FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

23 and 24 please

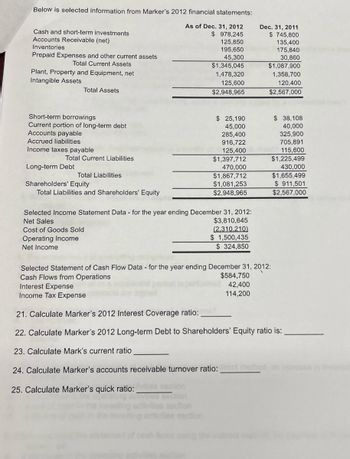

Transcribed Image Text:Below is selected information from Marker's 2012 financial statements:

Cash and short-term investments

Accounts Receivable (net)

Inventories

Prepaid Expenses and other current assets

Total Current Assets

Plant, Property and Equipment, net

Intangible Assets

Total Assets

As of Dec. 31, 2012

Dec. 31, 2011

$ 978,245

125,850

$ 745,800

135,400

195,650

175,840

45,300

30,860

$1,345,045

$1,087,900

1,478,320

125,600

$2,948,965

1,358,700

120,400

$2,567,000

Short-term borrowings

Current portion of long-term debt

Accounts payable

$ 25,190

45,000

$ 38,108

40,000

325,900

Accrued liabilities

Income taxes payable

Total Current Liabilities

Long-term Debt

Total Liabilities

285,400

916,722

705,891

125,400

115,600

$1,397,712

$1,225,499

470,000

430,000

$1,867,712

$1,655,499

$1,081,253

$2,948,965

$ 911,501

$2,567,000

Shareholders' Equity

Total Liabilities and Shareholders' Equity

Selected Income Statement Data - for the year ending December 31, 2012:

Net Sales

Cost of Goods Sold

$3,810,645

(2,310,210)

Operating Income

Net Income

$ 1,500,435

$ 324,850

Selected Statement of Cash Flow Data - for the year ending December 31, 2012:

Cash Flows from Operations

Interest Expense

$584,750

42,400

114,200

Income Tax Expense

21. Calculate Marker's 2012 Interest Coverage ratio:

22. Calculate Marker's 2012 Long-term Debt to Shareholders' Equity ratio is:

23. Calculate Mark's current ratio

24. Calculate Marker's accounts receivable turnover ratio:rect method, an increase in Inverto

25. Calculate Marker's quick ratio:vities section

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accountarrow_forwardPrepare the Cash Flow for the year 2021arrow_forwardThe following table shows an abbreviated income statement and balance sheet for McDonald's Corporation for 2012. INCOME STATEMENT OF MCDONALD'S CORP., 2012 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Taxes Net income 27,570 17,572 1,405 8,593 520 8,073 2,620 5,453arrow_forward

- Use the current asset section of the balance sheets of the Waverley Company as of June 30, 2017 and 2016 presented below to answer the questions that follow. 2017 2016Cash and cash equivalents R 75,000 R 58,800Trade accounts receivable, net 157,500 193,200Inventory 208,200 253,400Other current assets 18,400 15,500Total current assets R 459,100 R 520,900Total assets R2,650,000 R3,430,000Required:Complete a horizontal analysis of the current asset section of Waverley Company’s balance sheet for 2017. Your answers for “% Change” should be rounded to one decimal place, e.g.,…arrow_forwardGiven the data in the following table, what was net cash flow from investing activities for 2023?arrow_forwardCurrent assets: Cash Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue Short-term debt Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity: Common stock ($0.00001 par value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $ 48,844 51,713 22,926 4,106 35,230 162,819 105,341 37,378 32,978 $ 338,516 $ 46,236 43,700 5,522 10,260 105,718 91,807 50,503 248,028 1 45,173 45,314 90,488 $ 338,516arrow_forward

