FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give image format and solve all required

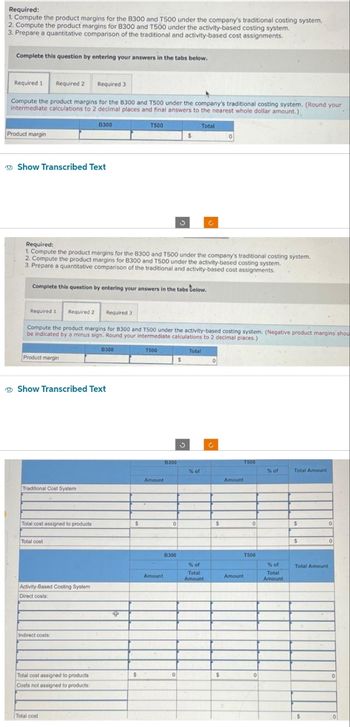

Transcribed Image Text:Required:

1. Compute the product margins for the B300 and T500 under the company's traditional costing system,

2. Compute the product margins for B300 and T500 under the activity-based costing system.

3. Prepare a quantitative comparison of the traditional and activity-based cost assignments.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Compute the product margins for the B300 and T500 under the company's traditional costing system. (Round your

intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.)

Product margin

Show Transcribed Text

Required 1 Required 2

Product margin

Required:

1. Compute the product margins for the B300 and T500 under the company's traditional costing system.

2. Compute the product margins for B300 and T500 under the activity-based costing system.

3. Prepare a quantitative comparison of the traditional and activity-based cost assignments.

Complete this question by entering your answers in the tabs below.

Traditional Cost System

Total cost assigned to products

B300

Show Transcribed Text

Total cost

Compute the product margins for 8300 and T500 under the activity-based costing system. (Negative product margins shou

be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.)

Total

Activity-Based Costing System

Direct costs:

Indirect costs:

Total cost assigned to products

Costs not assigned to products:

Required 3

Total cost

8300

T500

4

$

$

T500

Amount

Amount

B300

$

0

B300

Total

$

% of

% of

Total

Amount

0

$

$

Amount

T500

0

T500

Amount

0

% of

% of

Total

Amount

Total Amount

$

$

0

Total Amount

$

0

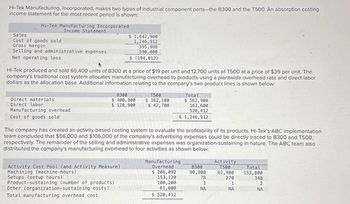

Transcribed Image Text:Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing

income statement for the most recent period is shown:

Hi-Tek Manufacturing Incorporated

Income Statement

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating loss

Hi-Tek produced and sold 60,400 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $39 per unit. The

company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor

dollars as the allocation base. Additional information relating to the company's two product lines is shown below:

Direct materials

Direct labor

Manufacturing overhead

Cost of goods sold

$ 1,642,900

1,246,912

395,988

590,000

$ (194,012)

8300

$ 400,800

$ 120,900

Activity Cost Pool (and Activity Measure)

Machining (machine-hours)

Setups (setup hours)

Product-sustaining (number of products)

Other (organization-sustaining costs)

Total manufacturing overhead cost

T500

$ 162,100.

$ 42,700

The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation

team concluded that $56,000 and $106,000 of the company's advertising expenses could be directly traced to B300 and T500,

respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also

distributed the company's manufacturing overhead to four activities as shown below:

Total

$ 562,900

163,600

520,412

$ 1,246,912

Manufacturing

Overhead

$ 206,092

153, 120

100, 200

61,000

$ 520,412

8300

90,900

78

1

NA

Activity

T500

62,900

270

RIM

1

NA

Total

153,800

348

2

NA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What goes in what, like what do I put on Collum a,b,c, etc I'm confused where to put the dataarrow_forwardHow do you access the Power Query interface?arrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education