FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:es

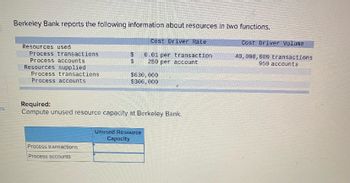

Berkeley Bank reports the following information about resources in two functions.

Cost Driver Rate

Resources used

Process transactions.

Process accounts

Resources supplied

Process transactions

Process accounts

$

Process transactions

Process accounts

$

0.01 per transaction

250 per account

$630, 000

$306, 000

Required:

Compute unused resource capacity at Berkeley Bank.

Unused Resource

Capacity

Cost Driver Volume

40,000,000 transactions

950 accounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2.arrow_forwardUnits produced per year Prime costs Direct labor hours Machine hours Production runs Inspection hours Maintenance hours Direct labor hours: Scientific calculator Business calculator Total Machine hours: Scientific calculator Business calculator Total Overhead costs: Setup costs Inspection costs Power Maintenance Total Required: Plantwide rate Overhead cost per unit: Scientific Product-Related Data Business Business Scientific 74,000 $239,000 99,800 49,500 100 2,000 2,250 Department Data Department 1 Department 2 77,300 139,720 217,020 23,000 381,800 404,800 $232,500 170,000 260,000 208,000 $870,500 1. Compute the overhead cost per unit for each product using a plantwide, unit-based rate using direct labor hours per direct labor hour 740,000 $2,390,000 998,000 495,000 150 3,000 9,000 per unit per unit 22,500 858,280 880,780 26,500 113,200 139,700 $232,500 170,000 133,000 219,500 $755,000arrow_forwardcan you get me the formula to excelarrow_forward

- ABC Company has an ABC system with three pools: Total cost in cost pool Activity Machine setups Customer service Maintenance $18,500 $5,000 Cost Driver $29,000 #setups O $9,000 #orders not enough information machine- hours $13,000 $6,000 $10,000 Compute total capacity costs allocated to product X. Activity volume (#cost driver units) Product X Product Y Total 45 15 25 20 5 25 65 20 50arrow_forwardPlease do not give solution in image format thankuarrow_forwardBerkeley Bank reports the following information about resources in two functions. Cost Driver Rate $ 0.01 per transaction $ 250 per account Resources used Process transactions Process accounts Resources supplied Process transactions Process accounts $675,000 $360,000 Required: Compute unused resource capacity at Berkeley Bank. Process transactions Process accounts Unused Resource Capacity Cost Driver Volume 40,000,000 transactions 950 accountsarrow_forward

- A1arrow_forwardI attached the data as well please do it Thanksarrow_forwardKing Company has two divisions whose most recent financial statements are shown below: Residential Division Commercial Division 5,340 $417,000 Unit sales Sales Less: cost of goods sold: Unit-level production costs Depreciation, production equipment Gross margin Less: operating expenses: Unit-level selling and administrative Corporate-level facility costs (fixed) Net income (loss) Unit sales Sales Less: cost of goods sold: Unit-level production costs Depreciation, production equipment Required: a. Compute the impact on profit if the Residential Division is eliminated. Gross margin Less: operating expenses: Unit-level selling and administrative Corporate-level facility costs (fixed) Net income (loss) 176,700 83,500 $156,800 Commercial Division Yes No 41,700 21,000 $94, 100 b. Do you recommend that King eliminate the Residential Division? 1,340 $117,000 61,700 33,500 $21,800 11,700 16,000 $(5,900)arrow_forward

- Do not give image format and fast answeringarrow_forwardSimkin Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below: Wait time Process time Inspection time Move time. Queue time The manufacturing cycle efficiency (MCE) was closest to: (Round your intermediate calculations to 1 decimal place.) Multiple Choice O 0.51 O 0.10 0.15 Hours 20.8 2.5 0.3 2.9 5.0 O 0.23arrow_forwardGive me correct answer with explanation.jarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education