Bishop Co has previously calculated figures as follows:

Ke = 18.5%, market value of 1 ordinary share = $2.50

Kp = 5.4%, market value of one

Kd(1–t)’ (irredeemable debt) = 7%, market value per $100 nominal

value =$105

Kd(1–t)’ (redeemable debt) = 6.9%, market value per $100 nominal

value =$93.96

Kd(1–t)’ (non tradable debt) = 5.4%, book value $2m.

Kp = 6%, market value of one preference share(non-cummulative)

= $1.70

In addition the following information is relevant:

Ordinary shares in issue 3.8 million

Preference shares in issue 2.5 million

Preference shares (non-cummulative) in issue 1 million

Nominal value in issue of irredeemable loan notes = $6 million

Nominal value of redeemable loan notes in issue = $0.8 million.

Required:-

Calculate the current WACC by market values.

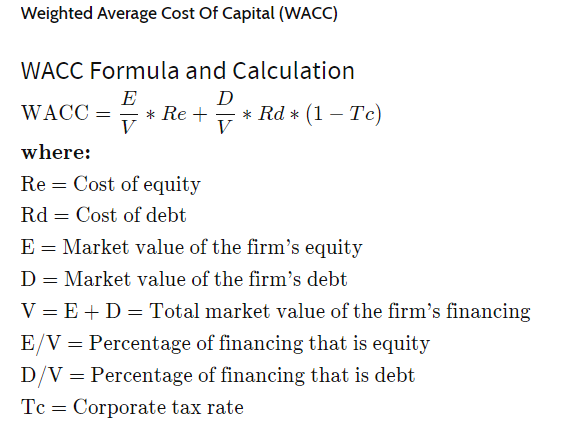

WACC is Weighted Average Cost of Capital which refers to the firm's cost of capital in which each category is proportionately weighted. Different capital sources like bonds, preferred stock or common stock ,all long term debts are weighted and included under WACC calculation. An increase in WACC denotes decrease in valuation and increase in risk.

Formula is :

Step by stepSolved in 2 steps with 1 images

- Andyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.8. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets $1,090 Liabilities & Equity Debt $460 Equity $630 The debt weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forwardAndyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.8. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets $1,090 Liabilities & Equity Debt $460 Equity $630 The equity weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forwardFama's Llamas has a WACC of 8.8 percent. The company's cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the company's target debt - equity ratio? Note: Do not round intermediate calculations and round your answer to 4 decimal places, e.g .. 32.1616.arrow_forward

- glenboro fire prevention corp has a profit margin of 7.70% total asset turn over of 1.90 and roe of 19.17%. what is this firm debt equity ratio?arrow_forwardGreen Fire Company has a debt-equity ratio of .75. Return on assets is 2.25 percent, and total equity is $800,000. �What is its equity multiplier? Question 5 options: 2.75 0.88 1.98 2.40 1.75arrow_forwardUrsala, Incorporated, has a target debt-equity ratio of 1.20. Its WACC is 8.7 percent, and the tax rate is 25 percent. a. If the company's cost of equity is 13 percent, what is its pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If instead you know that the aftertax cost of debt is 5.8 percent, what is the cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Cost of debt b. Cost of equity 6.31 % 13.39 %arrow_forward

- Estimating Components of both WACC and DDMAn analyst estimates the cost of debt capital for Abbott Laboratories is 3.0% and that its cost of equity capital is 5.0%. Assume that ABT’s statutory tax rate is 21%, the risk-free rate is 2.1%, the market risk premium is 5%, the ABT market price is $84.10 per common share, and its dividends are $1.28 per common share.(a) Compute ABT’s average pretax borrowing rate and its market beta. (Round your answers to one decimal place.) Average borrowing rate = Market beta = (b) Assume that its dividends continue at the current level in perpetuity. Use the constant perpetuity dividend discount model to infer the market's expected cost of equity capital. (Hint: Use Price per share = Dividends per share/Cost of equity capital.) (Round your answer to one decimal place.)arrow_forwardSubject:- financearrow_forwardCalculate Cost of Debt, given: Capital Structure consists of 45% Debt, 45% Preferred Stock, and 10% Equity; DEBT is 25%; Preferred Stock: Sales Price (par value) is $200 and Dividend is $50; Common Stock: Sales Price is $90 and Dividend is $20; Expected Growth Rate is 12%; and the Effective Tax Rate is 26%. 0.29 or 0.19arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education