FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

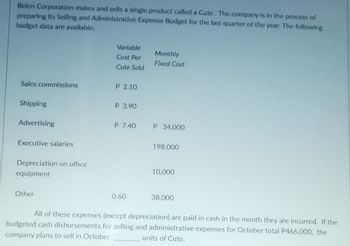

Transcribed Image Text:Belen Corporation makes and sells a single product called a Cute. The company is in the process of

preparing its Selling and Administrative Expense Budget for the last quarter of the year. The following

budget data are available:

Variable

Monthly

Cost Per

Fixed Cost

Cute Sold

Sales commissions

P 2.10

Shipping

P 3.90

Advertising

P 7.40

P 34,000

Executive salaries

198,000

Depreciation on office

10,000

equipment

Other

0.60

38,000

All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the

budgeted cash disbursements for selling and administrative expenses for October total P466,000, the

company plans to sell in October

units of Cute.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haresharrow_forwardSarafiny Corporation is in the process of preparing its annual budget. The following beginning and ending inventory levels are planned for the year. Finished goods (units) Raw material (grams) Each unit of finished goods requires 3 grams of raw material. The company plans to sell 630,000 units during the year. Multiple Choice The number of units the company would have to manufacture during the year would be: O O O 630,000 units 708,000 units Beginning Inventory 28,000 58,000 572,000 units Ending Inventory 78,000 48,000 680,000 unitsarrow_forwardQuestion: Asy Clean operates a chain of dry cleaners. It is experimenting with a continuous-improvement (i.e., kaizen) budget for operating expenses. Currently, a typical location has operating expenses of $14,000 per month. Plans are in place to achieve labor and utility savings. The associated operational changes are estimated to reduce monthly operating costs by a factor of 0.99 beginning in January. What is the estimated operating cost for: i) January? ii) For June? iii) For December?arrow_forward

- Gardner Corporation manufactures skateboards and is in the process of preparing next year's budget. The pro forma income statement for the current year is presented below. Sales $ 1,500,000 Cost of sales: Direct Material $ 250,000 Direct labor 150,000 Variable Overhead 75,000 Fixed Overhead 100,000 575,000 Gross Profit $ 925,000 Selling and G&A Variable 200,000 Fixed 250,000 450,000 Operating Income $ 475,000 The break-even point (rounded to the nearest dollar) for Gardner Corporation for the current year is:arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 29 $ 13 $ 14,080 1,030 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. 1234 should be entered as 12.34).) 1. Margin of safety (in dollars) 2. Margin of safety percentage %arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $179,400, and 13,800 orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. per sales order b. Determine the amount of sales order processing cost that Nozama.com would receive if it had 7,900 sales orders.arrow_forward

- Please answer the followingarrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 23 2416 $ 5,810 980 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (l.e. 1234 should be entered as 12.34).) . Margin of safety (in dollars) 2. Margin of salety percentagearrow_forwardPreparing a Selling and Administrative Expenses Budget Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of $20,000,000. There is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following: Salaries $ 960,000 Utilities 365,000 Office space 230,000 Advertising 1,200,000 Required: Prepare a selling and administrative expenses budget for Fazel Company for the coming year. Fazel Company Selling and Administrative Expenses Budget For the Coming Year Variable selling expenses $fill in the blank 1 Fixed expenses: Salaries $fill in the blank 2 Utilities fill in the blank 3 Office space fill in the blank 4 Advertising fill in the blank 5 Total fixed expenses fill in the blank 6 Total selling and administrative expenses $fill in the blank 7arrow_forward

- Baskin Promotions, Incorporated sells T-shirts decorated for a variety of concert performers. The company has developed the following budget for the coming year based on a sales forecast of 80,000 T-shirts: Sales Cost of Goods Sold Gross Profit Operating Expenses ($100,000 is fixed) Operating Income Income Taxes (30% of operating income) Net Income $ 1,400,000 820,000 580,000 418,400 161,600 48,480 $ 113, 120 Cost of goods sold and variable operating expenses vary directly with sales, and the income tax rate is 30% at all levels of operating income. If the concert season is slow due to poor weather, Baskin estimates that sales could fall to as low as 60,000 T-shirts. Assume Baskin actually achieves the 60,000 unit sales level, and that net income actually earned at this level was $70,000. A performance report would indicate that net income was:arrow_forwardNathan Davidson, financial analyst at LMN Corporation, is examining the behavior of quarterly utility costs for budgeting purposes. Davidson collects the following data on machine-hours worked and utility costs for the past 8 quarters: (Click the icon to view the data.) Read the requirements. Requirement 1. Estimate the cost function for the quarterly data using the high-low method. (Complete all answer boxes.) Data table + Quarter Machine-Hours Utility Costs Quarter 1 100,000 $ 265,000 Quarter 2 55,000 200,000 Quarter 3 90,000 250,000 Quarter 4 105,000 280,000 Quarter 5 70,000 220,000 Quarter 6 95,000 260,000 Quarter 7 85,000 275,000 Quarter 8 80,000 245,000 Print Done - ☑ Requirements 1. Estimate the cost function for the quarterly data using the high-low method. 2. Plot and comment on the estimated cost function. 3. Davidson anticipates that LMN will operate machines for 105,000 hours in quarter 9. Calculate the predicted utility costs in quarter 9 using the cost function estimated…arrow_forwardGig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales Selling price per unit Cost per unit Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) Interest expense for the year Required: Prepare the company's budgeted income statement for the year. Gig Harbor Boating Budgeted Income Statement 600 $ 2,020 $ 1,670 $ 55 $ 107,000 $ 18,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education