Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

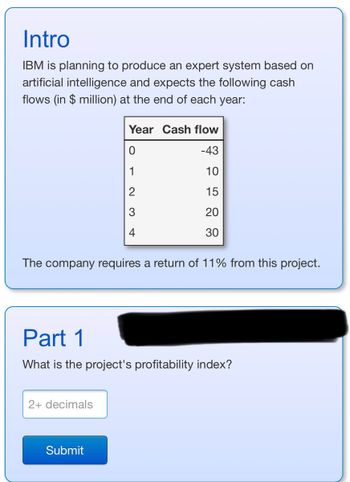

Transcribed Image Text:Intro

IBM is planning to produce an expert system based on

artificial intelligence and expects the following cash

flows (in $ million) at the end of each year:

The company requires a return of 11% from this project.

Year Cash flow

0

-43

1

10

15

20

30

Part 1

What is the project's profitability index?

2+ decimals

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 10.-From the following options, choose the four that correspond to the application of financial management in the long term. A) Preparing financial reports B) Long-term investments C) Manage working capital D) Capital structure E) Support in identifying SWOT F) Budgeting G) Financial strategy (Class excercise)arrow_forwardH2.arrow_forwardHelp pleasearrow_forward

- Which term is used to represent the sales level that results in a project's net income exactly equalling zero? Group of answer choices Cash breakeven Operational breakeven Present value breakeven Financial breakeven Accounting profit breakevenarrow_forward26.1arrow_forwardExercise 14-7 (Algo) Net Present Value Analysis of Two Alternatives [LO14-2] Perit Industries has $110,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project A $ 110,000 $0 $ 20,000 $ 8,600 1. Net present value project A 2. Net present value project B 3. Which investment alternative (if either) would you recommend that the company accept? 6 years Project B $0 $ 110,000 $ 68,000 $0 6 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is 16%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest…arrow_forward

- Cop dogarrow_forwardOpportunity Cost In the context of capital budgeting, what is an NG AND CONCEPTS REVIEW 9.2 Depreciation Gjyen the choice would a firm prefer to use MACRS 9.1 opportunity cost?arrow_forwardQuestion 34 of 50: Select the best answer for the question. 34. Which of the following would a lender most likely use to determine whether a firm could make its current loan payments? O A. Asset management ratios O B. Liquidity ratios OC. Profitability ratios OD. Market value ratios Mark for review (Will be highlighted on the review page)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education