FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need help with preparring a

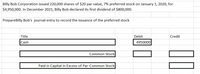

Billy Bob Corporation issued 220,000 shares of $20 par value, 7% preferred stock on January 1, 2020, for $4,950,000. In December 2021, Billy Bob declared its first dividend of $800,000.

How do you calculate the Common Stock and "Paid-In" results?

Transcribed Image Text:Billy Bob Corporation issued 220,000 shares of $20 par value, 7% preferred stock on January 1, 2020, for

$4,950,000. In December 2021, Billy Bob declared its first dividend of $800,000.

PrepareBilly Bob's journal entry to record the issuance of the preferred stock

Title

Debit

Credit

Cash

4950000

Common Stock

Paid in Capital in Excess of Par-Common Stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Per your request I am resubmitting question S-13 and adding S-12 per your request. Thanksarrow_forwardThe following financial information is available for Flintlock Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income BIU T₂ T² Ix !!! 111 2022 lil $2,532 298 40 504 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. Comment on your findings. W 2021 $2,591 144 611 40 555 트 M II á TT ¶ O Word(s)arrow_forwardDonnie Hilfiger has the following balances in its stockholders' equity accounts on December 31, 2021: Treasury Stock, $375,000; Common Stock, $250,00O; Preferred Stock, $1,300,000; Retained Earnings, $1,650,000; and Additional Paid-in Capital, $3,100,000. Prepare the stockholders' equity section of the balance sheet for Donnie Hilfiger as of December 31, 2021. (Amounts to be deducted should be indicated with a minus sign.) DONNIE HILFIGER Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' equity: Total paid-in capital Total stockholders' equityarrow_forward

- On January 1, 2019, Concord Corporation had $1,470,000 of common stock outstanding that was issued at par. It also had retained earnings of $741,500. The company issued 41,500 shares of common stock at par on July 1 and earned net income of $400,000 for the year.Journalize the declaration of a 15% stock dividend on December 10, 2019, for the following independent assumptions. (a) Par value is $10, and market price is $18. (b) Par value is $5, and market price is $21.arrow_forwardThe company issued its 2023 financial statements on April 30 2024. Calculate the weighted average cost of common shares to be used for 2023.arrow_forwardBramble Corp. reported the following balances at December 31, 2021: common stock $408,000, paid-in Capital in Excess of Par- common stock $106,000, and retained earnings $242,000. During 2022, the following transactions affected stockholders' equity. 1. 2. 3. 4. Issued preferred stock with a par value of $128,500 for $209,000. Purchased treasury stock (common) for $36,500. Earned net income of $135,000. Declared and paid cash dividends of $52,500. Prepare the stockholders' equity section of Bramble Corp's December 31, 2022, balance sheet.arrow_forward

- The stockholders' equity accounts of G.K. Chesterton Company have the following balances on December 31, 2025. Common stock, $10 par, 300,000 shares issued and outstanding Paid-in capital in excess of par-common stock Retained earnings Shares of G.K. Chesterton Company stock are currently selling on the Midwest Stock Exchange at $37. Prepare the appropriate journal entries for each of the following cases. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) a. b. C. No. Account Titles and Explanation a. (1) A stock dividend of 5% is (1) declared and (2) issued. A stock dividend of 100% is (1) declared and (2) issued. A 2-for-1 stock split is (1) declared and (2) issued. a. (2) $3,000,000 1,200,000 5,600,000 Debit Creditarrow_forwardCan you help me with this problem with step by step explanation, please? Thank you :) On January 1, 2021, Gerlach Inc. had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 247,000 shares issued $ 247,000 Paid-in capital—excess of par, common 494,000 Paid-in capital—excess of par, preferred 165,000 Preferred stock, $100 par, 16,500 shares outstanding 1,650,000 Retained earnings 3,300,000 Treasury stock, at cost, 4,700 shares 23,500 During 2021, Gerlach Inc. had several transactions relating to common stock. January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $11.3 per share, fair value $9.65 per share). February 17: Distributed the property dividend. April 10: A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Fascom chose to reduce Paid-in capital—excess of par.) The fair…arrow_forwardAt the beginning of 2023, Barnes & Noble had 240,000 shares of $5 par value common stock outstanding. On August 1, Barnes & Noble issued another 120,000 shares. The Company’s 2023 Net Income was $524,000. In addition, you are given the following portion of Barnes & Noble’s 12/31/2023 Stockholders’ Equity section of its Balance Sheet: Preferred Stock ( 4%, $10 par, 72,000 shares issued and outstanding) $720,000 Calculate Barnes & Noble’s Earnings per Share for 2023 (round to the nearest cent). Select one: a. $1.38 b. $2.06 c. $1.71 d. $1.46 e. $1.81 PreviousSave AnswersFinish attempt ...arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education