FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

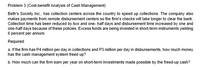

Transcribed Image Text:Problem 3 (Cost-benefit Analysis of Cash Management)

Beth's Society Inc., has collection centers across the country to speed up collections. The company also

makes payments from remote disbursement centers so the firm's checks will take longer to clear the bank.

Collection time has been reduced by two and one- half days and disbursement time increased by one and

one-half days because of these policies. Excess funds are being invested in short-term instruments yielding

6 percent per annum.

Required:

a. If the firm has P4 million per day in collections and P3 million per day in disbursements, how much money

has the cash management system freed up?

b. How much can the firm earn per year on short-term investments made possible by the freed-up cash?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data on Nathan Enterprises has determined that it needs Php 7.8 million in cash per week. If Data on Nathan Enterprises needs additional cash, it can sell marketable securities, incuring a fee of Php 500 for each transaction. If Data on Nathan Enterprises leaves funds in its marketable securities, it expects to earn approximately 0.6% per week on their investment. Using the economic order quantity model, how much cash should Data on Nathan Enterprises raise from selling securities each week to minimize its costs of cash? 5.arrow_forwardThe Fed conducts an open market operation and increase a bank's excess reserves by $7,000. Explain the first five rounds of the money creation process if the desired reserve ratio is 20% and if people keep no currency outside of the banking system. (5 points) Rounds Deposits Reserves Loans 1 $7,000 $1,400 $5,600 2 $5,600 $1,120 $4,480 345 $4,480 $896 $3,584 $3,584 $716.8 $2,867.2 $2,867.2 $573.44 $2,293.76arrow_forwardAnne Teak, the financial manager of a furniture manufacturer, is considering operating a lock-box system. She forecasts that 400 payments a day will be made to lock boxes with an average payment size of $3,000. The bank's charge for operating the lock boxes is $0.50 a check. The interest rate is 0.012% per day. a. If the lock box makes the cash available 2 days earlier, calculate the net daily advantage of the system. Note: Do not round intermediate calculations. b. Is it worthwhile to adopt the system? c. What minimum reduction in the time to collect and process each check is needed to justify use of the lock-box system? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Net daily advantage b. Is it worthwhile to adopt the system? c. Minimum reduction in time $ Yes (56) 1.39 daysarrow_forward

- A linear programming computer package is needed. The employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments together with annual rates of return are as follows. Type of Loan/Investment Automobile loans Furniture loans Other secured loans Signature loans Risk-free securities Annual Rate of Return (%) 7 $ $ $ $ $ 9 What is the projected total annual return? $ 10 11 The credit union will have $2,200,000 available for investment during the coming year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments. 8 • Risk-free securities may not exceed 30% of the total funds available for investment. ● Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured,…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardes Agarwal, Incorporated, has a 50-day average collection period and wants to maintain a minimum cash balance of $40 million, which is what the company currently has on hand. The company currently has a receivables balance of $198 million and has developed the following sales and cash disbursement budgets (in millions): Sales Total cash disbursement Beginning receivables Sales Cash collections Ending receivables Total cash collections Total cash disbursements Net cash inflow Beginning cash balance Net cash inflow Q1 $ 459 302 Ending cash balance Minimum cash balance Cumulative surplus (deficit) Q2 $531 466 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32. Q1 Q3 $ 612 720 AGARWAL, INCORPORATED Cash Budget (in millions) 459 Q4 $576 477 302 Q2 531 466 Q3 612 720 Q4 576 477arrow_forward

- Suppose that the First United Bank of America has two loans. Each is due to be repaid one period hence and has independent and identically distributed cash flows. Each loan will repay $300 with a probability of 0.8 and $150 with a probability of 0.2. However, while the bank knows this, the investors cannot distinguish this loan from that of the Third TransAmerica Bank, which has the same number of loans, but will pay $300 with a probability of 0.5 and $150 with a probability of 0.5. There is a prior belief of 0.5 that the First United Bank of America has the higher-valued portfolio. Suppose that the First United wished to securitize these loans, and if it does so without a credit enhancement, the cost of communicating the true value is 7.5% of the true value. Assume that the discount rate is zero and that everybody is risk-neutral. Consider the following securitization scenario. The First United can create two classes of bondholders in a senior- subordinated structure or junior-senior…arrow_forwardABC Corporation has annual cash demand of 3,000,000 for a fund set aside for operating expenses. The cost to transfer funds into this account is 500 each time. If cash was not placed into this fund, it would have earned 4% annually. Its current policy is to transfer 125,000 every 15 days. What is the increase/ decrease in income if the Optimum Cash Balance model was applied to this account?arrow_forward1.arrow_forward

- mni.3arrow_forwardNikularrow_forwardYou are considering investing in Dakota's Security Services. You have been able to locate the following information on the firm: Total assets are $32.6 million, accounts receivable are $4.46 million, ACP is 25 days, net income is $4.83 million, and debt-to-equity is 1.3 times. All sales are on credit. Dakota's is considering loosening its credit policy such that ACP will increase to 30 days. The change is expected to increase credit sales by 6 percent. Any change in accounts receivable will be offset with a change in debt. No other balance sheet changes are expected. Dakota's profit margin will remain unchanged. How will this change in accounts receivable policy affect Dakota's net income, total asset turnover, equity multiplier, ROA, and ROE? Note: Do not round intermediate calculations. Enter your answer in millions of dollars. Round your answers to 2 decimal places. Use 365 days a year. Net income Total asset turnover Equity multiplier ROA ROE million times times % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education