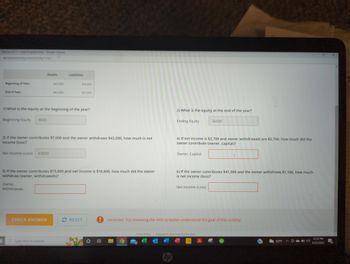

Using the Expanded Accounting EquationUsing the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions.Assets LiabilitiesBeginning of Year: $25,000 $18,000End of Year: $62,000 $25,000 n1) What is the equity at the beginning of the year?Beginning Equity 7,000 2) What is the equity at the end of the year?Ending Equity 37,000 3) If the owner contributes $7,000 and the owner withdraws $38,400, how much is net income (loss)?Net Income (Loss) 4) If net income is $1,000 and owner withdrawals are $9,400, how much did the owner contribute (owner, capital)?Owner, Capital 5) If the owner contributes $18,400 and net income is $16,400, how much did the owner withdraw (owner, withdrawals)?Owner, Withdrawals 6) If the owner contributes $42,100 and the owner withdraws $1,300, how much is net income (loss)?Net Income (Loss)

Need answer for 3,4 and 6

Accounting Cycle Tutorial Step:1 Account Balances

4 Balancing the Expanded Accounting EquationCalculator Glossary

Activity 4.b - Using the Expanded Accounting EquationUsing the

n1) What is the equity at the beginning of the year?Beginning Equity 7,000

2) What is the equity at the end of the year?Ending Equity 37,000

3) If the owner contributes $7,000 and the owner withdraws $38,400, how much is net income (loss)?Net Income (Loss)

4) If net income is $1,000 and owner withdrawals are $9,400, how much did the owner contribute (owner, capital)?Owner, Capital

5) If the owner contributes $18,400 and net income is $16,400, how much did the owner withdraw (owner, withdrawals)?Owner, Withdrawals

6) If the owner contributes $42,100 and the owner withdraws $1,300, how much is net income (loss)?Net Income (Loss)

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps with 6 images