar.arrow_forwardMargin of Safety Heads-Up Company sold 6,600 scooter helmets at $80.00 each this fiscal year. Unit variable costs were $50.00 (includes direct material, direct labor, variable manufacturing overhead, and variable selling expense). Total fixed costs equaled $82,500 (includes fixed manufacturing overhead and fixed selling and administrative expense). Operating income for the year was $115,500. Calculate the margin of safety in units. Select one: a. 3,850 b. 1,375 c. 6,600 d. 4,400 e. 2,750arrow_forwardDhapaarrow_forward

- Drake Company produces a single product. Last year's income statement is as follows: Sales (25,000 units) $1,532,500 Less: Variable costs 1,027,500 Contribution margin $505,000 Less: Fixed costs 273,600 Operating income $231,400 Required: 1. Compute the break-even point in units and sales revenue. In your computations, round the contribution margin per unit to the nearest cent and round the contribution margin ratio to four decimal places. Round your final answers to the nearest whole unit or dollar. Break-even units units Break-even dollars $ 2. What was the margin of safety in dollars for Drake Company last year? Round your final answer to the nearest whole dollar. 3. Suppose that Drake Company is considering an investment in new technology that will increase fixed costs by $216,600 per year, but will lower variable costs to 50 percent of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming Drake makes this…arrow_forwardVikramarrow_forwardStaley Co. manufactures computer monitors. The following is a summary of its basic cost and revenue data: Per Unit Percent Sales price $ 420 100.00 Variable costs 217 51.67 Unit contribution margin $ 203 48.33 Assume that Staley Co. is currently selling 550 computer monitors per month and monthly fixed costs are $79,300.Staley Co.'s margin of safety ratio (MOS%) if 550 units are sold would be (round intermediate calculation up to nearest whole number of units): Multiple Choice 41.81%. 26.11%. 28.91%. 27.91%. 82.91%.arrow_forward

- Mulhiarrow_forwardA manufacturer's contribution margin income statement for the year follows. Prepare a contribution margin income statement if the number of units sold (a) increases by 300 units and (b) decreases by 300 units. Sales ($12 per unit x 10,300 units) $123,600 Variable costs 72,100 Contribution margin 51,500 Fixed costs Income 41,000 $ 10,500 Sales Variable costs Contribution Margin Income Statement For Year Ended December 31 Contribution margin Fixed costs Income 10,600 units sold 10,000 units sold $ 127,200 $ 120,000 $ 41,000 41,000 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education