ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

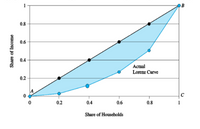

Below is a Lorenz Curve for a given country. Suppose its government cuts spending on Medicaid, Supplemental Nutrition Assistance Program and other aids to the poor. Show how the spending cuts would affect income inequality by drawing the new Lorenz Curve.

Transcribed Image Text:1

OB

0.8

0.6

0.4

Actual

Lorenz Curve

0.2

C

0.2

0.4

0.6

0.8

1

Share of Households

Share of Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In DevEconLand, there are 10 people. Four of them earn $1/day each, two earn $3/day each and the remaining four earn $4/day each. If the poverty line is defined as $2/day, what is the headcount ratio, the total poverty gap ratio and the total poverty gap squared ratio respectively? Select one: a. 1/5, 1/5 and 1/10 respectively. b. 1/5, 2/5 and 1/5 respectively. c. 2/5, 1/5 and 1/10 respectively. d. None of the above.arrow_forward8. Four students have yearly incomes of $5,000, $15,000, $20,000, and $60,000. a. Make a table of the Lorenz Curve and use the Trapezoidal Rule with 4 trapezoids to find the area under the Lorenz Curve. Your answer should be correct to 2 places after the decimal point. The area under the Lorenz Curve is b. Use the results of Part a to find the Gini Index. Your answer should be correct to 2 places after the decimal point. The Gini Index isarrow_forwardThe $1.4 billion trick to make us accept income inequality Lotteries take money from the poor and redistribute it unequally. The poor, the uneducated, and minorities play the lottery the most, and it takes a big chunk of their income Source: The Huffington Post, January 12, 2016 If the news clip is correct, how does a lottery change the distribution of income? Draw two Lorenz curves to illustrate your answer. Lotteries result in the distribution of income Draw the Lorenz curve in a country that does not have lotteries. Label it Before Draw the Lorenz curve for the country after the introduction of lotteries. Label it After >>> To reposition the label click on the cross by the label box and dragging it 100 80 60 40- 20 Cumulative percentage of income 100 20 40 60 00 Cumulative percentage of households >>>Draw only the objects specified in the question Garrow_forward

- What is the Lorenz curve and what does it illustrate? Are incomes distributed equally? What would happen if incomes were equal? Why do you think income distribution is so unequal? Identify and explain three reasons.arrow_forwardList and explain how income inequality arises?arrow_forwardMake a case for income inequalityarrow_forward

- Using the above Lorenz Curve, answer the following questions. . . Approximately what percentage of the income does the richest 20% of Country A earn? Approximately what percentage of the income does the poorest 20% of Country B earn? If the government of Country B increased the progressivity of income taxes, would its Lorenz Curve move closer to the 45-degree reference line, closer to Country A's Lorenz Curve, or not move at all?arrow_forwardThe values in the table reflect the percentages of pre-tax-and transfer income. 22. Refer to Table 20-1. The trend in income inequality from 1980 to 2010 is 23. Refer to Table 20-1. If the distribution of income were completely equal, what percentage of income would the bottom fifth of the population earn? 24. A government policy aimed at protecting people against the risk of adverse events is calledarrow_forwardWhat are the causes, effects, and solutions of the rising income inequality in the United States?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education