FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:exercise for finance acc.pdf

O File | C:/Users/User/Desktop/FIN%20ACC/exercise%20for%20finance%20acc.pdf

+

(D Page view

A Read aloud

T Add text

V Draw

E Highlight

O Erase

of 4

increase

Decrease

No Effect

3 The company receives cash from a bank loan

Asset

Increase

Decrease

No Effect

Liability

Increase

Decrease

No Effect

Owner's Equity

Increase

Decrease

No Effect

4 The company repays the bank loan.

Asset

Increase

Decrease

No Effect

Liability

Increase

Decrease

No Effect

Owner's Equity

Increase

Decrease

No Effect

5 The company purchases office equipment by cash.

Asset

Increase

Decrease

No Effect

Liability

Increase

Decrease

No Effect

Owner's Equity

Increase

Decrease

No Effect

5:29 PM

O Type here to search

IMI

26/10/2021

ENG

(p ツ

Transcribed Image Text:exercise for finance acc.pdf

O File | C:/Users/User/Desktop/FIN%20ACC/exercise%20for%20finance%20acc.pdf

D Page view

A Read aloud

T Add text

V Draw

E Highlight

O Erase

of 4

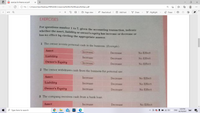

EXERCISES

For questions number 1 to 7, given the accounting transaction, indicate

whether the asset, liability or owner's equity has increase or decrease or

has no effect by circling the appropriate answer.

1 The owner invests personal cash in the business. (Example)

Asset

Increase

Decrease

No Effect

Liability

Increase

Decrease

No Effect

Owner's Equity

Increase

Decrease

No Effect

2 The owner withdraws cash from the business for personal use.

Asset

Increase

Decrease

No Effect

Liability

Increase

Decrease

No Effect

Owner's Equity

Increase

Decrease

No Effect

3 The company receives cash from a bank loan

Asset

Increase

Decrease

No Effect

5:29 PM

O Type here to search

IMI

26/10/2021

ENG

Expert Solution

arrow_forward

Step 1 Introduction

The assets includes cash, account receivables, prepaid expenses, etc. The assets are debited with an increase.

The liabilities include creditors, account payable, accrued expenses, etc. The liabilities are credited with an increase..

The equity includes the cash investment or withdrawal by owner. It increases with investment and profits and decrease with withdrawal or losses.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What two transaction types decrease owner's equity? liabilities and revenue expenses and withdrawals expenses and revenue withdrawals and investmentsarrow_forwardAnswer with Explanation of correct answer and incorrect answerarrow_forwardNet Income: Multiple Choice Decreases equity. Represents the amount of assets owners put into a business. Equals assets minus liabilities. Is the excess of revenues over expenses. Represents owners' claims against assets.arrow_forward

- Real estate is a: a. Cash flow business b. An easy entry business c. Risk for profit business d. All of the above Market Analysis a. Is not necessary to perform a cashflow analysis b. Adds quality to the numbers c. Used only if for court purposes d. Delineates a trade areaarrow_forwardatement this account. or Balance Account Name Account Type (*) Is this account part of Retained Earnings? Yes or No Normal Balance You increase with a Debit or Credit Write DEBIT or CREDIT. Financial Statement where you find this account. Write: Income Statement or Balance Sheet Prepaid Maintenance Prepaid Supplies Property Tax Property, plat & Equipment Rent Expense Retained Earnings Sales Sales Allowances Sales Discount Sales Revenue Sales Tax Payable Service Revenue Short Term Debt Telephone Expense Trademarks Travel Treasury Stock Utilities Wages Payable Work in Process Inventoryarrow_forwardRevenue will be recognized when the following occurs as a result of a business activity with a customer: a) There is an increase in assetsb) There is an increase in liabilities c) There is a decrease in assetsd) none of thesearrow_forward

- Which of the following decrease owner's equity or stockholder's equity? A. Paying cash to vendors. B. Paying cash to clients. C. Revenue. D. Expenses.arrow_forwardcorrect Answer pleasearrow_forwardA business provider services to a customer on credit.Which of the following is correct: A.Assets increase and liabilities decrease at the time the cash is collected B.Assets increase and liabilities increase at the time of the sale C.Assets increase and the owner's equity increases at the time the cash is collected D.Assets increase and the owner's equity increases at the time of the salearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education