Concept explainers

Bergo Bay's accounting system generated the following account balances on December 31. The company’s manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded.

| Debit | Credit | |

|---|---|---|

| Cash | $ 70,000 | |

| 39,000 | ||

| Raw materials inventory | 24,500 | |

| Work in process inventory | 0 | |

| Finished goods inventory | 15,000 | |

| Prepaid rent | 5,000 | |

| Accounts payable | $ 11,800 | |

| Notes payable | 14,800 | |

| Common stock | 50,000 | |

| 94,000 | ||

| Sales | 158,900 | |

| Cost of goods sold | 112,000 | |

| Factory |

28,000 | |

| General and administrative expenses | 36,000 | |

| Totals | $ 329,500 | $ 329,500 |

These six documents must be processed to bring the accounting records up to date.

| Materials requisition 10: | $ 4,400 | direct materials to Job 402 |

|---|---|---|

| Materials requisition 11: | $ 7,800 | direct materials to Job 404 |

| Materials requisition 12: | $ 2,400 | indirect materials |

| Labor time ticket 52: | $ 7,000 | direct labor to Job 402 |

| Labor time ticket 53: | $ 13,000 | direct labor to Job 404 |

| Labor time ticket 54: | $ 5,000 | indirect labor |

Jobs 402 and 404 are the only jobs in process at year-end. The predetermined overhead rate is 150% of direct labor cost.

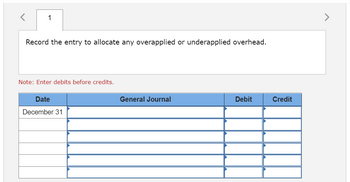

2-a. In Factory Overhead T-account, enter amounts from part 1 related to factory overhead. Determine the amount of over- or underapplied overhead.

2-b. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- ! Required information [The following information applies to the questions displayed below.] Bergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded. Cash Accounts receivable Raw materials inventory Work in process inventory. Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals Cash Accounts receivable Raw materials inventory Work in process inventory Debit $ 70,000 39,000 24,500 BERGO BAY COMPANY List of Account Balances December 31 0 6,000 2,000 Debit These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials…arrow_forward3. Job 113 was completed at a cost of $5,000, and Job 85 was completed at a cost of $3,000 and sold on account for $4,500. Work in Process Inventory Cost of Goods Sold Finished Goods Inventory Manufacturing Overhead Sales Accounts Payable Accounts Receivable Direct Materials Merchandise Inventory PLEASE NOTE #1: For similar accounting treatment (DR or CR), you are to record accounts in the same order as shown in the problem. PLEASE NOTE #2: You must enter the account names exactly as written above and all whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Using the above accounts, prepare journal entries for the following transactions: Using the above accounts, prepare journal entries for the following transactions: Completion of Job 113: DR ? ? CR ? ? Completion of Job 85: DR ? ? CR ? ? Sale of Job 85: DR ? ? CR ? ? DR ? ? CR ? ?arrow_forwardRequired information [The following information applies to the questions displayed below.] Bergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded. Cash Accounts receivable Raw materials inventory. Work in process inventory. Finished goods inventory Prepaid rent Accou Accounts payable Notes payable Comme Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals a. Direct materials. b. Direct labor. c. Overhead applied. d. Indirect materials. e. Indirect labor. View transaction list No Debit $ 70,000 39,000 24,500 View journal entry worksheet 0 6,000 2,000 Transaction 108,000 25,000 37,000 $ 311,500 These six documents must be processed to bring the accounting records up…arrow_forward

- Quality Motor Company is an auto repair shop that uses standards to control its labor time and labor cost. The standard labor cost for a motor tune-up is given below: Motor tune-up Standard Hours 2.50 Standard Rate Standard Cost $ 29.00 $ 72.50 The record showing the time spent in the shop last week on motor tune-ups has been misplaced. However, the shop supervisor recalls that 54 tune-ups were completed during the week, and the controller recalls the following variance data relating to tune-ups: Labor rate variance $ 120 F Labor spending variance $ 170 U Required: 1. Determine the number of actual labor-hours spent on tune-ups during the week. 2. Determine the actual hourly pay rate for tune-ups last week. Note: Round your answer to 2 decimal places. 1. Actual labor hours 2. Actual hourly rate hours per hourarrow_forwardI'm so confused - i've forgotten some of this stuff.. especially B.arrow_forwardBergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded. Cash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals Debit $ 75,000 44,000 27,000 0 12,000 4,000 106,000 25,000 54,000 $ 347,000 Credit $ 8,800 11,800 40,000 84,000 202,400 $ 347,000 These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials requisition 12: Labor time ticket 52: Labor time ticket 53: Labor time ticket 54: $ 4,800 direct materials to Job 402 $ 7,600 direct materials to…arrow_forward

- The auto repair shop of Quality Motor Company uses standards to control the labor time and labor cost in the shop. The standard labor cost for a motor tune-up is given below: Motor tune-up Standard Hours 2.50 Standard Rate $33.00 Standard Cost $82.50 The record showing the time spent in the shop last week on motor tune-ups has been misplaced. However, the shop supervisor recalls that 58 tune-ups were completed during the week, and the controller recalls the following variance data relating to tune-ups: Labor rate variance Labor spending variance Required: $ 80 F $ 118 U 1. Determine the number of actual labor-hours spent on tune-ups during the week. 2. Determine the actual hourly rate of pay for tune-ups last week. (Round your answer to 2 decimal places.) 1. Actual labor hours hours 2. Actual hourly rate per hourarrow_forwardBergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded. Cash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals Debit $ 68,000 37,000 23,500 Labor time ticket 53: Labor time ticket 54: 0 9,000 3,000 113,000 25,000 45,000 $ 323,500 Credit $ 10,800 13,800 30,000 93,000 175,900 $ 323,500 These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials requisition 12: Labor time ticket 52: $4,700 direct materials to Job 402 $ 7,300 direct materials to…arrow_forwardVikrambhaiarrow_forward

- Quality Motor Company is an auto repair shop that uses standards to control its labor time and labor cost. The standard labor cost for a motor tune-up is given below: Standard Hours Standard Rate Standard Cost Motor tune-up 2.50 $ 33.00 $ 82.50 The record showing the time spent in the shop last week on motor tune-ups has been misplaced. However, the shop supervisor recalls that 58 tune-ups were completed during the week, and the controller recalls the following variance data relating to tune-ups: Labor rate variance $ 80 F Labor spending variance $ 118 U Required: Determine the number of actual labor-hours spent on tune-ups during the week. Determine the actual hourly pay rate for tune-ups last weekarrow_forwardSweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during March- Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Molding 4, 200 $ 16,800 Fabrication 2,520 $ 25, 200 Total Estimated total machine-hours used Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead per machine- 6,720 $ 42,000 hour $ 1.40 $ 2.20 Job Q $ 13,440 $ 12,600 Job P Direct materials Direct labor cost $ 21,840 $35,280 Actual machine-hours used: Molding Fabrication 2,890 1,010 1,340 1,480 Total 3,900 2,820 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates…arrow_forwardHardevarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education