FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

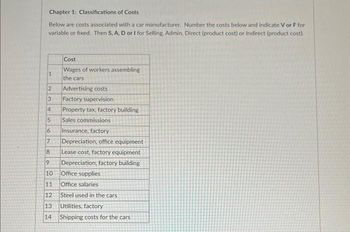

Transcribed Image Text:Chapter 1: Classifications of Costs

Below are costs associated with a car manufacturer. Number the costs below and indicate V or F for

variable or fixed. Then S, A, D or I for Selling. Admin, Direct (product cost) or Indirect (product cost).

1

Cost

Wages of workers assembling

the cars

2 Advertising costs

3

Factory supervision

4

Property tax, factory building

5

Sales commissions

6 Insurance, factory

7 Depreciation, office equipment

8

Lease cost, factory equipment

9 Depreciation, factory building

10

11

12

13

14

Office supplies

Office salaries

Steel used in the cars

Utilities, factory

Shipping costs for the cars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. a) A company manufactures and retails tablet computers. You are required to group the costs which are listed below and numbered (1)-(10) into the following classifications i-v (each cost is intended to belong to only one classification): 1- Wiring for the tablet 2-The maintenance contract from the machines 3- Aftersales customer service 4- The Chief Executive Salary 5- Shipping costs from the warehouse to the retailer 6- Marketing Costs 7- Interest on bank overdraft 8- Staff Training costs 9- Electricity to run the production line 10- Warehouse storage rent for the tablets. i. ii. iii. iv. V. Direct materials 1 Indirect production overhead 2 Selling and distribution costs Administration costs Finance costsarrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. A. Lumber used to construct decks ($12.00 per square foot) B. Carpenter labor used to construct decks ($10 per hour) C. Construction supervisor salary ($45,000 per year) D. Depreciation on tools and equipment ($6,000 per year) E. Selling and administrative expenses ($35,000 per year) F. Rent on corporate office space ($34,000 per year) G. Nails, glue, and other materials required to construct deck (varies per job)arrow_forwardWhich of the following costs is best classified as a fixed cost with respect to volume of activity? (See your Chapter 20 notes, page 5) Direct labor Electricity used to heat, light, and cool a factory Cleaning supplies used in an automobile assembly plant Straight-line depreciation expense of a machine used in a factory Total cost of salaries paid to quality inspectors in a manufacturing plant Tires used in an automobile manufacturing plantarrow_forward

- Classifying costsThe following is a list of costs that were incurred in the production andsale of lawn mowers: a. Premiums on insurance policy for factory buildingsb. Tires for lawn mowersc. Filter for spray gun used to paint the lawn mowersd. Paint used to coat the lawn mowers, the cost of which isimmaterial to the cost of the final product e. Plastic for outside housing of lawn mowersf. Salary of factory supervisorg. Hourly wages of operators of robotic machinery used inproduction h. Engine oil used in mower engines prior to shipmenti. Salary of vice president of marketingj. Property taxes on the factory building and equipmentk. Cost of advertising in a national magazine1. Gasoline engines installed in the lawn mowers m. Electricity used to run the robotic machineryn. Straight-line depreciation on the robotic machinery used tomanufacture the lawn mowerso. Salary of quality control supervisor who inspects each lawnmower before it is shipped p. Attorney fees for drafting a new lease…arrow_forwardClassify Costs Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as variable, fixed, or mixed. 1. Cost of labor for hourly workers Fixed 2. Factory cleaning costs, $6,000 per month Mixed 3. Hourly wages of machine operators Variable 4. Computer chip (purchased from a vendor) 5. Electricity costs, $0.20 per kilowatt-hour 6. Metal 7. Salary of plant manager 8. Property taxes, $165,000 per year on factory building and equipment 9. Plastic 10. Oil used in manufacturing equipment 11. Rent on warehouse, $10,000 per month plus $25 per square foot of storage used 12. Property insurance premiums, $3,600 per month plus $0.01 for each dollar of property over $1,200,000 13. Straight-line depreciation on the production equipment 14. Pension cost, $1.00 per employee hour on the job 15. Packagingarrow_forwardClassify each cost as being either variable or fixed with respect to the number of units produced and sold. 1. Insurance on IBM's corporate headquarters 2Salary of a supervisor overseeing production of printers at Hewlett 3. Commissions paid to automobile salespersons. 4. Depreciation of factory lunchroom facilities at a General Electric plant. 5. Steering wheels installed in BMWs.arrow_forward

- 1.26 The Company bears the following costs for the manufacture of weed cutting tools: Weed cutting shaft and scissor blade Weed cutting motor Factory work for workers assembling weed cutting shears Nylon yarn used in weed cutting machine(not detected on product) Glue to hold the housing Salaries of factory foremen Factory rent Sales commissions Salaries of administrators Factory utilities Shipping costs of finished weed cutting products to customers Requested: Describe the difference between period cost and product cost Classify Lawlor costs as period costs or product costs. One costs are product costs, then classify these as direct materials, direct labor or general industrial expenses.arrow_forwardThe following is a list of costs for a car manufacturer. Classify each of the following costs as: a. Direct or indirect with respect to one unit (car) produced; b. Direct materials (DM), direct labor (DL), manufacturing overhead (MOH), selling (S), or administrative (A) Cost Steel used in cars CEO's salary Cost of shipping cars to customers Factory manager's salary Direct or Indirect DM, DL, MOH, S, or Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education