FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

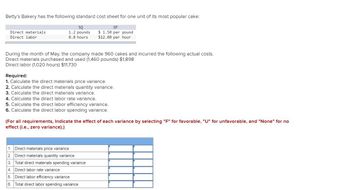

Transcribed Image Text:**Betty’s Bakery Cost Analysis**

Betty’s Bakery has provided the following standard cost sheet for one unit of its most popular cake:

| Component | SQ | SP |

|----------------|----------|---------------------|

| Direct materials | 1.2 pounds | $1.50 per pound |

| Direct labor | 0.8 hours | $12.00 per hour |

During the month of May, the company produced 960 cakes with the following actual costs:

- Direct materials purchased and used (1,460 pounds): $1,898

- Direct labor (1,020 hours): $11,730

**Required Calculations:**

1. Calculate the direct materials price variance.

2. Calculate the direct materials quantity variance.

3. Calculate the total direct materials variance.

4. Calculate the direct labor rate variance.

5. Calculate the direct labor efficiency variance.

6. Calculate the total direct labor spending variance.

For each requirement, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

**Variance Analysis Table:**

| # | Description | Variance Amount | Effect |

|---|-----------------------------------------|-----------------|----------|

| 1 | Direct materials price variance | | |

| 2 | Direct materials quantity variance | | |

| 3 | Total direct materials spending variance| | |

| 4 | Direct labor rate variance | | |

| 5 | Direct labor efficiency variance | | |

| 6 | Total direct labor spending variance | | |

This exercise requires calculating cost variances to determine the financial performance of Betty's Bakery and its efficiency in managing production costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ces of The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 3 gallons at $3 per gallon Labor: 2 hours at $12 per hour Overhead: 80% of direct labor Total $9 24 19 $ 52 During the month of October 20X1, Job O-3 was completed. It was the only job worked on during October. Five thousand two hundred units were produced from the job. The actual costs were as shown below: Materials: 15,800 gallons at $3.10 per gallon Labor: 10,500 hours at $12.10 per hour Actual overhead Total Standard cost of materials Actual cost of materials Total variance for materials $ 48,980 127,050 101,640 $277,670 Required: Calculate the total variance for materials for the month. (Indicate the effect of the variance by selecting "Favorable", "Unfavorable", and "None" for no effect (i.e., zero variance).)arrow_forwardDengerarrow_forwardJulia Company produces a single product. The company has set the following standards for materials and labor: Standard quantity or hours per unit Standard price or rate Direct materials ? pounds per unit $ ? per pound Direct labor 3.0 hours per unit $ 10 per hour During the past month, the company purchased 7,000 pounds of direct materials at a cost of $17,500. All of this material was used in the production of 1,300 units of product. Direct labor cost totaled $36,750 for the month. The following variances have been computed: Materials quantity variance $ 1,375 U Total materials variance $ 375 F Labor efficiency variance $ 4,000 F Required:1. For direct materials:a. Compute the standard price per pound of materials.b. Compute the standard quantity allowed for materials for the month's production.c. Compute the standard quantity of materials…arrow_forward

- Please do not give images formatarrow_forwardA company produces a cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 5.70 pounds $ 2.50 per pound $ 14.25 Direct labor 0.50 hours $ 7.50 per hour $ 3.75 During the most recent month, the following activity was recorded: Eleven thousand pounds of material were purchased at a cost of $2.40 per pound. The company produced only 1,100 units, using 9,900 pounds of material. (The rest of the material purchased remained in raw materials inventory.) 650 hours of direct labor time were recorded at a total labor cost of $7,800. Required: Compute the materials price and quantity variances for the month.arrow_forward2. Blue Hose Company employees a standard cost system for product costing. The standard cost of the product is the following: Raw Materials 2 lbs per unit at $6 per lbLabor 4 hours per unit at $12 per hour Actual direct material cost was $418,000 for 76,000 lbs of material used to manufacture 30,400 units in November. All materials purchased were used in November. Workers were paid $1,510,000 for 125,000 hours of work. Compute the price/rate, quantity/efficiency and flexible spending variances for direct materials and direct labor. Please label all variances. For the price and quantity/efficiency variances, explain what happened and then give a possible explanation as to why it happened. Please Answer With A Step By Step Solutionarrow_forward

- Hartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: Budget Actual 7,600 hours 6,100 hours Direct labor hours Machine hours 7,200 hours 6,300 hours Depreciation on salespeople's autos $23,000 $23,000 Indirect materials $48,500 $50,500 Depreciation on trucks used to deliver uniforms to customers solla $13,000 $70,000 $40,000 $11,000 Depreciation on plant and equipment Indirect manufacturing labor $72,500 $42,000 Customer service hotline $19,000 $21,000 Plant utilities $35,900 $38,400 Direct labor cost $72,500 $85,500 Requirements 1odel tba 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers usA accoarrow_forwardHuron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 7.90 pounds $ 2.10 per pound $ 16.59 Direct labor 0.50 hours $ 5.00 per hour $ 2.50 During the most recent month, the following activity was recorded: Fourteen thousand eight hundred and fifity pounds of material were purchased at a cost of $2.00 per pound. All of the material purchased was used to produce 1,500 units of Zoom. 600 hours of direct labor time were recorded at a total labor cost of $4,200. Required: 1. Compute the materials price and quantity variances for the month. 2. Compute the labor rate and efficiency variances for the month. (For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).arrow_forwardHuron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below. Direct materials Direct labor Standard Quantity or Hours 7.80 pounds 0.30 hours Standard Price or Rate $ 2.30 per pound $ 8.00 per hour During the most recent month, the following activity was recorded: a. 25,900.00 pounds of material were purchased at a cost of $2.10 per pound b. All of the material purchased was used to produce 3,000 units of Zoom c. 700 hours of direct labor time were recorded at a total labor cost of $6,300 Required: 1. Compute the materials price and quantity variances for the month. 2. Compute the labor rate and efficiency variances for the month 1. Materials price variance 1. Materials quantity variance 2 Labor rate variance 2 Labor efficiency variance Standard Cast $17.94 $2.40 Note: For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education