FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

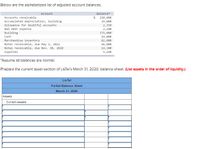

Transcribed Image Text:Below are the alphabetized list of adjusted account balances.

Account

Balance

Accounts receivable

110,800

29,000

2,350

2,100

375,000

19,000

Accumulated depreciation, building

Allowance for doubtful accounts

Bad debt expense

Building

Cash

Merchandise inventory

82,000

Notes receivable, due May 1, 2022

Notes receivable, due Nov. 30, 2020

Supplies

61,000

14,300

5,260

*Assume all balances are normal.

Prepare the current asset section of LIsTel's March 31, 2020, balance sheet. (List assets In the order of liquidity.)

LisTel

Partial Balance Sheet

March 31, 2020

Assets

Current assets:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardd) Golden Music Company uses the allowance method to estimate uncollectible accounts receivable. An aging of the accounts receivable revealed the following: Estimated Percentage Uncollectible Current Accounts $17,000 $1,500 $1,200 $500 $900 $21,100 1% 1-30 days past due 31–60 days past due 61–90 days past due Over 90 days past due Total Accounts Receivable 3% 6% 12% 25% On 31 December 2021, the company has found out that a customer went bankrupt and management agreed that the accounts receivable of $900 included above which is past due for over 90 days can be written off. i) Compute the total estimated uncollectible accounts receivable as at 31 December 2021. ii) Prepare the journal entry year-end to write off the accounts receivable of $900 and the adjusting journal entry to record the bad debts for the year ended 31 December 2021.arrow_forward

- On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardSuzuki Supply reports the following amounts at the end of 2024 (before adjustment). Credit Sales for 2024 Accounts Receivable, December 31, 2024 Allowance for Uncollectible Accounts, December 31, 2024 $248,000 43,000 1,000 (debit) Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 10% of receivables will not be collected. 2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates 2% of credit sales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method.arrow_forwardCalculate the allowance ratio for the year ending 30 June 2020. Assume the number of days in the year is 365. Round the percentage change to one decimal placearrow_forward

- Please help me. Thankyou.arrow_forwardAfter the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $743,691 and Allowance for Doubtful Accounts has a balance of $20,139. What is the net realizable value of the accounts receivable? Select the correct answer. $723,552 $20,139 $763,830 $743,691arrow_forwardVishnuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education