FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

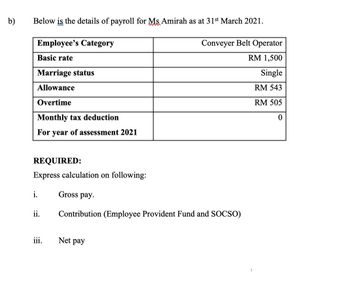

Transcribed Image Text:b)

Below is the details of payroll for Ms Amirah as at 31st March 2021.

Employee's Category

Conveyer Belt Operator

RM 1,500

Basic rate

Marriage status

Single

Allowance

RM 543

Overtime

RM 505

Monthly tax deduction

0

For year of assessment 2021

REQUIRED:

Express calculation on following:

i.

ii.

iii.

Gross pay.

Contribution (Employee Provident Fund and SOCSO)

Net pay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Seun started his self-employment on 1 July 2020, he prepared the first period of accounts to 31 December 2021. What tax year will be his first tax year? 2020/2021 2021/2022 2019/2020 2022/2023arrow_forwardCalculate payroll An employee earns $30 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 54 hours during the week, determine the employee’s (a) gross pay and (b) net pay for the week. Assume that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and the employee’s federal income tax withheld is $295.arrow_forwardThe monthly salaries for December and the year-to-date earnings of the employees of Bush Consulting Company as of November 30 follow. Determine the amount of Medicare tax to be withheld from each employee's gross pay for December. Assume a 1.45 percent Medicare tax rate and that all salaries and wages are subject to the tax. (Round your final answers to 2 decimal places.) Medicare Taxable Year-to-Date Employee No. December Salary Earnings Through Earning- Medicare Tax 1.45% November 30 December 1 $ 9,400 $ 99,500 2 9,500 70,500 3 10,209 123,800 4 9,500 100,500 es.arrow_forward

- How do you calculate FIT on payroll register? If employees are paid on a biweekly basis and they are all married and do not request any additional withholding. Each employee has also requested that 5% of their pay is withheld for the retirement plan. What calculations do I use to find FIT?arrow_forwardReese works in Prince Edward Island and has 2022 payroll totals of regular earnings of $62,700.00, vacation pay of $2,680.00, overtime pay of $518.00, interest-free loan taxable benefit of $780.00, group term life insurance taxable benefit of $314.00, pension adjustment of $2,880.00 and employee contributions to a Registered Retirement Savings Plan of $1,890.00. Calculate the total to be recorded in Box 14 of Reese's T4 information slip. Your answer: 66992arrow_forwardKendall, who earned $121,200 during 2023, is paid on a monthly basis, is married, (spouse does not work) and claims two dependents who are under the age of 17. Use the percentage method tables for automated Payroll systems with step 2 of Forms W-4 is not checked. Required: a. What is Kendall's federal tax withholding for each pay period? b. What is Kendall's FICA withholding for each pay period? Note: For all requirements, round your intermediate computations and final answers to 2 decimal places. a. Federal tax withholdings b. Total FICA withholding Amount 24,069.00arrow_forward

- Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Amount to Be Withheld Percentage Method Employee Ruiz, S. Flume, X. Farley, H. Comey, P. Hanks, R.. Marital Status SSMMM No. of Withholding Allowances 2 1 6 Gross Wage or Salary $1,040 weekly 2,190 weekly 1,890 biweekly 2,315 semimonthly. 3,200 monthly Wage-Bracket Methodarrow_forwardHow do I do this?arrow_forwardon 4 An employee has total gross wages of $7,000, Federal Unemployment Expense, and State Unemployment Expense. What is the correct journal entry for the employer's payroll taxes and otl expenses? Debit Crédit $535.50 $420.00 FICA Expenses Federal Unemployment Expense State Unemployment $378.00 Expense FICA Payable Federal Unemployment Expense State Unemployment Expense $535.50 $420.00 $378.00 Debit Credit FICA Expenses Federal Unemployment $535.50 $420.00 Expense State Unemployment Expense $378.00 Cash $1,333.50 Debit Credit FICA Payable Federal Unemployment $535.50 $420.00 Expense State Unemployment Payable FICA Expenses Federal Unemployment Expense State Unemployment Expense $378.00 $535.50 $420.00 $378.00 MacBook Airarrow_forward

- For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. 1: Michael Daugherty (married; 5 federal withholding allowances) earned weekly gross pay of $875. For each period, he makes a 403(b) retirement plan contribution of 14% of gross pay.Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $arrow_forward1 ences Piperel Lake Resort's four employees are paid monthly. Assume an income tax rate of 20%. Required: Complete the payroll register below for the month ended January 31, 2021. (Do not round intermediate values. Round the final answers to 2 decimal places.) Click here to view the CPP Tables for 2021. Click here to view the El Tables for 2021. Employee Wynn, L Short, M. Pearl, P Quincy, B Totals $ $ Gross Pay 2,000.00 1,750.00 1,950.00 1,675.00 7,375.00 El Premium Income Taxes Medical Ins. $ Deductions $ 65.00 65.00 65.00 65.00 260.00 A CPP $ $ United Way 40.00 100.00 0.00 50.00 190.00 Total Deductions Pay Net Pay Distribution Office Salaries 1,750.00 Guide Salaries S 2.000.00 1,950.00 1,675.00arrow_forwardDogarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education