FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

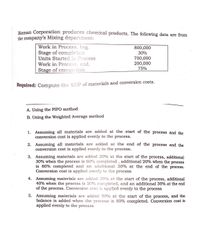

Transcribed Image Text:Bioman Corporation produces chemical products. The following data are from

the company's Mixing depariment:

Work in Process, beg.

Stage of completion

Units Started in Process

800,000

30%

700,000

200,000

Work in Process, end.

75%

Stage of compiction

Required: Compute the EUP of materials and conversion costs.

A. Using the FIFO method

B. Using the Weighted Average method

1. Assuming all materials are added at the start of the process and the

conversion cost is applied evenly to the process.

2. Assuming all materials are added at the end of the process and the

conversion cost is applied evenly to the process.

3. Assuming materials are added 20% at the start of the process, additional

30% when the process is 60% completed , additional 20% when the process

is 80% completed and an additional 30% at the end of the process.

Conversion cost is applied evenly to the process

4. Assuming materials are added 30% at the start of the process, additional

40% when the process is 50% completed, and an additional 30% at the end

of the process. Conversion cost is applied evenly to the process

5. Assuming materials are added 50% at the start of the process, and the

balance is added when the process is 80% completed. Conversion cost is

applied evenly to the process

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. What is the total cost to be accounted for? 2. What is the total cost accounted for?arrow_forwardSubject: acountingarrow_forwardRequired:(a) Compute the equivalent units for direct materials (From Moulding & Direct materialsadded) and conversion costs.(b) Compute the: Cost per equivalent unit for direct materials and conversion costs Total cost of the skis completed and transferred out to the Packing Department. Cost of the unexpected losses Cost of ending work in process inventory in the Spraying Department.arrow_forward

- The Molding Department of Bonita Company has the following production data: beginning work in process inventory 26000 units (70% complete as to conversion), started into production 473000 units, completed and transferred out 449000 units, and ending work in process inventory 50000 units (30% complete as to conversion). Assuming that conversion costs are incurred uniformly during the process, the equivalent units of production for conversion costs are 464000. 449000. 458000. 499000.arrow_forwardCycle Time, Velocity, Product Costing Mulhall, Inc., has a JIT system in place. Each manufacturing cell is dedicated to the production of a single product or major subassembly. One cell, dedicated to the production of mopeds, has four operations: machining, finishing, assembly, and qualifying (testing). The machining process is automated, using computers. In this process, the model’s frame and engine are constructed. In finishing, the frame is sandblasted, buffed, and painted. In assembly, the frame and engine are assembled. Finally, each model is tested to ensure operational capability. For the coming year, the moped cell has the following budgeted costs and cell time (both at theoretical capacity): Budgeted conversion costs $5,541,120 Budgeted materials $18,668,000 Cell time 35,520 Theoretical output 17,760 models During the year, the following actual results were obtained: Actual conversion costs $5,541,120 Actual materials $4,009,000 Actual cell time…arrow_forwardThe cost per equivalent unit of direct materials and conversion in the Bottling Department of Beverages on Jolt Company is $0.50 and $0.20, respectively. The equivalent units to be assigned costs are as follows: Inventory in process, beginning of period Started and completed during the period Transferred out of Bottling (completed) Inventory in process, end of period Total units to be assigned costs Direct Materials 52,120 0 52,120 3,010 55,130 LA LA Conversion The beginning work in process inventory had a cost of $3,020. Determine the cost of completed and transferred-out production and the ending work in process inventory. When required, round your answers to the nearest dollar. Completed and transferred out production Inventory in process, ending 3,110 52,120 55,230 2,700 57,930arrow_forward

- Weighted Average Method, FIFO Method, Physical Flow, Equivalent Units Middelton Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for October: All materials are added at the beginning of the process. Beginning work in process had 80,500 units, 30 percent complete with respect to conversion costs. Ending work in process had 14,000 units, 40 percent complete with respect to conversion costs. Started in process, 91,000 units. Required: 1. Prepare a physical flow schedule. Middelton Company Physical Flow Schedule Units to account for: Total units to account for Units accounted for: Units completed and transferred out: Total units accounted for 2. Compute equivalent units using the weighted average method. Weighted average method: Equivalent Units Direct Materials Conversion Costs 3.…arrow_forwardQualCo manufactures a single product in two departments: Cutting and Assembly. Information for the Cutting department for May follows. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for Equivalent units of production (EUP) Cost per equivalent unit of production + Equivalent units of production Cost per equivalent unit of production Cost assignment Beginning work in process To complete beginning work in process Direct materials Conversion Started and completed Direct materials Conversion Completed and transferred out Ending work in process Direct materials Conversion Total costs accounted for Units EUP Units 37,500 150,000 187,500 51, 250 Required: 1-3. Using the FIFO method, assign May's costs to the units transferred out and assign costs to its ending work in…arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education