FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

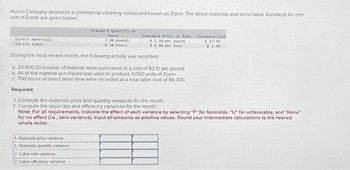

Transcribed Image Text:Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one

unit of Zoom are given below.

Direct materials

Direct labor

Standard Quantity or

Hours

7.80 pounds

0.30 hours

Standard Price or Rate

$ 2.30 per pound

$ 8.00 per hour

During the most recent month, the following activity was recorded:

a. 25,900.00 pounds of material were purchased at a cost of $2.10 per pound

b. All of the material purchased was used to produce 3,000 units of Zoom

c. 700 hours of direct labor time were recorded at a total labor cost of $6,300

Required:

1. Compute the materials price and quantity variances for the month.

2. Compute the labor rate and efficiency variances for the month

1. Materials price variance

1. Materials quantity variance

2 Labor rate variance

2 Labor efficiency variance

Standard Cast

$17.94

$2.40

Note: For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None"

for no effect (i.e., zero variance). Input all amounts as positive values. Round your intermediate calculations to the nearest

whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Caprice, Inc. has adopted a JIT management system and has the following transactions in December:Dec 3 Purchased raw materials on account, $80,000Dec 8 Incurred labor and overhead costs, $105,000Dec 15 Completed 750 units with standard costs of $106 for direct materials and $165 for conversion costsDec 23 Sold 650 units for $395 eachRecord the journal entries for Caprice, Inc. for December.arrow_forwardMonroe Materials processes a purchased material, PM-20, and produces three outputs, Alpha, Beta, and Gamma. In February, the costs to process PM-20 are $524,000 for materials and $196,000 for conversion costs. The results of the processing follow: Alpha Beta Gamma Product Alpha Beta Units Produced 24,000 19, 200 4,800 Required: Assign costs to Alpha, Beta, and Gamma for February using the net realizable value method. Gamma Total Sales Value per Unit $ 9.60 18.00 80.00 Cost Assignedarrow_forwardHardevarrow_forward

- The cost data and production data for Beth Company for the month of August were as follows:Cost Data:Work in process, August 1: Materials 52,000 Cost added this month: Materials 600,000Conversion costs 69,000 Conversion costs 1,602,000Production Data:Work in process, August 1 (60% complete) 9,375 units Work in process, August 31 (30% to be done) 16,250 unitsStarted in production this August 100,000 units Normal lost units 1,375 unitsTransferred out 90,625 units Abnormal lost units ?All materials are added at the start of the process and lost units are detected at the inspection point of 75% completion.Requirement:1. Using the FIFO method, what are the cost assigned to units transferred out and units in ending work in process?2. Using the average method, what are the cost assigned to units transferred out and units in ending work in process?3. Using FIFO and weighted average, what is the amount that shall be expensed as incurred?arrow_forwardRahularrow_forwardThe Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. Work in process, January 1, 1,400 units, 75% completed. 22,960*Direct materials (1,400 x $12.65) $17,710 Conversion (1,400 x 75% x $5.00) 5,250 ___________ $22,960 Materials added in January from Weaving Department $742,40058,000 units. Direct labor for January $134,550 Factory Overhead for January $151,611 Goods finished during Janaury…arrow_forward

- Chenango Industries uses 12 units of part JR63 each month in the production of radar equipment. The cost of manufacturing one unit of JR63 is the following: 5 4,000 Direct naterial Material handling (20x of direct-naterial cost) Direct labor Manufarturing overhead (150% of direct labor) 39,000 S8,500 Total manufacturing cost $102, 300 Material handling represents the direct variable costs of the Recelving Department that are applied to direct materials and purchased components on the basis of their cost. This is a separate charge in addition to manufacturing overhead. Chenango Industries' annual manufacturing overhead budget is one-third variable and two thirds fixed. Scott Supply, one of Chenango Industries' reliable vendors. has offered to supply part number JR63 at a unit price of $64,000.arrow_forwardSubject: acountingarrow_forwardM Huron Company produces a cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours 6.00 pounds 0.50 hours During the most recent month, the following activity was recorded: a. 22,900.00 pounds of material were purchased at a cost of $2.70 per pound. b. All of the material purchased was used to produce 3.000 units of Zoom c1,400 hours of direct labor time were recorded at a total labor cost of $18.200 Required: 1. Compute the materials price and quantity variances for the month, 2. Compute the labor rate and efficiency variances for the month. Note: For all requirements, Indicate the effect of ench variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round your intermediate calculations to the nearest whole dollar. Direct materials Direct labor 1. Materials price vanance 1. Materials quantity variance 2.…arrow_forward

- Coparrow_forwardThe direct materials and direct labour standards for one bottle of Clean-All spray cleaner are given below: Standard Quantity or Hours Direct materials Direct labour 7.0 millilitres 0.4 hours Standard Price or Rate $ 0.26 per millilitre $12.00 per hour Standard Cost $1.82 $4.80 During the most recent month, the following activity was recorded: a. 25,000 millilitres of material was purchased at a cost of $0.21 per millilitre. b. All of the material was used to produce 3,000 bottles of Clean-All. c. 750 hours of direct labour time was recorded at a total labour cost of $9,000. Required: 1. Compute the direct materials price and quantity variances for the month. (Indicate the effect of each varlance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (l.e., zero variance).) Materials price variance Materials quantity variance 2. Compute the direct labour rate and efficiency variances for the month. (Indicate the effect of each varlance by selecting "F" for…arrow_forwardVishnuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education