FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

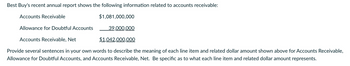

Transcribed Image Text:Best Buy's recent annual report shows the following information related to accounts receivable:

Accounts Receivable

$1,081,000,000

Allowance for Doubtful Accounts

39,000,000

Accounts Receivable, Net

$1,042,000,000

Provide several sentences in your own words to describe the meaning of each line item and related dollar amount shown above for Accounts Receivable,

Allowance for Doubtful Accounts, and Accounts Receivable, Net. Be specific as to what each line item and related dollar amount represents.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. c. Determine the net realizable value of accounts receivable.arrow_forwardNeed help with this questionarrow_forwardmn.2arrow_forward

- Crell Computers categorizes its accounts receivable into four age groups for purposes of estimating its allowance for uncollectible accounts.1. Accounts not yet due = $60,000; estimated uncollectible = 5%.2. Accounts 1–30 days past due = $15,000; estimated uncollectible = 10%.3. Accounts 31–60 days past due = $10,000; estimated uncollectible = 20%.4. Accounts more than 60 days past due = $5,000; estimated uncollectible = 30%.What should be the balance in Crell’s allowance for uncollectible accounts?arrow_forwardThe allowance method of estimating uncollectible accounts receivable based on an analysis of receivables shows that $772 of accounts receivable are uncollectible. Allowance for Doubtful Accounts has a debit balance of $97. The adjusting entry at the end of the year will include a credit to Allowance for Doubtful Accounts in the amount of a.$97 b.$772 c.$869 d.$675arrow_forwardplease solve with proper explanation , computation ,formula with steps answer in text thanksarrow_forward

- Please read and enter answers carefully using the table provided.arrow_forward11. Please answer which is best forarrow_forwardView Policies Current Attempt in Progress Assume the following information for Teal Mountain Corp. Accounts receivable (beginning balance) Allowance for doubtful accounts (beginning balance) Net credit sales Collections Write-offs of accounts receivable Collections of accounts previously written off (a) Account Titles and Explanation Uncollectible accounts are expected to be 6% of the ending balance in accounts receivable. (To record sales on account) (To record collection of accounts receivable) Prepare the entries to record sales and collections during the period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) eTextbook and Media $143.000 List of Accounts 11,340 Save for Later Using multiple attempts will impact your score. 10% scare reduction after attempt 5 930,000 912.000 6,400 2,200…arrow_forward

- At December 31, Gill Co. reported accounts receivable of $236,000 and an allowance for uncollectible accounts of $1,450 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $1,450 $4.980 $3,270. $4,720arrow_forwardOn January 1, Year 1, the Accounts Receivable balance was $29,000 and the balance in the Allowance for Doubtful Accounts was $3,400. On January 15, Year 1, an $980 uncollectible account was written-off. What is the net realizable value of accounts receivable immediately after the write-off? Multiple Choice O O $28,020 $26,580 $25,600 $24,620arrow_forwardCan you help me with the final answers I am getting incorrect? Assume the following information for Teal Mountain Corp. Accounts receivable (beginning balance) $143,000 Allowance for doubtful accounts (beginning balance) 11,340 Net credit sales 930,000 Collections 912,000 Write-offs of accounts receivable 6,400 Collections of accounts previously written off 2,200 Uncollectible accounts are expected to be 6% of the ending balance in accounts receivable. Your answer is correct. Prepare the entries to record sales and collections during the period. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record sales on account) (To record collection of accounts…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education