- Assume an investee has the following financial statement information for the three years ending December 31, 2013: (At December 31) 2011 2012 2013 Current assets Tangible fixed assets $310,500 844,500 75,000 $416,550 $428,205 861,450 992,595 67,500 60,000 Intangible assets Total assets $1,230,000 $1,345,500 $1,480,800 $150,000 $165,000 $181,500 Current liabilities Noncurrent liabilities Common stock 330,000 363,000 399,300 150,000 150,000 150,000 150,000 150,000 150,000 Additional paid-in capital Retained earnings 450,000 517,500 600,000 Total liabilities and equity $1,230,000 $1,345,500 $1,480,800 (At December 31) 2011 Revenues Expenses Net income Dividends 2012 2013 $1,275,000 $1,380,000 $1,455,000 1,162,500 1,260,000 1,314,000 $112,500 $120,000 $141,000 $37,500 $52,500 $58,500 Review of pre-consolidation cost method (controlling investment in affiliate, fair value equals book value) Assume that on January 1, 2011, an investor company purchased 100% of the outstanding voting common…arrow_forwardBest Buy Co., Inc.Balance SheetAt January 30, 2016($ in millions)AssetsCurrent assets:Cash and cash equivalents $ 1,976Short-term investments 1,305Accounts receivable, net 1,162Merchandise inventories 5,051Other current assets 392Total current assets 9,886Long-term assets 3,633Total assets $13,519Liabilities and Shareholders’ EquityCurrent liabilities:Accounts payable $ 4,450Other current liabilities 2,475Total current liabilities 6,925Long-term liabilities 2,216Shareholders’ equity 4,378Total liabilities and shareholders’ equity $13,519Best Buy Co., Inc.Income StatementFor the Year Ended January 30, 2016($ in millions)Revenues $ 39,528 Costs and expenses 38,153Operating income 1,375 Other income (expense)* (65)Income before income taxes 1,310 Income tax expense 503Net income $ 807*Includes $80 of interest expense.Liquidity and solvency ratios for the industry are as follows:Industry AverageCurrent ratio 1.23Acid-test ratio 0.60Debt to equity 0.70Times interest earned 5.66…arrow_forwardCondensed financial data of Sheridan Company for 2025 and 2024 are presented below. Cash Receivables Inventory Plant assets Sheridan Company Comparative Balance Sheet As of December 31, 2025 and 2024 Accumulated depreciation Long-term investments (held-to-maturity) Accounts payable Accrued liabilities Bonds payable Common stock Retained earnings 2025 $1,780 1,760 1,620 1,910 1,670 (1,210) (1,160) 1,330 1,440 $7,190 $6,280 $1,230 210 2024 $1,170 1,370 1,920 2,460 $7,190 1,280 1,880 $920 250 1,560 1,680 1,870 $6,280arrow_forward

- Using the Financial Statements below Calculate the Free Cash flows for RPI , Inc for the year ended December 31, 2011 from an Asset perspective Calculate the Free Cash flows for RPI , Inc for the year ended December 31, 2011 from a Finance perspective ASSETS 2010 2011 LIABILITIES & EQUITY 2010 2011 Cash 12000 12750 Accounts Payables 36,000 41250 Marketable Securities 5250 5400 Notes Payables 12,000 9750 Accounts Receivables 31500 28500 Accruals 2,250 1875 Inventory 37500 69750 Tax Payable 2,250 1875 Prepaid Rent 900 825 Total Current Liabilities 52,500 54,750 Total Current Assets 87150 117225 Long Term Debt 120,000 112500 Net Plant & Equipment 214500 217500 Common Stockholders’ Equity 129150 167475 Total Assets 301650 334725 Total Liabilities and Equity 301,650 334,725 Sales 525000 Less: Cost of Goods Sold 375000 Gross…arrow_forwardhat is the amount of Target’s total liabilities at the end of FY2023 and FY 2022 (Hint: use the Statement of FinancialPosition)?b. What percentage of Target's assets was being financed withliabilities at the end of FY 2023 and FY 2022 versus thepercentage of assets financed with shareholders' equity (Hint:use the Statement of Financial Position)?c. Comment on the change in total liabilities in $ amounts and asa percentage of total assets between 2022 and 2023. Is this apositive or negative and why?d. What is the amount of debt and interest rate for Target’slongest term debt Due 2049-2053 as of the end of FY 2023(Hint: use the chart in the Long Term Debt footnote 16)?e. Target reported Accrued and Other Current Liabilities of $6,090 as of the end of FY 2023. What was the largestarrow_forwardSuppose the following financial data were reported by 3M Company for 2021 and 2022 (dollars in millions). 3M Company Balance Sheets (partial) Current assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total current assets Current liabilities 2022 $3,010 3,510 2,765 1,914 2021 $4,770 $1,908 3,195 3,028 1,621 $11,199 $9,752 $5,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education