FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

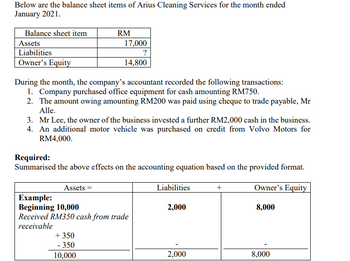

Transcribed Image Text:Below are the balance sheet items of Arius Cleaning Services for the month ended

January 2021.

Balance sheet item

RM

Assets

17,000

Liabilities

?

Owner's Equity

14,800

During the month, the company's accountant recorded the following transactions:

1. Company purchased office equipment for cash amounting RM750.

2.

The amount owing amounting RM200 was paid using cheque to trade payable, Mr

Alle.

3. Mr Lee, the owner of the business invested a further RM2,000 cash in the business.

4. An additional motor vehicle was purchased on credit from Volvo Motors for

RM4,000.

Required:

Summarised the above effects on the accounting equation based on the provided format.

Assets =

Liabilities

+

Owner's Equity

Example:

Beginning 10,000

2,000

8,000

Received RM350 cash from trade

receivable

+350

- 350

10,000

2,000

8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2019: 1. Prepare a multiple-step income statement.2. Prepare a statement of owner’s equity.3. Prepare a balance sheet, assuming that the current portion of the note payable is$7,000.4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardThe October transactions were as follows. Oct. 5 Received $1,510 in cash from customers for accounts receivable due. 10 Billed customers for services performed $5,050. 15 Paid employee salaries $1,110. 17 Performed $570 of services in exchange for cash. 20 Paid $1,980 to creditors for accounts payable due. 29 Paid a $300 cash dividend. 31 Paid utilities $320.arrow_forwardPlease show working and see attachments for the question.arrow_forward

- The following trial balance has been extracted from Keith LTD as 31 March 2021. All amounts are stated in thousands of euro. Account Debit Credit Advertising 30 Bank overdraft 7 Bank interest paid 2 Creditors 69 Debtors 452 Directors remuneration 55 Insurance 17 Machinery: At cost 420 Accumulated depreciation at 1.4.20 152 Ordinary share capital 200 Preference shares (cumulative 10% share of EUR 1 each) 50 Preference share dividend paid 4 Profit and loss account (at 1.04.20) 132 Purchases 1.240 Standard rates 75 Sales 2.100 Share premium account 40 Stock (at 1.04.20) 134 Wages and salaries 321 Total 2.750 2.750 Additional information: 1.Stock at 31 March 2021 valued at cost amounted to EUR 155.000 2.Depreciation is to be provided on machinery at a rate of 20% on…arrow_forwardAn extracted trial balance for sole trader B Moore. as at 30 September 2021 is as follows: B Moore DR CR Trial Balance as at30 September 2021 £ £ Cash at bank 45,000 Cash in hand 6,800 Accounts receivable (Debtors) 8,000 Accounts payable (Creditors) 14,500 Inventory (Stock): 30 September 2020 18,000 Car 25,000 Drawings 7,500 Fixtures and Fittings 18,500 Sales 95,000 Purchases 110,000 Return inwards (Sales Returns) 3,500 Carriage inwards 890 Returns outwards (Purchase Returns) 720 Carriage outwards 500 Motor expenses 1,400 Rent 7,000 Telephone charges 830 Wages and salaries 14,000 Insurance 1030 Office expenses 800 Sundry expenses 250 Capital 158,780 269,000 269,000 Inventory as at 30 September 2021 as £13,000. Required Prepare an Income Statement for B Moore for the year…arrow_forwardQuestion Carlene Johnson is the Accountant in the Finance Department at Fairway Trading Limited who manages the company Accounts Receivables. She was given the following information by the Finance Manager which was extracted from the debtor's ledger as at December 31, 2022. Category of Total value of Customers Sales To Customer $ Keith Green Karen White June Hinds John Wayne 180,0000 240,000 390,000 380,000 Paul Gayle 346,000 Date of Sales December 16, 30 days 2021 December 10, 60 days 2021 November 15, 2022 30 days June 26, 2022 30 days 30 days August 25, 2022 Terms Percentage provision to be created Date of Last Payment on A/C January 15, 2022 February 14, 2022 December 20, 2022 October 24, 2022 September 24, 2022 Total Amount Paid to Date on Account S 90,500 180,000 170,000 295,000 235,000 The Accountant decided that she would age the debt outstanding in the following category and the percentage to be provided for bad debt in the amount stated beside each category accordingly. Aging…arrow_forward

- The balance sheet of RS Corp. as at December 31, 1979 contained the following current assets: Cash 96, 578 Accounts receivable 452,800 Inventories 376,300 925,678 An examination of the accounts disclosed that the accounts receivable consisted of the following items: Trade customers’ accounts 357,742 Due from employees – current 43,658 Equity in 50,000 of uncollected accounts receivable assigned under guaranty 16,000 Selling price of merchandise on consignment at 140% of cost and not sold 50,400 Allowance for doubtful accounts…arrow_forwardTransactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: Opened a business bank account with a deposit of $25,000 from personal funds. Purchased office supplies on account, $2,540. Paid creditor on account, $1,610. Earned sales commissions, receiving cash, $25,920. Paid rent on office and equipment for the month, $5,080. Withdrew cash for personal use, $8,000. Paid automobile expenses (including rental charge) for the month, $2,440, and miscellaneous expenses, $1,170. Paid office salaries, $3,060. Determined that the cost of supplies on hand was $860; therefore, the cost of supplies used was $1,680. Required: 1. Indicate the effect of each transaction and the balances after each transaction. For those boxes in which no entry is required, leave the box blank. If required, enter negative values as negative numbers. Assets = Liabilities + Owner's Equity Cash +…arrow_forwardThe Butler-Huron Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Cash and marketable securities Accounts receivable* Inventories** Other current assets Total current assets Plant and equipment (net) Other assets Total assets $82 820 1,507 22 $2,431 3,967 6,460 $6,460 Liabilities and Equity Accounts payable****** Accrued liabilities (salaries and benefits) Other current liabilities Total current liabilities Long-term debt and other liabilities Earnings before taxes Taxes Earnings after taxes (net income) Common stock Retained earnings Net sales Cost of sales Selling, general, and administrative expenses Other expenses Total expenses Total stockholders' equity Total liabilities and equity **Assume that average inventory over the year was the same as ending inventory. ***Assume that average accounts payable are the same as ending accounts payable. Income Statement (in Millions of Dollars) *Assume that all sales are…arrow_forward

- Please SHOw your workarrow_forwardTransactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: Opened a business bank account with a deposit of $34,000 from personal funds. Purchased office supplies on account, $3,470. Paid creditor on account, $2,190. Earned sales commissions, receiving cash, $35,390. Paid rent on office and equipment for the month, $6,940. Withdrew cash for personal use, $11,000. Paid automobile expenses (including rental charge) for the month, $3,330, and miscellaneous expenses, $1,590. Paid office salaries, $4,180. Determined that the cost of supplies on hand was $1,170; therefore, the cost of supplies used was $2,300. Required: 1. Indicate the effect of each transaction and the balances after each transaction. For those boxes in which no entry is required, leave the box blank. If required, enter negative values as negative numbers. Assets = Liabilities + Owner's Equity Cash +…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education