FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

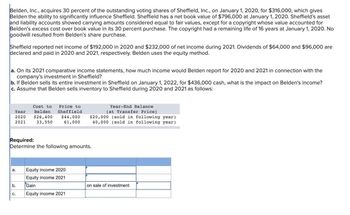

Transcribed Image Text:Belden, Inc., acquires 30 percent of the outstanding voting shares of Sheffield, Inc., on January 1, 2020, for $316,000, which gives

Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $796,000 at January 1, 2020. Sheffield's asset

and liability accounts showed carrying amounts considered equal to fair values, except for a copyright whose value accounted for

Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2020. No

goodwill resulted from Belden's share purchase.

Sheffield reported net income of $192,000 in 2020 and $232,000 of net income during 2021. Dividends of $64,000 and $96,000 are

declared and paid in 2020 and 2021, respectively. Belden uses the equity method.

a. On its 2021 comparative income statements, how much income would Belden report for 2020 and 2021 in connection with the

company's investment in Sheffield?

b. If Belden sells its entire investment in Sheffield on January 1, 2022, for $436,000 cash, what is the impact on Belden's income?

c. Assume that Belden sells inventory to Sheffield during 2020 and 2021 as follows:

Year

2020

2021

Required:

Determine the following amounts.

a.

b.

Cost to Price to

Year-End Balance

(at Transfer Price)

Belden Sheffield

$26,400 $44,000 $20,000 (sold in following year)

33,550

40,000 (sold in following year).

61,000

C.

Equity income 2020

Equity income 2021

Gain

Equity income 2021

on sale of investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Simmons Corporation owns stock of Armstrong, Inc. Prior to 2020, the investment was accounted for using the equity method. In early 2020, Simmons sold part of its investment in Armstrong, and began using the fair value method. In 2020, Armstrong earned net income of $80,000 and paid dividends of $95,000. Prepare Simmons's entries related to Armstrong's net income and dividends, assuming Simmons now owns 10% of Armstrong's stock.arrow_forwardABC owns 29% of XYZ Corp. During 2020, XYZ reported a net income of $415,000 and did not declare any dividends. Additionally, XYZ sold a piece of land, with a carrying value of $140,000 to ABC for $345,000. ABC still holds the land. ABC accounts for its investment in XYZ Corp using the equity method. Required: On December 31, 2022, a journal entry is required to record the impact of the above transactions. What is the net debit to the Investment in XYZ Corp account / the net credit to the Equity Income.arrow_forwardPitino acquired 90 percent of Brey's outstanding shares on January 1, 2019, in exchange for $342,000 in cash. The subsidiary's stockholders' equity accounts totaled $326,000, and the noncontrolling interest had a fair value of $38,000 on that day. However, a building (with a nine-year remaining life) in Brey's accounting records was undervalued by $18,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (six-year remaining life). Brey reported net income from its own operations of $64,000 in 2019 and $80,000 in 2020. Brey declared dividends of $19,000 in 2019 and $23,000 in 2020. Brey sells inventory to Pitino as follows: Year Cost to Brey Transfer Price to Pitino Inventory Remaining at Year-End (at transfer price) 2019 $ 69,000 $ 115,000 $ 25,000 2020 81,000 135,000 37,500 2021 92,800 160,000 50,000 At December 31, 2021, Pitino owes Brey $16,000 for inventory acquired during the…arrow_forward

- Milani, Incorporated, acquired 10 percent of Seida Corporation on January 1, 2023, for $192,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2024, Milani purchased an additional 30 percent of Seida for $591,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $1,970,000 in total. Seida's January 1, 2024, book value equaled $1,820,000, although land was undervalued by $139,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2024, Seida reported income of $319,000 and declared and paid dividends of $100,000. Required: Prepare the 2024 journal entries for Milani related to its investment in Seida. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 2 3 5 Record investee dividend…arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida’s common stock was $2,000,000 in total. Seida’s January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida’s book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. 2. Record the 40% income earned by Seida.arrow_forwardAshvinnarrow_forward

