FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Direct labor variances

Bellingham Company produces a product that requires 3 standard direct labor hours per unit at a standard hourly rate of $21.00 per hour. 15,100 units used 61,100 hours at an hourly rate of $19.95 per hour.

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

What is the direct labor (a) rate variance, (b) time variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number.

| a. Direct labor rate variance | $ | |

| b. Direct labor time variance | $ | |

| c. Direct labor cost variance |

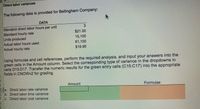

Transcribed Image Text:Direct labor variances

The following data is provided for Bellingham Company:

DATA

Standard direct labor hours per unit

Standard hourly rate

Units produced

Actual labor hours used

Actual hourly rate

$21.00

15,100

61,100

$19.95

Using formulas and cell references, perform the required analysis, and input your answers into the

green cells in the Amount column. Select the corresponding type of variance in the dropdowns in

cells D15:D17. Transfer the numeric results for the green entry cells (C15:C17) into the appropriate

fields in CNOWV2 for grading.

Amount

Formulas

5 a. Direct labor rate variance

b. Direct labor time variance

7 C. Direct labor cost variance

Transcribed Image Text:Direct labor variances

Bellingham Company produces a product that requires 3 standard direct labor hours per unit at a standard hourly rate of $21.00 per hour. 15,100 units used 61,100

hours at an hourly rate of $19.95 per hour.

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

X.

Open spreadsheet,

What is the direct labor (a) rate variance, (b) time variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative

number using a mihus sign and an unfavorable variance as a positive number.

a. Direct labor rate variance

b. Direct labor time variance

c. Direct labor cost variance

$4

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with all answers thankuarrow_forwardGive labor rate variancearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Direct Labor Variances The following data relate to labor cost for production of 4,000 cellular telephones: Type Actual: Standard: Hours and Rate 2,690 hrs. at $14.70 2,650 hrs. at $15.00 a. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. b. The employees may have been less-experienced workers who were paid less than more-experienced workers or poorly trained, thereby resulting in a labor rate than planned. The lower level of efficient performance. Thus, the actual time required experience or training may have resulted in than standard. NB: Based upon your answer to (a) use Less, More or Lower to fill in the blank in (b) wasarrow_forwardDirect Labor Variances The following data relate to labor cost for production of 5,200 cellular telephones: Actual: 3,480 hrs. at $15.00 Standard: 3,430 hrs. at $15.20 a. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Rate variance Time variance Total direct labor cost variance $ $ b. The employees may have been less-experienced or poorly trained, thereby resulting in a or training may have resulted in efficient performance. Thus, the actual time required was labor rate than planned. The lower level of experience than standard.arrow_forwardDo not give image formatarrow_forward

- Direct labor variances Bellingham Company produces a product that requires 3 standard direct labor hours per unit at a standard hourly rate of $22.00 per hour. 15,300 units used 64,400 hours at an hourly rate of $19.60 per hour. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet What is the direct labor (a) rate variance, (b) time variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct labor rate variance $fill in the blank 2 b. Direct labor time variance $fill in the blank 4 c. Direct labor cost variance $fill in the blank 6arrow_forwardDirect labor variances Alvarado Company produces a product that requires 3 standard direct labor hours per unit at a standard hourly rate of $20.00 per hour. 15,900 units used 65,500 hours at an hourly rate of $19.15 per hour. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet What is the direct labor (a) rate variance, (b) time variance, and (e) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct labor rate variance b. Direct labor time variance c. Direct labor cost variance Favorable Unfavorable Unfavorable ✓ ✓arrow_forwardNeed Help with this Questionarrow_forward

- Please redo this problem and show me steps on how to get the following questions correct, its stating I am wrong. Please help Direct Labor Variances The following data relate to labor cost for production of 6,600 cellular telephones: Actual: 4,480 hrs. at $16.10 $72,128 Standard: 4,410 hrs. at $16.40 $72,324 a. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter all values as a positive number and then identify the variance (e.g. Favorable or Unfavorable) in the adjacent column. Rate variance $ Favorable Time variance $ Unfavorable Total direct labor cost variance $ Favorable b. The employees may have been less-experienced or poorly trained, thereby resulting in a lower labor rate than planned. The lower level of experience or training may have resulted in less efficient performance. Thus, the actual time required was more than standard. LIz Carrow_forwardThorne Company has the following information available for the past year. They use machine hours to allocate overhead. NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F” (for Favorable) or "U” (for Unfavorable) - capital letter and no quotes. What is the variable overhead efficiency variance? Is it favorable or unfavorable?arrow_forwardplease answer all requirements or skip/leave answer with must must explanation , computation for each parts and steps clearly and completely answer in text form remember attempt if answer all or skiparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education