- Pitino acquired 90 percent of Brey's outstanding shares on January 1, 2019, in exchange for $351,000 in cash. The subsidiary's stockholders' equity accounts totaled $335,000, and the noncontrolling interest had a fair value of $39,000 on that day. However, a building (with a ten-year remaining life) in Brey's accounting records was undervalued by $15,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (four-year remaining life). Brey reported net income from its own operations of $65,000 in 2019 and $81,000 in 2020. Brey declared dividends of $19,500 in 2019 and $23,500 in 2020. Brey sells inventory to Pitino as follows: Year Cost to Brey Transfer Price to Pitino Inventory Remaining at Year-End (at transfer price) 2019 $ 70,000 $ 120,000 $ 26,000 2020 77,000 140,000 38,000 2021 99,000 165,000 40,000 At December 31, 2021, Pitino owes Brey $17,000 for inventory acquired during the…arrow_forwardBelden, Incorporated, acquires 30 percent of the outstanding voting shares of Sheffield, Incorporated, on January 1, 2023, for $306,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $784,000 at January 1, 2023. Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values, except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2023. No goodwill resulted from Belden's share purchase. Sheffield reported net Income of $182,000 in 2023 and $244,000 of net Income during 2024. Dividends of $64,000 and $90,000 are declared and paid in 2023 and 2024, respectively. Belden uses the equity method. Required: a. On its 2024 comparative Income statements, how much Income would Belden report for 2023 and 2024 in connection with the company's Investment in Sheffield? b. If Belden sells its…arrow_forwardBelden, Inc. acquires 30 percent of the outstanding voting shares of Sheffield, Inc. on January 1, 2017, for $316,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $796,000 at January 1, 2017. Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2017. No goodwill resulted from Belden's share purchase. Sheffield reported net income of $192,000 in 2017 and $232,000 of net income during 2018. Dividends of $64,000 and $96,000 are declared and paid in 2017 and 2018, respectively. Belden uses the equity method. On its 2018 comparative income statements, how much income would Belden report for 2017 and 2018 in connection with the company's investment in Sheffield? If Belden sells its entire investment in…arrow_forward

- On July 1, 2021, Gupta Corporation bought 25% of the outstanding common stock of VB Company for $110 million cash, giving Gupta the ability to exercise significant influence over VB’s operations. At the date of acquisition of the stock, VB’s net assets had a total fair value of $360 million and a book value of $240 million. Of the $120 million difference, $22 million was attributable to the appreciated value of inventory that was sold during the last half of 2021, $84 million was attributable to buildings that had a remaining depreciable life of 15 years, and $14 million related to equipment that had a remaining depreciable life of 5 years. Between July 1, 2021, and December 31, 2021, VB earned net income of $24 million and declared and paid cash dividends of $16 million. Required:1. Prepare all appropriate journal entries related to the investment during 2021, assuming Gupta accounts for this investment by the equity method.2. Determine the amounts to be reported by Gupta.arrow_forwardBelden, Incorporated, acquires 30 percent of the outstanding voting shares of Sheffield, Incorporated, on January 1, 2023, for $306,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $824,000 at January 1, 2023. Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values, except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2023. No goodwill resulted from Belden's share purchase. Sheffield reported net income of $200,000 in 2023 and $256,000 of net income during 2024. Dividends of $90,000 and $60,000 are declared and paid in 2023 and 2024, respectively. Belden uses the equity method. Required: a. On its 2024 comparative income statements, how much income would Belden report for 2023 and 2024 in connection with the company's investment in Sheffield? b. If Belden sells its…arrow_forwardBelden, Inc., acquires 30 percent of the outstanding voting shares of Sheffield, Inc., on January 1, 2020, for $304,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $820,000 at January 1, 2020. Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values, except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2020. No goodwill resulted from Belden's share purchase. Sheffield reported net income of $198,000 in 2020 and $252,000 of net income during 2021. Dividends of $74,000 and $90,000 are declared and paid in 2020 and 2021, respectively. Belden uses the equity method. a. On its 2021 comparative income statements, how much income would Belden report for 2020 and 2021 in connection with the company's investment in Sheffield? b. If Belden sells its entire investment in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education